First Mover Americas: Cryptocurrency Trading Volumes Increase for First Time in 3 Months

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

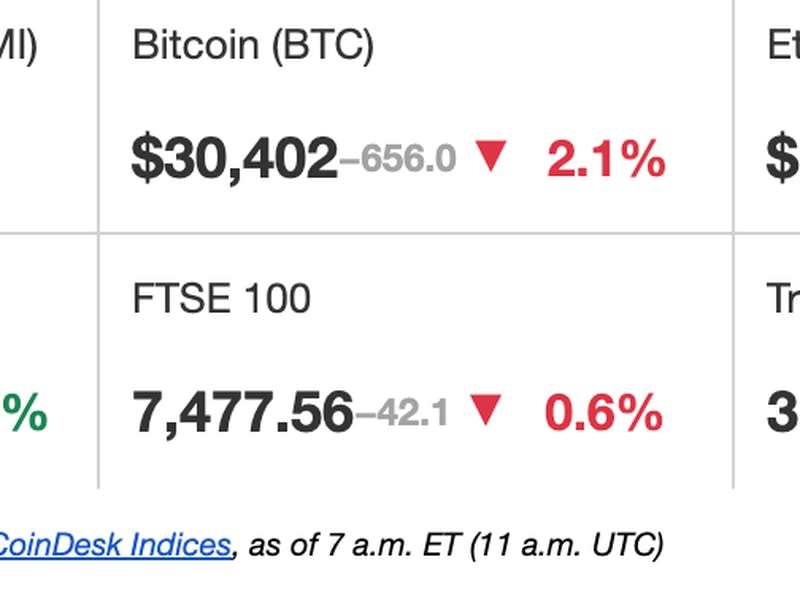

Latest Prices

Top Stories

Crypto trading volumes rose in June for the first time in three months amid optimism following the filing of spot bitcoin exchange-traded-fund (ETF) proposals by BlackRock and other asset managers. The combined spot and derivative trading volumes on centralized exchanges climbed 14% to $2.71 trillion, according to a report by CCData. This was the first monthly increase in trading volume since March, said the report. Among other high-profile U.S. institutions that filed or refiled last month with the U.S. Securities and Exchange Commission (SEC) for spot bitcoin ETFs were Fidelity, Invesco and WisdomTree.

Bitcoin's fortune is no longer tied to movement in the U.S. stock markets. The 90-day rolling correlation of changes in bitcoin's spot price to changes in Wall Street's tech-heavy equity index, Nasdaq and the broader S&P 500 has declined to near zero, the lowest in two years, according to data tracked by crypto derivatives analytics firm Block Scholes. "It [the correlation] is now at the lowest level observed since July 2021, when BTC was between its twin peaks in April and November," Andrew Melville, research analyst at Block Scholes, said in an email.

Binance Australia’s office was searched by that country's financial regulator, the Australian Securities & Investments Commission (ASIC), on Tuesday, according to a report in Bloomberg. The story, citing anonymous sources, comes after the company’s derivatives license was canceled in April following an investigation into how it classified clients as professional wholesale investors in order to be saddled fewer regulatory protections than if they were regular retail customers. "We are cooperating with local authorities and Binance is focused on meeting local regulatory standards in order to serve our users in Australia in a fully compliant manner,” a Binance Australia spokesperson told CoinDesk in an e-mailed statement.

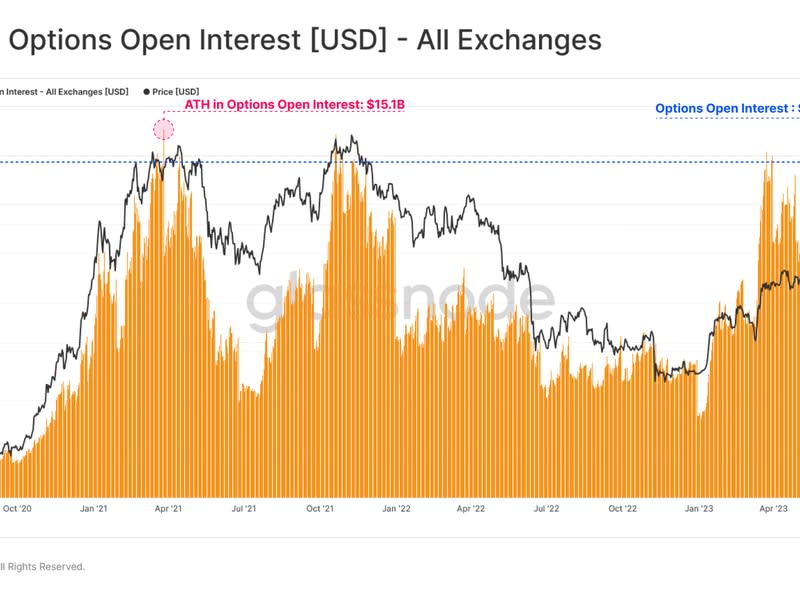

Chart of the Day

The chart shows notional open interest, or the dollar amount locked in the number of active options contracts tied to bitcoin, has surged to $13.8 billion.

Market participants are seeking exposure to risk-defined derivatives instruments, per Glassnode.

Glassnode tracks open interest on Deribit, CME, FTX and OKX.

- Omkar Godbole

Trending Posts

Denmark's Financial Watchdog Orders Saxo Bank to Shed its Crypto Holdings

Aave Holders Vote on Proposal for DeFi Protocol to Convert 1,600 Ether Into wstETH and rETH

Bitcoin May Be Forming a 'Bull Flag' on Price Chart: Technical Analysis

Yahoo Finance

Yahoo Finance