First GLS site in Toa Payoh in eight years attracts $968 mil bid from CDL, Frasers Property, and Sekisui House

CDL, Frasers Property, and Sekisui House have announced that if they win the bid for this GLS site, they intend to develop a residential project comprising two blocks of 40 storeys with close to 800 residential units.

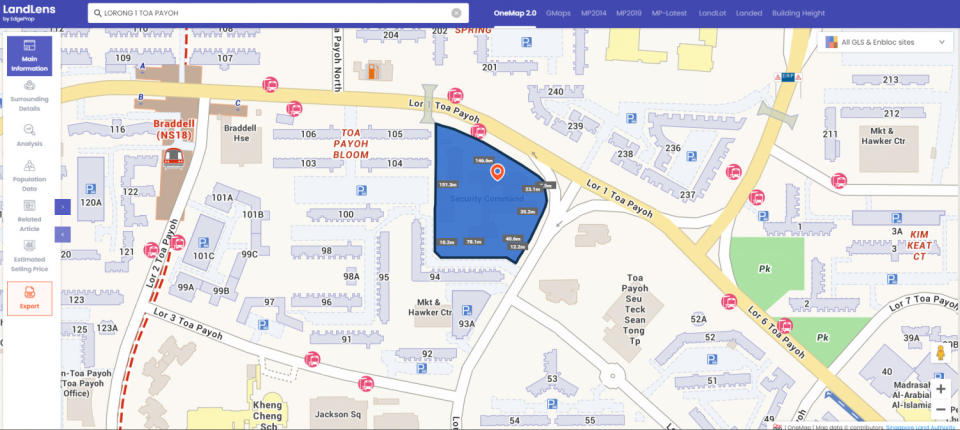

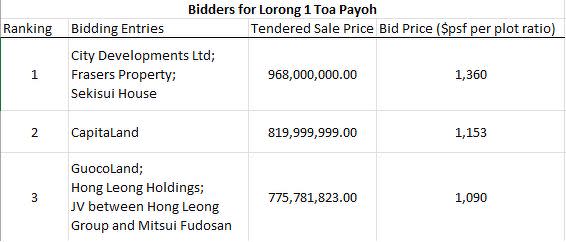

Three major property developers banded together to submit the highest bid for a Government Land Sales (GLS) site at Lorong 1 Toa Payoh. Property giants City Developments Ltd (CDL), Frasers Property, and Sekisui House jointly submitted the $968 million tender for the 1.57ha site located at the junction of Lorong 1 and Lorong 4 Toa Payoh. This translates to a land rate of $1,360 psf per plot ratio (ppr).

According to a media statement by CDL, the joint venture is a 50:25:25 split between CDL, Frasers Property and Sekisui House. “We are delighted to be the top bidder for this rare District 12 site and honoured to have our first collaboration with Frasers Property and Sekisui House,” says Sherman Kwek, group CEO of CDL. He adds: “Together with our partners, we look forward to tapping on our collective expertise to create an iconic development in the highly sought-after Toa Payoh estate.”

The tender of this GLS site was batched with two other GLS sites — one at Clementi Avenue 1 and another at Pine Grove (Parcel B). The land parcels at Lorong 1 Toa Payoh and Pine Grove (Parcel B) attracted three bids each, while the land parcel at Clementi Avenue 1 attracted six bids.

Read also: MCL Land and CSC Land JV submit highest bid of $1,250 psf ppr for Clementi Avenue 1 GLS site

According to Leonard Tay, head of research at Knight Frank Singapore, notes that despite the seemingly lower participation rate compared to the GLS tenders in 2022, “developers were willing to place bullish bids in order to secure top position”.

This was evident in the case of Lorong 1 Toa Payoh where the joint bid from CDL, Frasers Property, and Seikisui House of $1,360 psf ppr is 18% higher than the next highest bid of $819.99 million ($1,153 psf ppr) submitted by Tanglin Land, a subsidiary of CapitaLand.

It has been eight years since the last GLS site was tendered in Toa Payoh — a neighbouring land parcel that has since been developed into Gem Residences by Gamuda Land and Evia Real Estate. When that GLS site was awarded, it attracted a winning bid of $345.86 million ($755 psf ppr).

CDL, Frasers Property, and Sekisui House have announced that if they win the bid for this GLS site, they intend to develop a residential project comprising two blocks of 40 storeys with close to 800 residential units.

“We look forward to this rare opportunity of delivering an iconic residential development in the highly established and popular estate of Toa Payoh — the first residential site in Toa Payoh in eight years,” says Soon Su Lin, CEO of Frasers Property Singapore.

It has been eight years since the last GLS site was tendered in Toa Payoh — a neighbouring land parcel that has since been developed into Gem Residences. (Map: URA)

According to Mohan Sandrasegeran, head of research and data analytics at Singapore Realtors Inc (SRI), the appeal of the latest GLS site at Lorong 1 Toa Payoh is “evident” given the allure of its mature residential location and the dearth of new project launches in the area.

Read also: Orchard Boulevard GLS site launched for tender

“The Toa Payoh estate has experienced a considerable seven-year hiatus since the last property launch in 2016, when Gem Residences was launched. This extended gap will likely create pent-up demand (for new condo units) and development potential within the area, this likely piqued [developers’] interest and ignited their enthusiasm to invest in this estate,” says Sandrasegeran.

Moreover, the site is close to Braddell MRT Station, which is one stop from Bishan MRT Interchange on the North-South and Circle Lines.

Toa Payoh has also generated several million-dollar HDB resales in recent years, says Sandrasegeran, adding that the estate has recorded 49 such transactions in the first 10 months of this year. “This reflects a promising pool of potential HDB upgraders within the Toa Payoh estate, adding to the overall potential demand outlook for the upcoming development on the Lorong 1 Toa Payoh site,” he says.

EdgeProp's Landlens tool estimates a selling price of $2,535 psf for the new development. (Map: EdgeProp Singapore)

However, the strength of the GLS had led some market watchers to anticipate many more bids for this Toa Payoh GLS site. Justin Quek, deputy CEO of OrangeTee&Tie, says that the number of bids were below their expectations, although the top bid exceeded their initial estimations. “Some developers could have been cautious about the large size of this land parcel and may prefer to consider smaller plots of land in future land sales exercises,” he says.

Wong Siew Ying, head of research and content at PropNex Realty, echoed this sentiment. “We had anticipated this site to appeal to more developers since it is relatively well located,” she says, adding: “Perhaps the larger development size and higher quantum for this plot have deterred some developers from entering the fray even though this plot has superior attributes.”

She believes the average selling price for the new project may range between $2,400 psf and $2,500 psf. This is close to EdgeProp Singapore’s estimate utilising our proprietary Landlens tool, which casts an estimated selling price of $2,535 psf for the upcoming development.

Read also: Rivière taps design and tech to foster community spirit

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

MCL Land and CSC Land JV submit highest bid of $1,250 psf ppr for Clementi Avenue 1 GLS site

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance