First Capital Leads Three Key Dividend Stocks For Investors

The United States stock market has shown robust performance, with a 1.8% increase over the last week and a significant 23% rise over the past 12 months, alongside forecasts of annual earnings growth of 15%. In this buoyant environment, dividend stocks like First Capital can offer investors both stability and potential income growth.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.62% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.04% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.83% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.15% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.93% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.90% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.03% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.74% | ★★★★★★ |

First Bancorp (NasdaqGS:FNLC) | 5.99% | ★★★★★☆ |

Citizens & Northern (NasdaqCM:CZNC) | 6.53% | ★★★★★☆ |

Click here to see the full list of 210 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

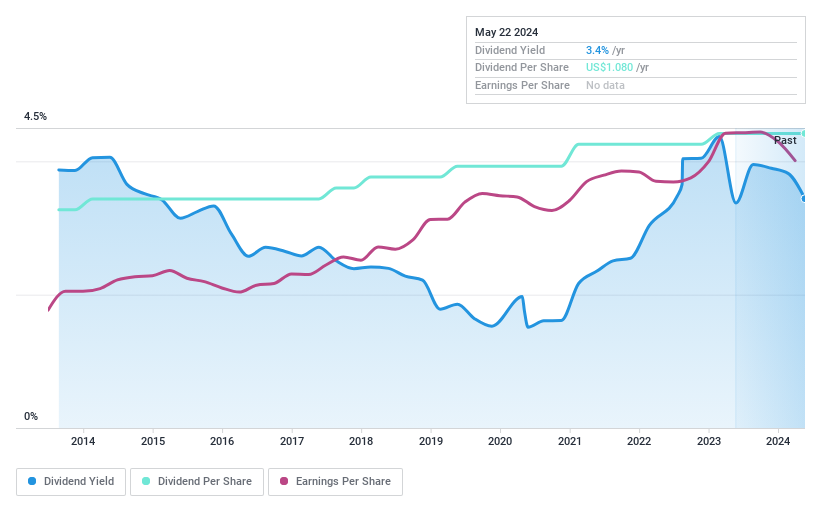

First Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc., functioning as the holding company for First Harrison Bank, offers a range of banking services to individual and business customers, with a market capitalization of approximately $100.67 million.

Operations: First Capital, Inc. generates its revenue primarily from banking services, totaling $40.31 million.

Dividend Yield: 3.5%

First Capital offers a steady dividend yield of 3.54%, underpinned by a low payout ratio of 30.3%, indicating that dividends are well-covered by earnings. However, its yield trails the top quartile of U.S. dividend stocks, which stands at 4.73%. The company's dividends have shown stability and reliability over the past decade, with consistent growth in payments despite recent board changes and executive shifts not impacting operational policies or practices significantly. Trading at 58.7% below estimated fair value suggests potential undervaluation.

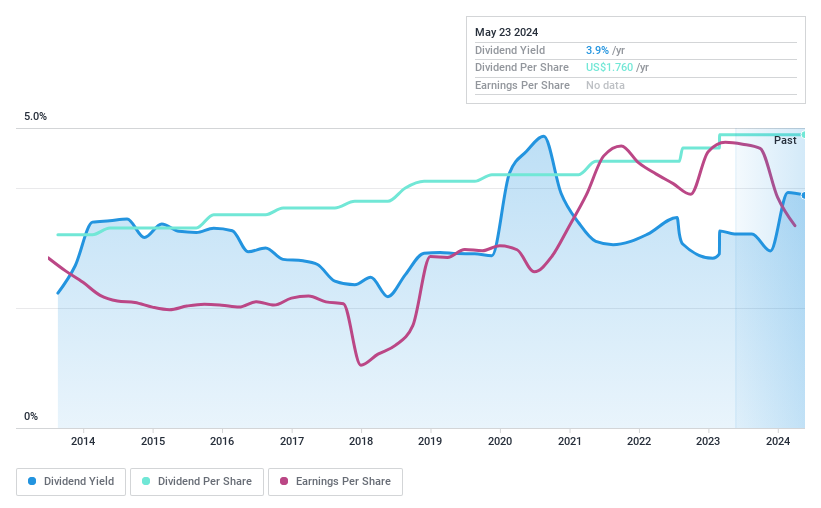

C&F Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&F Financial Corporation, serving as the bank holding company for Citizens and Farmers Bank, offers banking services to individuals and businesses with a market capitalization of approximately $149.42 million.

Operations: C&F Financial Corporation generates its revenue from three primary segments: Community Banking at $86.97 million, Consumer Finance at $17.69 million, and Mortgage Banking at $10.96 million.

Dividend Yield: 3.9%

C&F Financial recently affirmed a dividend of US$0.44 per share, maintaining its decade-long record of reliable and growing payouts, despite a dip in Q1 earnings to US$3.44 million from US$6.5 million year-over-year and a decrease in net interest income to US$23.16 million from US$24.96 million. The company's dividend yield stands at 3.91%, below the top quartile average of 4.73% but is well-supported by a conservative payout ratio of 29%.

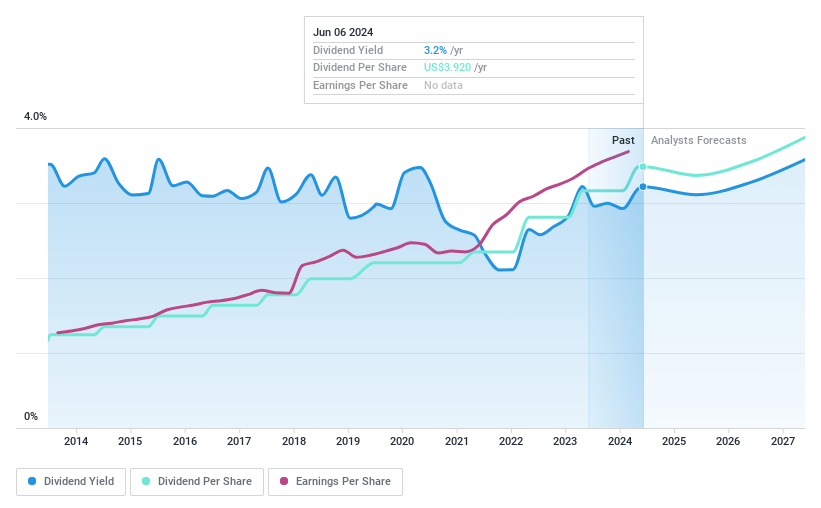

Paychex

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Paychex, Inc. offers integrated human capital management solutions including HR, payroll, benefits, and insurance services primarily for small to medium-sized businesses across the United States, Europe, and India, with a market capitalization of approximately $43.79 billion.

Operations: Paychex, Inc. generates $5.21 billion in revenue from its Business Services segment.

Dividend Yield: 3.2%

Paychex, Inc. recently increased its quarterly dividend to US$0.98 per share, reflecting a 10% hike and showcasing the company’s commitment to returning value to shareholders. Despite a stable dividend history over the past decade and dividends being well-covered by both earnings (77.3% payout ratio) and cash flows (73.5% cash payout ratio), Paychex's yield at 3.22% remains below the top quartile of U.S dividend payers which averages around 4.75%. The firm also continues to pursue strategic acquisitions aimed at bolstering its market position, supported by solid financial performance including a 10.5% earnings growth over the past year.

Get an in-depth perspective on Paychex's performance by reading our dividend report here.

Our expertly prepared valuation report Paychex implies its share price may be lower than expected.

Taking Advantage

Discover the full array of 210 Top Dividend Stocks right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FCAP NasdaqGS:CFFI and NasdaqGS:PAYX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance