Fannie Mae Reports Strong Annual Net Income Growth of 35% for 2023

Net Income: $17.4 billion for 2023, a 35% increase from $12.9 billion in 2022.

Net Worth: Reached $77.7 billion as of December 31, 2023, up 29% year-over-year.

Liquidity: Provided $369 billion, supporting approximately 1.5 million home purchases, refinancings, and rental units.

Credit Losses: Shifted to a $1.7 billion benefit in 2023 from a $6.3 billion provision in 2022.

Single-Family and Multifamily: Acquired about 805,000 single-family purchase loans and financed roughly 482,000 multifamily rental units.

On February 15, 2024, Federal National Mortgage Association Fannie Mae (FNMA) released its 8-K filing, announcing a significant increase in annual net income and a strengthened net worth position for the fiscal year ended December 31, 2023. The company, a key player in the U.S. secondary mortgage market, operates through its Single-Family and Multifamily segments, with the former being the primary revenue driver.

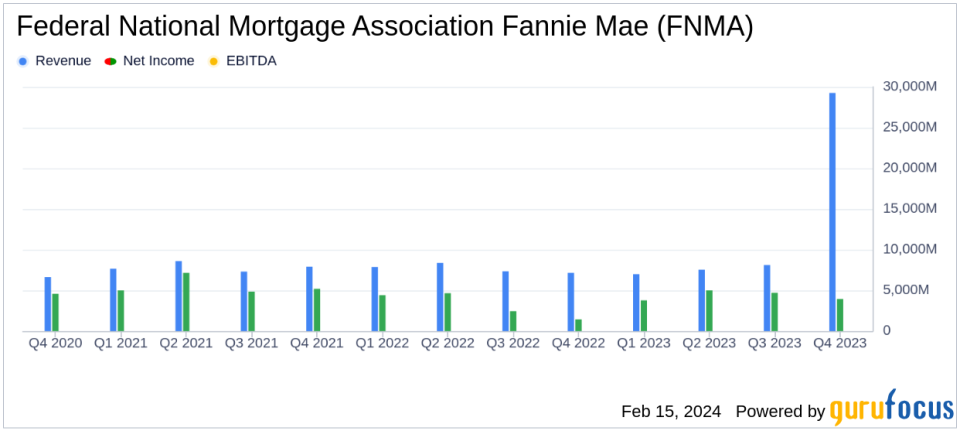

Fannie Mae's performance in 2023 was marked by robust financial achievements despite a challenging housing market environment characterized by higher mortgage rates, limited housing inventory, and persistent affordability issues. The company's net income for the year stood at $17.4 billion, a $4.5 billion or 35% increase from the previous year. This growth was primarily attributed to a significant $7.9 billion shift to a benefit for credit losses in 2023 from a provision for credit losses in 2022.

The company's commitment to supporting the housing market was evident in its provision of $369 billion in liquidity, enabling the financing of approximately 1.5 million home purchases, refinancings, and rental units. Notably, Fannie Mae acquired approximately 805,000 single-family purchase loans, with over 45% catering to first-time homebuyers, and financed around 482,000 units of multifamily rental housing, most of which were affordable to households earning at or below 120% of the area median income.

Despite a slight decrease in net interest income from $29.4 billion in 2022 to $28.8 billion in 2023, the company's financial position remained strong, driven by guaranty fee income and higher yields on securities in its corporate liquidity portfolio. The benefit for credit losses, totaling $1.7 billion for the year, reflected improved credit conditions and home price growth, though partially offset by a provision for multifamily credit losses due to declining property values.

FNMA's net worth increased to $77.7 billion, up 29% from the previous year, bolstering its financial stability and capacity to support the housing market. The company's serious delinquency rates for both single-family and multifamily segments remained a focus, with the single-family serious delinquency (SDQ) rate and multifamily SDQ rate being closely monitored.

In summary, Fannie Mae's 2023 financial results underscore its resilience and ongoing role in facilitating access to mortgage credit for American homeowners and renters. The company's ability to navigate a challenging housing landscape while delivering substantial earnings growth and liquidity support highlights its strategic management and commitment to its mission.

For a detailed view of Fannie Mae's financials, including its Consolidated Balance Sheets and Consolidated Statements of Operations and Comprehensive Income for the full year of 2023, stakeholders are encouraged to review the company's annual report on Form 10-K for the year ended December 31, 2023, which is available on the SEC's website and Fannie Mae's official website.

"The fourth quarter capped another successful year. Fannie Mae reported $3.9 billion in net income, marking our twenty-fourth consecutive quarter of positive earnings. In 2023, we delivered $17.4 billion in earnings and continued to rebuild our capital and further strengthen our financial stability. It was a challenging year for housing, with higher mortgage rates, limited homes for sale, and high home prices weighing on affordability. Against this backdrop, we provided $369 billion in liquidity, helping 1.5 million households buy, refinance, or rent a home. As we close on our 85th year supporting America's housing system, we remain committed to effectively managing risks and being a reliable source of mortgage credit for America's homeowners and renters," said Priscilla Almodovar, Chief Executive Officer of Fannie Mae.

Explore the complete 8-K earnings release (here) from Federal National Mortgage Association Fannie Mae for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance