Exploring Undervalued US Stocks For Strategic Investment In June 2024

As the U.S. stock market continues to reach new heights, with recent record closes for both the S&P 500 and Nasdaq, investors are keenly observing market dynamics for potential opportunities. Amidst this environment, identifying undervalued stocks becomes crucial as they may offer strategic investment potential against the broader trend of high valuations in sectors like technology. In considering what constitutes a good investment in undervalued stocks, it's essential to look beyond mere price metrics and consider factors such as robust fundamentals, potential for growth in challenging economic conditions, and resilience to market volatility. This approach aligns well with current market conditions where discernment can uncover value even as overall market valuations stretch higher.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Selective Insurance Group (NasdaqGS:SIGI) | $91.91 | $183.51 | 49.9% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.29 | $32.30 | 49.6% |

Associated Banc-Corp (NYSE:ASB) | $20.36 | $39.50 | 48.5% |

USCB Financial Holdings (NasdaqGM:USCB) | $12.02 | $23.71 | 49.3% |

AppLovin (NasdaqGS:APP) | $80.84 | $158.81 | 49.1% |

Hexcel (NYSE:HXL) | $63.26 | $122.58 | 48.4% |

DiDi Global (OTCPK:DIDI.Y) | $4.49 | $8.85 | 49.3% |

HeartCore Enterprises (NasdaqCM:HTCR) | $0.713 | $1.40 | 49.2% |

Rapid7 (NasdaqGM:RPD) | $36.33 | $70.33 | 48.3% |

Astronics (NasdaqGS:ATRO) | $18.59 | $35.95 | 48.3% |

Let's review some notable picks from our screened stocks

Light & Wonder

Overview: Light & Wonder, Inc. operates as a cross-platform games company both in the United States and internationally, with a market capitalization of approximately $8.80 billion.

Operations: The company generates revenue through three primary segments: Gaming ($1.91 billion), iGaming ($0.28 billion), and SciPlay ($0.80 billion).

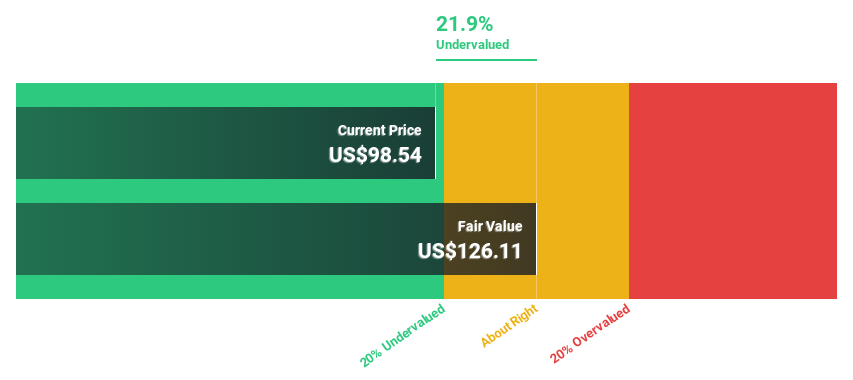

Estimated Discount To Fair Value: 21.9%

Light & Wonder, currently priced at US$98.54, appears undervalued by cash flow analysis with a fair value estimate of US$126.11, indicating potential underpricing by 21.9%. Recent financials show a significant uptick in earnings with a net income increase to US$82 million from US$22 million year-over-year and strong share buyback activities signaling confidence from management. However, revenue growth projections are modest at 5.7% annually, lagging behind the broader market expectation of 8.7%, and interest coverage issues suggest some financial strain.

Evercore

Overview: Evercore Inc., along with its subsidiaries, functions as an independent investment banking advisory firm across the United States, Europe, Latin America, and other global regions, boasting a market capitalization of approximately $9.01 billion.

Operations: The firm's revenue is primarily derived from its Investment Banking & Equities segment, which generated $2.36 billion, and its Investment Management segment, contributing $71.76 million.

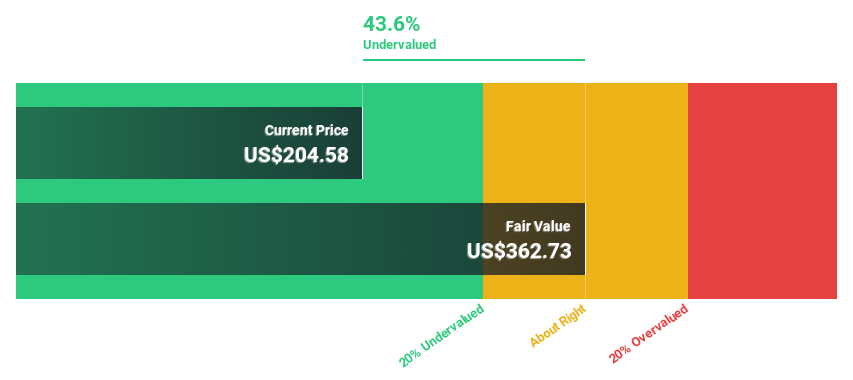

Estimated Discount To Fair Value: 43.6%

Evercore, trading at US$204.58, is significantly undervalued based on discounted cash flow estimates with a fair value of US$362.73. Despite a decrease in net profit margins from 15.4% to 10.6% over the past year, Evercore's revenue and earnings are forecasted to grow at an annual rate of 16.4% and 28.88%, respectively, outpacing the market averages of 8.7% and 14.9%. The firm pays a steady dividend yield of 1.56%, although shareholder dilution has occurred within the year.

Live Nation Entertainment

Overview: Live Nation Entertainment, Inc. operates globally as a live entertainment company with a market capitalization of approximately $21.12 billion.

Operations: The company generates revenue primarily through three segments: concerts, which brought in $19.36 billion, ticketing at $3.00 billion, and sponsorship & advertising contributing $1.14 billion.

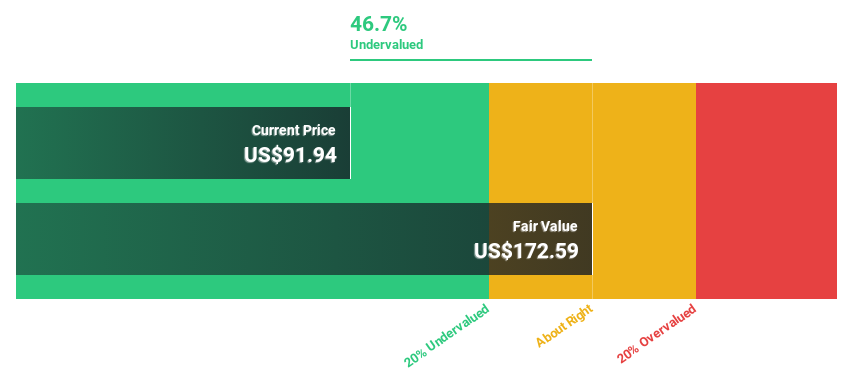

Estimated Discount To Fair Value: 46.7%

Live Nation Entertainment, valued at US$91.94, is currently priced well below the calculated fair value of US$172.59, indicating significant undervaluation based on discounted cash flow analysis. Despite recent legal challenges and a net loss reported in Q1 2024, analysts predict a robust earnings growth of approximately 28% annually over the next three years, surpassing the market's average growth rate. However, its revenue growth forecast at 7.2% annually lags behind the broader U.S. market expectation of 8.7%.

Make It Happen

Click through to start exploring the rest of the 169 Undervalued US Stocks Based On Cash Flows now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:LNW NYSE:EVR and NYSE:LYV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance