Exploring Undervalued Stocks On SEHK With Intrinsic Discounts Ranging From 11% To 48.3%

As global markets exhibit varied trends, the Hong Kong market presents a unique landscape, with the Hang Seng Index showing modest gains amidst broader economic challenges such as declining home prices and mixed retail sales data. In this context, identifying undervalued stocks becomes crucial as they may offer potential for significant returns when assessed against intrinsic values and current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

China Resources Mixc Lifestyle Services (SEHK:1209) | HK$26.25 | HK$46.16 | 43.1% |

United Energy Group (SEHK:467) | HK$0.30 | HK$0.57 | 47.5% |

China Cinda Asset Management (SEHK:1359) | HK$0.69 | HK$1.29 | 46.5% |

Zijin Mining Group (SEHK:2899) | HK$15.96 | HK$28.62 | 44.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$9.83 | HK$19.00 | 48.3% |

Super Hi International Holding (SEHK:9658) | HK$14.10 | HK$26.01 | 45.8% |

REPT BATTERO Energy (SEHK:666) | HK$13.92 | HK$27.18 | 48.8% |

Zhaojin Mining Industry (SEHK:1818) | HK$12.68 | HK$24.55 | 48.3% |

Innovent Biologics (SEHK:1801) | HK$39.05 | HK$73.32 | 46.7% |

CGN Mining (SEHK:1164) | HK$2.49 | HK$4.83 | 48.4% |

Let's dive into some prime choices out of from the screener

iDreamSky Technology Holdings

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform in the People’s Republic of China, publishing games through mobile apps and websites, with a market capitalization of approximately HK$4.57 billion.

Operations: The company generates revenue primarily from its Game and Information Services segment, which includes SaaS and other related services, amounting to CN¥1.92 billion.

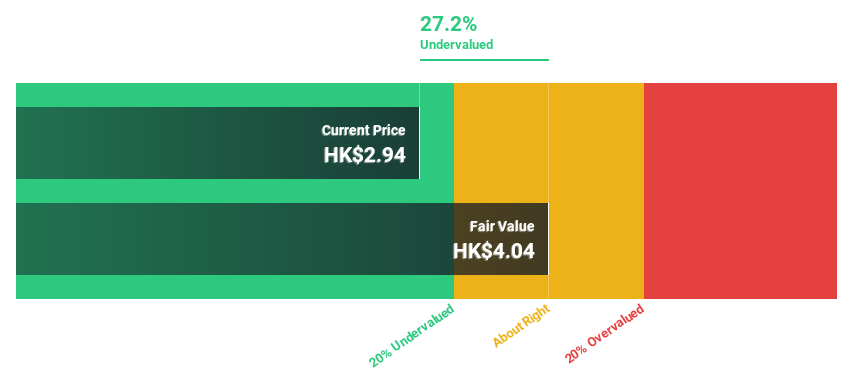

Estimated Discount To Fair Value: 27.2%

iDreamSky Technology Holdings, while facing a net loss of CNY 556.35 million in 2023, shows promise with a forecasted revenue growth of 29.8% per year, outpacing the Hong Kong market's average. Despite recent financial struggles, the stock is trading at HK$2.94, significantly below the estimated fair value of HK$4.04, suggesting it is undervalued based on discounted cash flows. Analysts expect profitability within three years and a substantial annual profit growth rate of 104.11%, indicating potential for recovery and growth.

MicroPort CardioFlow Medtech

Overview: MicroPort CardioFlow Medtech Corporation operates as a medical device company focused on developing and commercializing transcatheter and surgical solutions for structural heart diseases, with a market capitalization of approximately HK$2.00 billion.

Operations: The company generates revenue primarily from its surgical and medical devices segment, totaling CN¥336.22 million.

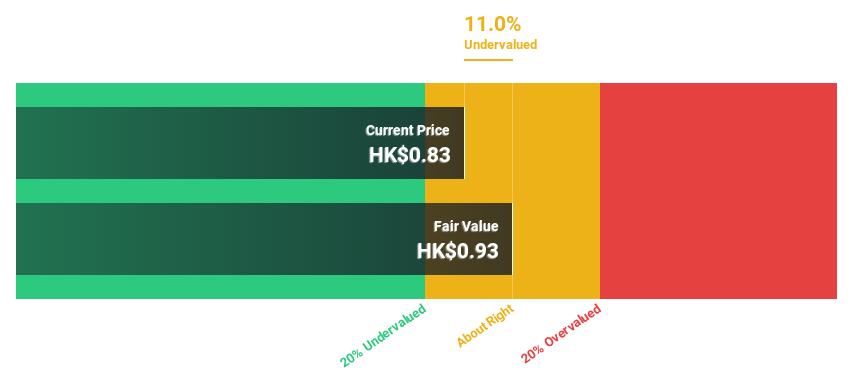

Estimated Discount To Fair Value: 11%

MicroPort CardioFlow Medtech, despite a net loss of CNY 471.53 million in 2023, is trading at HK$0.83, below the estimated fair value of HK$0.93. With revenue growth forecasted at a robust 21.4% per year, the company's financial trajectory outstrips the Hong Kong market average significantly. Recent corporate governance enhancements and service agreements underscore operational adjustments poised to support its anticipated shift to profitability within three years, aligning with above-average market growth expectations.

Zylox-Tonbridge Medical Technology

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, operating both in the People’s Republic of China and internationally, with a market capitalization of HK$3.18 billion.

Operations: The company generates its revenue primarily from the sale of neurovascular and peripheral-vascular interventional surgical devices, totaling CN¥527.75 million.

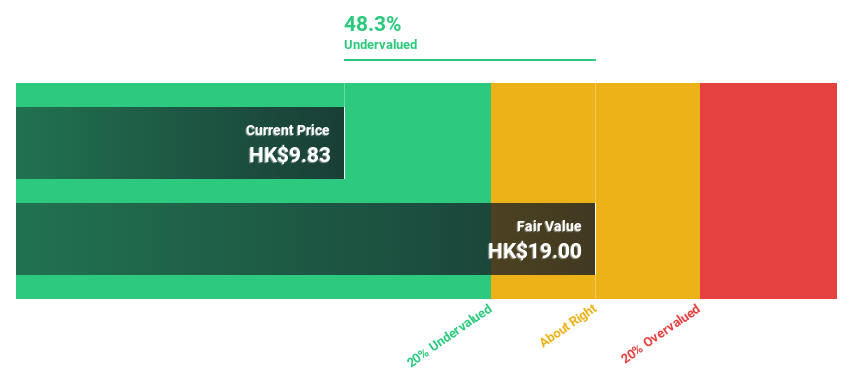

Estimated Discount To Fair Value: 48.3%

Zylox-Tonbridge Medical Technology, valued at HK$9.83, is perceived as undervalued with a fair value estimation of HK$19. The company's revenue is expected to grow by 24.1% annually, surpassing Hong Kong's average of 7.8%. Despite modest earnings growth over the past five years (0.1% per year), recent product approvals like the ZYLOX Unicorn® Suture-mediated Closure System indicate potential market expansion and innovation strength, which could enhance future profitability forecasts and cash flows significantly.

Turning Ideas Into Actions

Unlock our comprehensive list of 43 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:2160SEHK:2190 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance