Exploring Undervalued Stocks on SEHK: A Closer Look at Best Pacific International Holdings and Two Others

Amidst a landscape of global economic fluctuations and mixed market signals, Hong Kong's Hang Seng Index has shown resilience with a modest gain during a holiday-shortened week. This stability offers an intriguing context for investors to consider the potential of undervalued stocks within this market. Identifying such stocks involves looking beyond current valuations to factors like financial health, market position, and growth potential, which can provide substantial opportunities in these complex market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Giant Biogene Holding (SEHK:2367) | HK$41.25 | HK$75.60 | 45.4% |

China Cinda Asset Management (SEHK:1359) | HK$0.66 | HK$1.29 | 48.8% |

Super Hi International Holding (SEHK:9658) | HK$13.72 | HK$26.01 | 47.2% |

Zijin Mining Group (SEHK:2899) | HK$17.26 | HK$32.09 | 46.2% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$26.65 | HK$48.19 | 44.7% |

BYD (SEHK:1211) | HK$236.80 | HK$462.15 | 48.8% |

Vobile Group (SEHK:3738) | HK$1.19 | HK$2.31 | 48.5% |

AK Medical Holdings (SEHK:1789) | HK$4.39 | HK$7.95 | 44.7% |

MicroPort Scientific (SEHK:853) | HK$5.33 | HK$9.64 | 44.7% |

Q Technology (Group) (SEHK:1478) | HK$4.02 | HK$7.43 | 45.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Best Pacific International Holdings

Overview: Best Pacific International Holdings Limited, operating through its subsidiaries, engages in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace with a market capitalization of approximately HK$2.53 billion.

Operations: The company generates revenue through two primary segments: the manufacturing and trading of elastic webbing, which brought in HK$834.34 million, and the manufacturing and trading of elastic fabric and lace, which accounted for HK$3.37 billion.

Estimated Discount To Fair Value: 36.4%

Best Pacific International Holdings, currently trading at HK$2.43, is valued below its estimated fair value of HK$3.82, suggesting it is undervalued by more than 20%. The company's earnings have grown by 15.9% over the past year and are expected to increase significantly, with a forecasted annual growth rate of 24.29%. Despite this robust growth outlook, the company's Return on Equity is projected to be low at 19.4% in three years. Recently, the firm raised its dividend to HK$0.1138 per share for the year ended December 31, 2023.

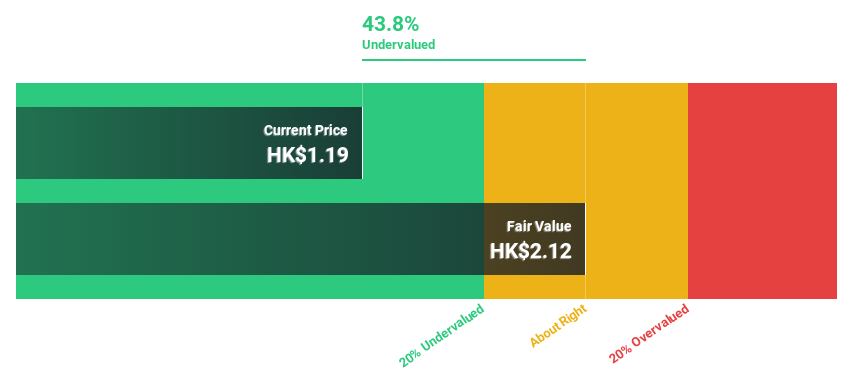

Vobile Group

Overview: Vobile Group Limited operates as an investment holding company, offering software as a service for the protection and transaction of digital content assets across the United States, Japan, Mainland China, and other international markets, with a market capitalization of approximately HK$2.69 billion.

Operations: The company generates HK$2 billion in revenue from its SaaS offerings for digital content asset protection and transactions.

Estimated Discount To Fair Value: 48.5%

Vobile Group, priced at HK$1.19, is considerably below its fair value of HK$2.31, indicating a significant undervaluation based on cash flows. The company's revenue is projected to grow by 21.7% annually, outpacing the Hong Kong market forecast of 7.7%. Despite this rapid growth and a transition to profitability expected within three years, potential investors should note the recent shareholder dilution and a modest forecasted Return on Equity of 6.6%. Recent corporate actions include amendments to company bylaws and an AGM focused on governance enhancements.

Our growth report here indicates Vobile Group may be poised for an improving outlook.

Dive into the specifics of Vobile Group here with our thorough financial health report.

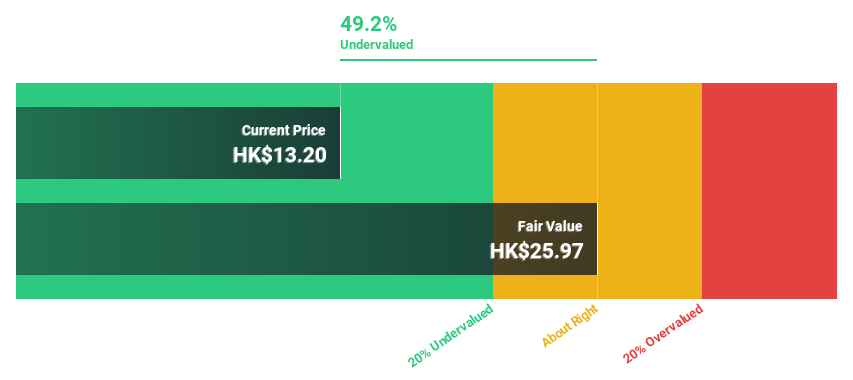

Super Hi International Holding

Overview: Super Hi International Holding Ltd., an investment holding company, operates Haidilao branded Chinese cuisine restaurants across Asia, North America, and other international locations with a market cap of approximately HK$8.92 billion.

Operations: The company generates its revenue primarily through the operation of Haidilao branded restaurants, totaling approximately $712.07 million.

Estimated Discount To Fair Value: 47.2%

Super Hi International Holding, trading at HK$13.72, is significantly undervalued with a fair value estimated at HK$26.01. The company's earnings are expected to grow by 48.4% annually, surpassing the Hong Kong market average of 11.3%. Despite recent losses reported in Q1 2024 and shareholder dilution from equity offerings, revenue growth projections remain strong at 14% per year. The appointment of Ms. Yang Lijuan as CEO could signal strategic shifts aimed at enhancing operational efficiency and market expansion.

Taking Advantage

Take a closer look at our Undervalued SEHK Stocks Based On Cash Flows list of 41 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2111 SEHK:3738 and SEHK:9658.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance