Exploring Undervalued Stocks On KRX With Intrinsic Discounts Ranging From 11.7% To 29.4%

The South Korean stock market recently halted its two-day winning streak, reflecting a blend of sector-specific movements and broader economic signals. As the KOSPI index navigates through these fluctuations, identifying stocks that appear undervalued relative to their intrinsic value could offer interesting opportunities for investors attentive to discrepancies between market price and fundamental worth.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Poongsan Holdings (KOSE:A005810) | ₩27350.00 | ₩49288.31 | 44.5% |

Solum (KOSE:A248070) | ₩21000.00 | ₩39922.07 | 47.4% |

Iljin ElectricLtd (KOSE:A103590) | ₩26200.00 | ₩50954.58 | 48.6% |

Protec (KOSDAQ:A053610) | ₩29550.00 | ₩55180.43 | 46.4% |

Caregen (KOSDAQ:A214370) | ₩21850.00 | ₩43428.59 | 49.7% |

Anapass (KOSDAQ:A123860) | ₩26800.00 | ₩48506.88 | 44.8% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49471.24 | 49.7% |

Intellian Technologies (KOSDAQ:A189300) | ₩58900.00 | ₩108558.75 | 45.7% |

IMLtd (KOSDAQ:A101390) | ₩6820.00 | ₩13548.25 | 49.7% |

Ray (KOSDAQ:A228670) | ₩12260.00 | ₩22352.30 | 45.2% |

Here we highlight a subset of our preferred stocks from the screener

KoMiCo

Overview: KoMiCo Ltd. specializes in providing semiconductor equipment cleaning and coating products across South Korea, the United States, China, Taiwan, and Singapore, with a market capitalization of approximately ₩833.58 billion.

Operations: The company generates its revenue primarily from semiconductor equipment and services, totaling approximately ₩362.16 billion.

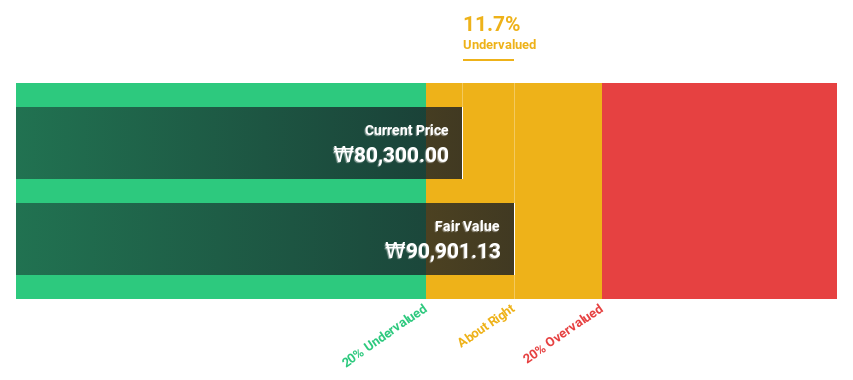

Estimated Discount To Fair Value: 11.7%

KoMiCo, priced at ₩80,300, is currently undervalued by 11.7%, trading below the estimated fair value of ₩90,901.13. While its revenue growth forecast of 18.2% per year underperforms the 20% benchmark, it surpasses Korea's market average of 10.5%. Earnings have increased by 12.4% over the past year with expectations to rise significantly at a rate of 27.71% annually over the next three years, outpacing the market's forecast growth rate of 29.2%. However, large one-off items have impacted its financial results.

C&C International

Overview: C&C International Co., Ltd specializes in the research, development, manufacturing, and sale of cosmetics within Korea and has a market capitalization of approximately ₩1.35 trillion.

Operations: The company generates revenue primarily from its personal products segment, totaling approximately ₩246.30 billion.

Estimated Discount To Fair Value: 13.8%

C&C International, with a current price of ₩135,400, is 13.8% undervalued compared to its fair value of ₩157,099.46. The company's earnings are projected to increase by 24% annually, slightly below the Korean market average of 29.2%. However, its revenue growth at 21.4% per year exceeds the market's 10.5%, indicating potential underappreciated strength in sales generation despite a highly volatile share price recently and significant non-cash earnings contributing to quality concerns.

ISU Petasys

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs), with a market capitalization of approximately ₩3.71 billion.

Operations: The company's revenue is primarily derived from the global manufacture and sale of printed circuit boards.

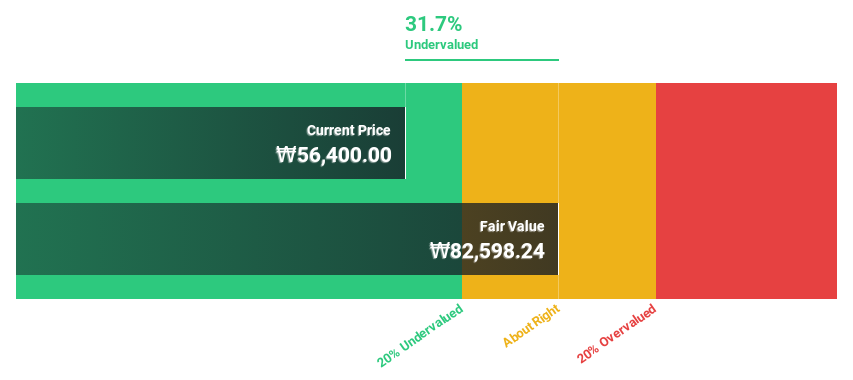

Estimated Discount To Fair Value: 29.4%

ISU Petasys, priced at ₩58,700, is significantly undervalued by 29.4% against a fair value of ₩83,167.73. It's poised for robust growth with earnings expected to surge by 41.48% annually over the next three years, outpacing the Korean market forecast of 29.2%. Revenue growth is also strong at 16.2% yearly, higher than the market's 10.5%. However, its debt isn't well covered by operating cash flow and profit margins have declined from last year’s 15.1% to current 7%, reflecting some financial strains despite high growth projections.

Where To Now?

Delve into our full catalog of 37 Undervalued KRX Stocks Based On Cash Flows here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A183300 KOSDAQ:A352480 and KOSE:A007660.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance