Exploring Undervalued Stocks On Chinese Exchanges With Discounts Ranging From 20.5% To 44.8%

Amidst a backdrop of deflationary pressures and subdued consumer confidence, China's stock markets have experienced notable fluctuations. This environment may present opportunities to identify stocks that are potentially undervalued relative to their intrinsic value. In such market conditions, discerning investors often look for companies with solid fundamentals that may be overlooked by the broader market, offering a potential discount on their true worth.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

YanKer shop FoodLtd (SZSE:002847) | CN¥47.38 | CN¥94.36 | 49.8% |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥56.85 | CN¥110.84 | 48.7% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.58 | CN¥21.97 | 47.3% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.60 | CN¥20.03 | 47.1% |

Hainan Drinda New Energy Technology (SZSE:002865) | CN¥46.08 | CN¥91.26 | 49.5% |

Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥14.82 | CN¥29.55 | 49.8% |

TianJin 712 Communication & Broadcasting (SHSE:603712) | CN¥20.29 | CN¥38.37 | 47.1% |

INKON Life Technology (SZSE:300143) | CN¥7.34 | CN¥14.64 | 49.9% |

Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.64 | CN¥26.97 | 49.4% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.26 | CN¥40.67 | 47.7% |

We'll examine a selection from our screener results

Ningxia Baofeng Energy Group

Overview: Ningxia Baofeng Energy Group Co., Ltd. is engaged in the production and sale of a range of products including coal mining, washing, coking, and chemicals like coal tar and methanol, with a market capitalization of approximately CN¥121.34 billion.

Operations: The company generates revenue from several key segments, including coal mining and washing at CN¥10.00 billion, coking at CN¥5.00 billion, and the production of chemicals such as coal tar, crude benzene, C4 deep-processed products, methanol, and olefins totaling CN¥15.00 billion.

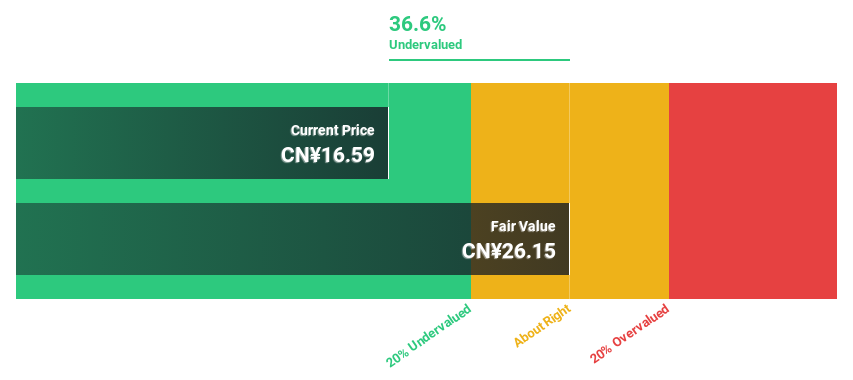

Estimated Discount To Fair Value: 36.6%

Ningxia Baofeng Energy Group, currently trading at CN¥16.59, significantly below the estimated fair value of CN¥26.15, appears undervalued based on cash flows and DCF analysis. Despite a high level of debt, the company's earnings are expected to grow by 32.95% annually over the next three years, outpacing the Chinese market forecast of 22.7%. Recent earnings reports show robust growth with Q1 2024 net income rising to CN¥1,420.94 million from CN¥1,185.22 million year-over-year.

Servyou Software Group

Overview: Servyou Software Group Co., Ltd. is a Chinese company specializing in financial and tax information services, with a market capitalization of approximately CN¥9.81 billion.

Operations: The firm specializes in delivering financial and tax information services across China.

Estimated Discount To Fair Value: 20.5%

Servyou Software Group, with a recent share price of CN¥24.09, trades below the DCF-estimated fair value of CN¥30.31, indicating potential undervaluation. Despite slower revenue growth at 17.7% annually compared to the broader Chinese market's 20%, its earnings are expected to surge by 48.75% annually over the next three years, significantly outstripping market predictions. However, concerns linger as profit margins have dipped from last year's 8.4% to just 4.5%. Recent financials show a steady performance with Q1 2024 net income slightly up at CN¥32.78 million from CN¥32.01 million year-over-year.

Quectel Wireless Solutions

Overview: Quectel Wireless Solutions Co., Ltd. operates globally, specializing in the research, development, design, production, and sales of wireless communication modules and solutions, with a market capitalization of approximately CN¥13.06 billion.

Operations: The company generates its revenue from the global sales of wireless communication modules and solutions.

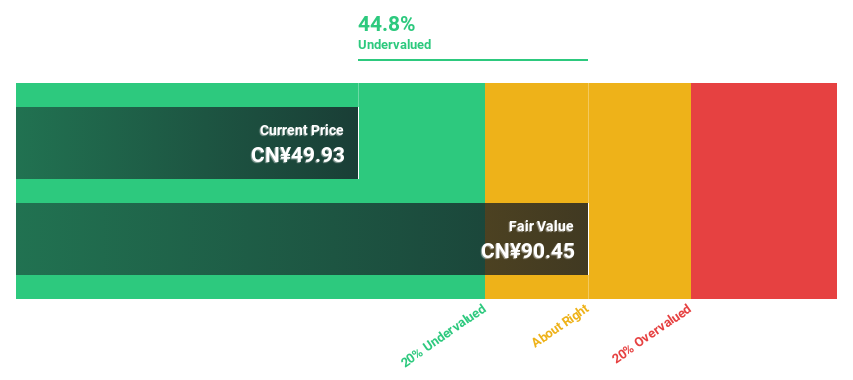

Estimated Discount To Fair Value: 44.8%

Quectel Wireless Solutions, priced at CN¥49.93, is significantly undervalued compared to its fair value of CN¥90.45, reflecting a 44.8% discount. The company's financial outlook is promising with earnings and revenue expected to grow by 38.9% and 21.2% annually over the next three years respectively—both metrics surpassing market averages significantly. Despite these strengths, the projected return on equity of 15.3% in three years remains modest, suggesting potential challenges in achieving higher profitability levels amidst aggressive growth strategies.

Summing It All Up

Embark on your investment journey to our 101 Undervalued Chinese Stocks Based On Cash Flows selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:600989 SHSE:603171 and SHSE:603236.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance