Exploring Undervalued Small Caps With Insider Actions In July 2024

Amid a backdrop of mixed global market performances, small-cap stocks have shown some vulnerability with the Russell 2000 Index experiencing slight declines. This nuanced landscape sets the stage for discerning investors to identify potentially undervalued small-cap companies, particularly those with recent insider buying actions that might signal unrecognized value or upcoming improvements.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Hanover Bancorp | 8.3x | 1.9x | 49.39% | ★★★★★☆ |

Tokmanni Group Oyj | 16.7x | 0.5x | 38.97% | ★★★★★☆ |

Guardian Capital Group | 10.6x | 4.1x | 31.39% | ★★★★★☆ |

Calfrac Well Services | 2.3x | 0.2x | 8.09% | ★★★★☆☆ |

Russel Metals | 8.5x | 0.5x | 0.67% | ★★★★☆☆ |

Franklin Financial Services | 8.7x | 1.8x | 38.49% | ★★★★☆☆ |

NSI | NA | 4.5x | 46.26% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -94.12% | ★★★★☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Freehold Royalties | 15.2x | 6.6x | 49.47% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Dicker Data

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor of computer peripherals, with a market capitalization of approximately A$2.27 billion.

Operations: In its latest reported period, the company generated A$2.27 billion in revenue from wholesale computer peripherals, achieving a gross profit of A$322.61 million and a net income of A$82.15 million, reflecting a gross profit margin of 14.23% and a net income margin of 3.62%.

PE: 23.1x

Dicker Data, a lesser-known yet promising company, recently displayed insider confidence as they purchased shares, signaling belief in the firm's potential. Despite a high debt level, this entity maintains growth prospects with earnings expected to rise by nearly 8% annually. Their financial strategy relies solely on external borrowing—considered higher risk—but this hasn't deterred insiders from investing. Additionally, a regular dividend was declared on May 13th, enhancing its appeal among yield-seeking investors. This blend of insider activity and financial planning underscores why Dicker Data stands out in its sector.

Delve into the full analysis valuation report here for a deeper understanding of Dicker Data.

Gain insights into Dicker Data's past trends and performance with our Past report.

Marksans Pharma

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company primarily engaged in the manufacturing and marketing of formulation products, with a market capitalization of approximately ₹21.77 billion.

Operations: Pharmaceuticals generated ₹21.77 billion in revenue, with a gross profit of ₹11.39 billion and operating expenses of ₹7.55 billion, leading to a net income of ₹3.14 billion and a gross profit margin of 52.32%.

PE: 27.2x

Recently, Marksans Pharma demonstrated financial resilience with a notable increase in yearly sales to INR 21.77 billion and revenue to INR 22.28 billion, reflecting a robust growth trajectory despite a slight dip in quarterly net income. Insider confidence is evident as they have actively purchased shares, signaling strong belief in the company's potential. With earnings per share also on the rise and a new dividend proposed, Marksans stands out for its promising prospects within its sector.

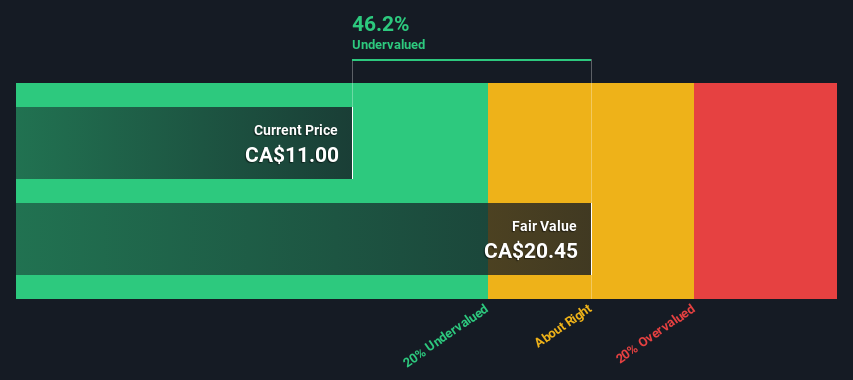

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

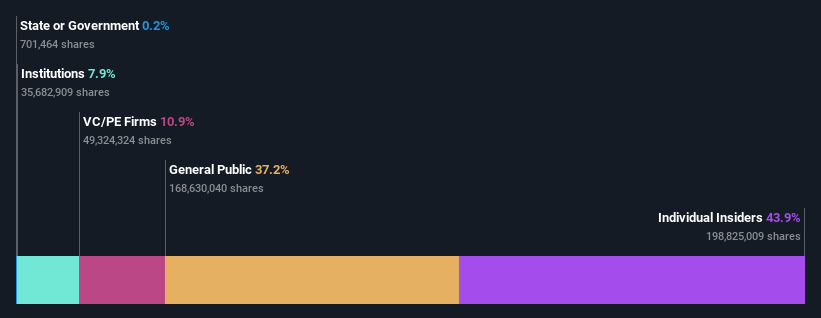

Overview: Dundee Precious Metals is a mining company that operates primarily through its two main gold and copper mines, Ada Tepe and Chelopech, with a market capitalization of approximately $1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, with the company achieving a net income margin of 34.36% in the most recent quarter reported. The gross profit margin has shown a notable increase to 52.79% during the same period, indicating improved efficiency in managing production costs relative to revenue.

PE: 8.8x

Dundee Precious Metals, reflecting a blend of financial prudence and strategic growth, recently confirmed robust production guidance for 2024, with expected significant outputs in gold and copper. This projection is supported by the company's solid Q2 performance and complements their strategic executive appointments aimed at enhancing corporate development. Notably, insider confidence is evident as they recently purchased shares, underscoring a belief in the company’s potential amidst its operational expansions and consistent dividend payouts.

Make It Happen

Take a closer look at our Undervalued Small Caps With Insider Buying list of 226 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:DDR NSEI:MARKSANS and TSX:DPM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance