Exploring Undervalued Small Caps With Insider Action In July 2024

As global markets navigate through a relatively quiet period, small-cap stocks in the U.S. have shown notable resilience and outperformance, particularly as investors adjust their positions ahead of major index rebalances. This backdrop sets an intriguing stage for investors to explore potential opportunities within undervalued small-cap stocks that may be poised for growth amidst these dynamics. In this context, a good stock might be characterized by solid fundamentals, insider buying activity which can signal confidence in the company's prospects from those who know it best, and valuation metrics suggesting that the stock is trading below its intrinsic value.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Nexus Industrial REIT | 2.4x | 3.0x | 20.97% | ★★★★★★ |

Dundee Precious Metals | 7.9x | 2.7x | 47.55% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.3x | 2.9x | 36.61% | ★★★★★☆ |

Russel Metals | 9.1x | 0.5x | 15.71% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 32.47% | ★★★★☆☆ |

Calfrac Well Services | 2.3x | 0.2x | 6.46% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -94.43% | ★★★★☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Freehold Royalties | 15.2x | 6.6x | 49.15% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -139.07% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

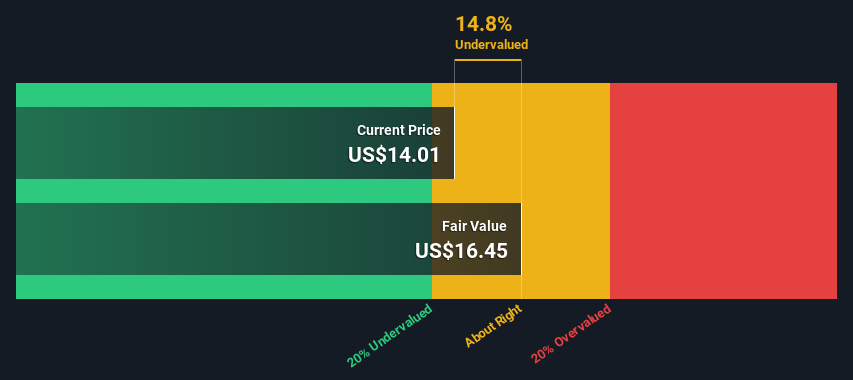

Semen Indonesia (Persero)

Simply Wall St Value Rating: ★★★★★☆

Overview: Semen Indonesia is a company primarily engaged in cement and non-cement production, with a market capitalization of approximately IDR 34.11 billion.

Operations: Cement Production and Non-Cement Production are the primary revenue contributors for SMGR, generating IDR 34.11 billion and IDR 13.13 billion respectively. The company has observed a Gross Profit Margin of 0.26% as of the latest reporting period in 2024, reflecting its cost management in relation to sales revenue.

PE: 12.7x

Recently, PT Semen Indonesia (Persero) Tbk showcased a dip in quarterly sales and net income as reported on May 10, 2024, with sales dropping to IDR 8.38 billion from IDR 8.94 billion year-over-year and net income decreasing to IDR 472 million from IDR 562 million. Despite these challenges, forecasters see earnings growth of about 13.5% annually. Significantly, the company maintains a unique funding structure with no customer deposits and complete reliance on external borrowing—considered higher risk but potentially rewarding for discerning investors looking for growth in lesser-known markets. At the recent Macquarie Asia Conference, they highlighted strategic initiatives poised to capitalize on emerging market dynamics. Additionally, insider confidence is reflected through recent share purchases by executives who are betting on the company's strategy and future prospects.

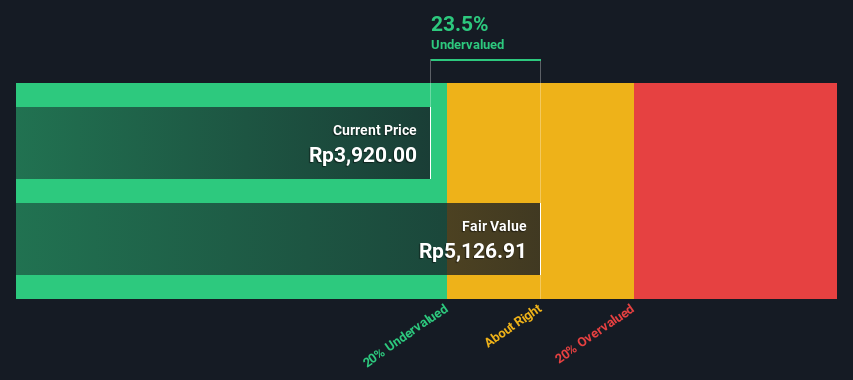

Ramaco Resources

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company focused on the production and sale of metallurgical coal, primarily serving the metals and mining sector, with a market capitalization of approximately $699.84 million.

Operations: The company generates revenue from coal mining, with recent figures showing a revenue of $699.84 million. Gross profit margins have seen an upward trend, reaching 0.25 in the latest period, indicating an increasing efficiency in managing production costs relative to sales.

PE: 13.2x

Ramaco Resources, a company deeply embedded in the mining sector, recently showcased its adaptability and potential for growth with strategic leadership changes and an enhanced credit facility. Despite a dip in profit margins from 17.3% to 8% over the past year, insider confidence remains robust as evidenced by recent share purchases by executives. This action underscores their belief in the company's prospects amidst operational expansions and financial restructuring aimed at bolstering future performance.

Click to explore a detailed breakdown of our findings in Ramaco Resources' valuation report.

Review our historical performance report to gain insights into Ramaco Resources''s past performance.

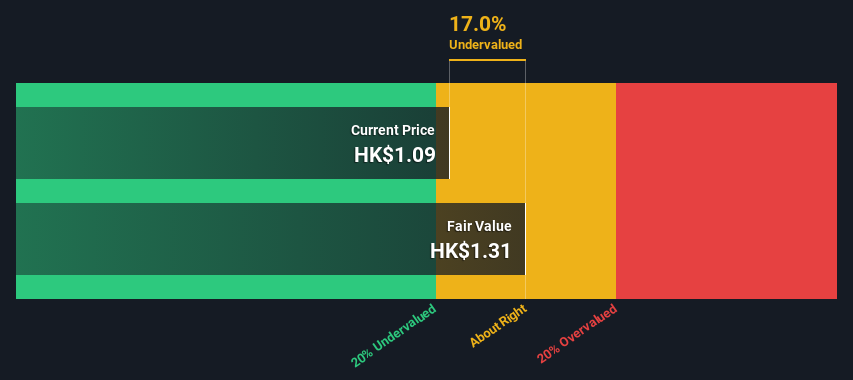

Kinetic Development Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company focused on real estate development and operations, with a market capitalization of approximately CN¥1.23 billion.

Operations: The company has demonstrated a significant increase in gross profit margin, rising from 9.05% in September 2013 to 59.07% by July 2024, reflecting improved operational efficiency and cost management. Over the same period, revenue grew from CN¥102.90 million to CN¥4745.07 million, indicating substantial expansion and increased market presence.

PE: 4.3x

Kinetic Development Group, amidst a backdrop of corporate governance enhancements and dividend adjustments, has demonstrated noteworthy insider confidence with recent acquisitions of shares by executives. This action, coupled with a purely external borrowing financial structure—devoid of customer deposits—suggests a bold strategic direction despite the inherent risks. With its next earnings anticipated on May 31, 2024, the firm's readiness to navigate future challenges while capitalizing on opportunities is palpable.

Key Takeaways

Investigate our full lineup of 228 Undervalued Small Caps With Insider Buying right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IDX:SMGR NasdaqGS:METC and SEHK:1277.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance