Exploring Undervalued Small Caps With Insider Actions In July 2024

As global markets navigate through a relatively quiet period, U.S. small-cap stocks have shown notable resilience and outperformance, particularly as investors adjust their positions in anticipation of the upcoming quarterly earnings reports. This backdrop sets an intriguing stage for investors to explore potential opportunities within undervalued small-cap stocks, especially those with significant insider actions, which can often signal confidence in the company's future prospects amidst broader market movements.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.9x | 2.7x | 46.35% | ★★★★★★ |

THG | NA | 0.4x | 43.15% | ★★★★★☆ |

Codan | 28.8x | 4.2x | 27.69% | ★★★★☆☆ |

China Leon Inspection Holding | 9.5x | 0.7x | 29.37% | ★★★★☆☆ |

Kambi Group | 17.7x | 1.5x | 26.71% | ★★★★☆☆ |

Norconsult | 27.9x | 1.0x | 43.33% | ★★★☆☆☆ |

Tai Sin Electric | 15.4x | 0.5x | 4.02% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -47.20% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -149.47% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ramaco Resources

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ramaco Resources is a company engaged in the coal mining sector, with a market capitalization of approximately $699.84 million.

Operations: In its Metals & Mining - Coal segment, the company generated a revenue of $699.84 million, with a gross profit margin of 25.27%. The net income for the period was $56.32 million, reflecting a net income margin of 8.05%.

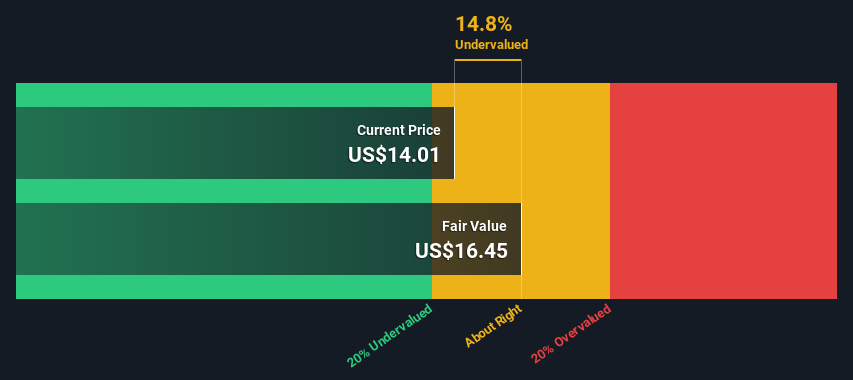

PE: 13.7x

Despite a challenging year with profit margins dipping to 8% from 17.3%, Ramaco Resources exhibits potential for modest earnings growth, forecasted at nearly 3% annually. Recently, the company has seen significant insider confidence, with purchases underscoring a belief in its future prospects. This aligns with strategic index shifts and leadership changes aimed at bolstering growth areas like critical mineral development. These moves suggest a readiness to capitalize on emerging opportunities while navigating market dynamics effectively.

Delve into the full analysis valuation report here for a deeper understanding of Ramaco Resources.

Review our historical performance report to gain insights into Ramaco Resources''s past performance.

Marksans Pharma

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company primarily engaged in the manufacturing and marketing of formulation products, with a market capitalization of approximately ₹21.77 billion.

Operations: Pharmaceuticals generated ₹21.77 billion in revenue, with a notable gross profit margin of 52.32% as of the latest reporting period, reflecting efficient cost management relative to sales. This sector has experienced an increase in operating expenses, reaching ₹7.55 billion, which underscores significant investment in operational activities to support business growth.

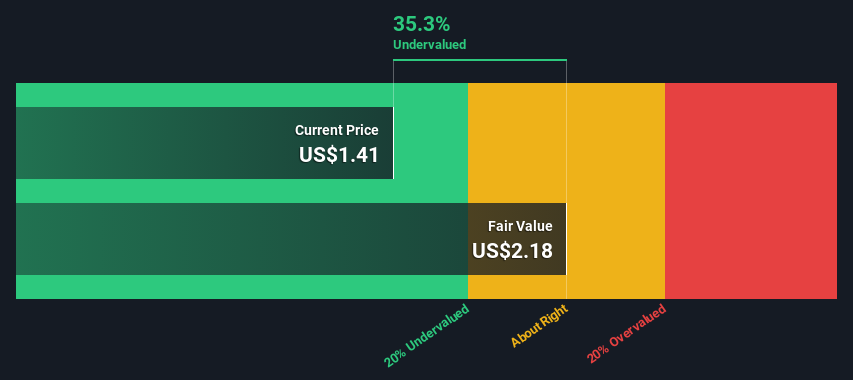

PE: 27.2x

Recently, Marksans Pharma showcased a robust financial performance, with annual revenue climbing to INR 22.28 billion, up significantly from the previous year’s INR 19.11 billion. This growth is underpinned by a promising earnings forecast of a 21.63% increase per year. Insider confidence is evident as insiders have recently increased their holdings, signaling their belief in the company's prospects amidst its strategic expansions and operational enhancements. With these developments and a recent dividend increase to INR 0.60 per share, Marksans stands out in its sector for its potential and financial health.

Clear Channel Outdoor Holdings

Simply Wall St Value Rating: ★★★★★☆

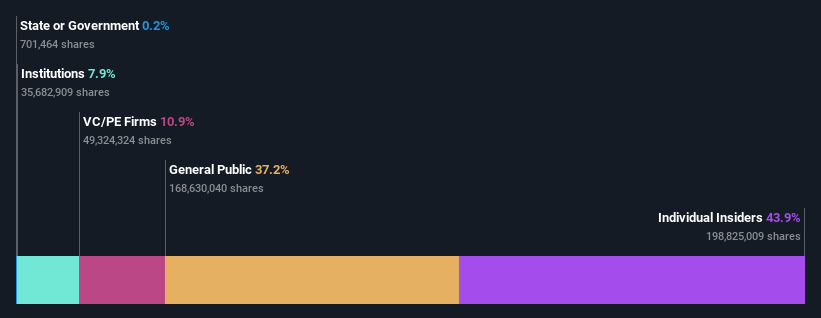

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning airport ads, European markets, and broader American regions, with a market capitalization of approximately $0.65 billion.

Operations: The company's revenue streams are primarily derived from its operations across America (excluding airports), Europe-North, and airport-based advertising, generating $1.11 billion, $630.45 million, and $334.74 million respectively. Over recent periods, the gross profit margin has shown variability but remained under 50%, indicating the cost of goods sold consistently represents over half of the revenue generated.

PE: -4.9x

Recently, Clear Channel Outdoor Holdings showcased insider confidence with significant share acquisitions, signaling strong belief in the company's potential despite its current unprofitability. With a recent inclusion in multiple Russell indexes and a robust sales increase to US$481.75 million in Q1 2024 from the previous year, the firm is positioning itself for growth. The company anticipates revenues between US$2.2 billion and US$2.26 billion for 2024, reflecting optimism about future performance amidst challenging conditions.

Make It Happen

Unlock our comprehensive list of 228 Undervalued Small Caps With Insider Buying by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:METC NSEI:MARKSANS and NYSE:CCO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance