Exploring Undervalued Small Caps With Insider Actions In The United States July 2024

Amidst a turbulent market landscape, where Nvidia's recent rebound has injected some optimism into the S&P 500 and Nasdaq, investors continue to navigate through mixed economic signals and cautious consumer sentiment. These conditions underscore the importance of identifying small-cap stocks that not only demonstrate solid fundamentals but also exhibit favorable insider actions, suggesting potential undervalued opportunities in this segment of the market.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

PCB Bancorp | 9.3x | 2.5x | 42.40% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 29.35% | ★★★★★☆ |

AtriCure | NA | 2.7x | 48.61% | ★★★★★☆ |

Columbus McKinnon | 21.4x | 1.0x | 45.46% | ★★★★☆☆ |

Leggett & Platt | NA | 0.3x | 18.38% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 17.61% | ★★★★☆☆ |

Papa John's International | 20.8x | 0.7x | 34.05% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -152.49% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -147.37% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Reservoir Media

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Reservoir Media is a music rights company that operates in music publishing and recorded music, with a market capitalization of approximately $282 million.

Operations: The company's gross profit margin has shown a rising trend, increasing from 58.18% in early 2019 to 61.70% by mid-2024, reflecting improved efficiency in managing the cost of goods sold which stood at $55.48 billion most recently. Revenue growth has been consistent, escalating from $49.23 billion at the start of 2019 to $144.86 billion by mid-2024, driven primarily by its Music Publishing and Recorded Music segments.

PE: 796.6x

Reservoir Media, reflecting a nuanced investment profile, recently reported a year-over-year sales increase to US$144.86 million but saw net income decline to US$0.644937 million. Despite lower profit margins compared to the previous year, insider confidence is evident as they recently purchased shares, signaling belief in the company's potential despite current financial headwinds. Looking ahead, Reservoir anticipates revenues between US$148 million and US$152 million for the next fiscal year, suggesting growth expectations remain intact amidst challenging conditions.

Navigate through the intricacies of Reservoir Media with our comprehensive valuation report here.

Examine Reservoir Media's past performance report to understand how it has performed in the past.

Petco Health and Wellness Company

Simply Wall St Value Rating: ★★★★☆☆

Overview: Petco Health and Wellness Company operates as a health and wellness company offering pet products, services, and veterinary care, with a market capitalization of approximately $4 billion.

Operations: Specialty retail operations generated $6.23 billion in revenue, with a gross profit margin of 37.38% as of the latest reporting period. The cost of goods sold was approximately $3.90 billion during the same timeframe.

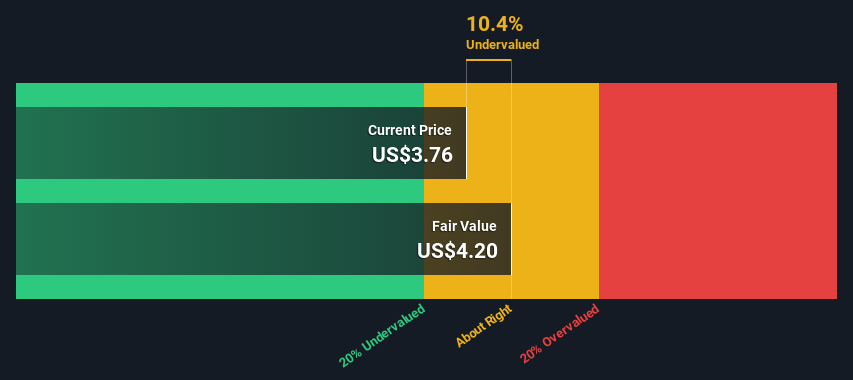

PE: -0.8x

Petco Health and Wellness Company, Inc., reflecting a potential for growth, recently announced leadership changes aimed at enhancing operational efficiency. With earnings expected to surge by 128.84% annually, insider confidence is underscored by recent purchases of shares, signaling strong belief in the company's future prospects. Despite a challenging quarter with a net loss of $46.48 million, the strategic executive adjustments and robust revenue guidance for Q2 suggest resilience and adaptability in its market strategy.

Clear Channel Outdoor Holdings

Simply Wall St Value Rating: ★★★★★☆

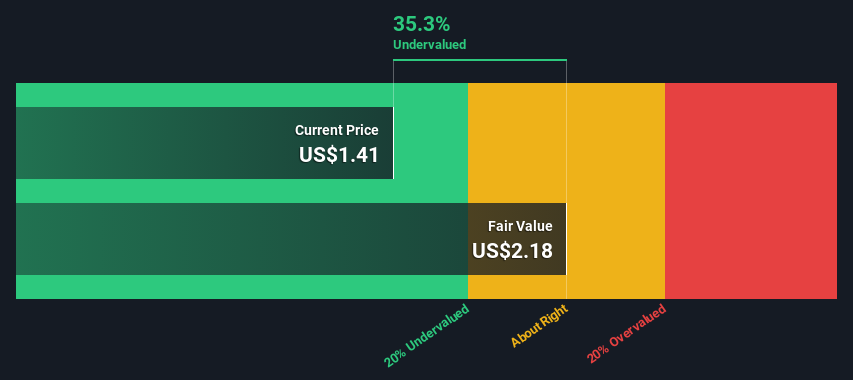

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations that span airport ads, European markets, and broader American territories, featuring a market capitalization of approximately $0.65 billion.

Operations: The entity generates revenue primarily from America (excluding airports), Europe-north, and airport advertising, totaling approximately $2.08 billion. It has experienced a fluctuating gross profit margin over recent periods, with the latest recorded at 48.15% in Q2 2024.

PE: -4.4x

Recently, Clear Channel Outdoor Holdings has demonstrated a proactive stance in shaping its corporate future, evidenced by a series of strategic moves including a significant shelf registration and amendments to its bylaws. Despite facing challenges with profitability, as seen in their first-quarter earnings report showing a net loss increase, the company's revenue trajectory suggests resilience with an optimistic revenue forecast for 2024. These actions reflect an adaptive management approach amidst financial headwinds, aiming to stabilize and eventually enhance shareholder value.

Make It Happen

Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Undervalued Small Caps With Insider Buying.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGM:RSVR NasdaqGS:WOOF and NYSE:CCO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance