Exploring Undervalued Small Caps With Insider Action In The United Kingdom June 2024

In the past year, the United Kingdom's market has shown modest growth, rising 7.4%, with a stable performance in the recent week and expectations of earnings growing by 13% annually over the next few years. In this context, undervalued small-cap stocks with insider buying activity can present particularly interesting opportunities for investors looking to potentially benefit from overlooked value in a gradually strengthening market.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Mitie Group | 11.5x | 0.3x | 37.93% | ★★★★★★ |

Stelrad Group | 9.3x | 0.5x | 41.65% | ★★★★★★ |

Norcros | 7.8x | 0.5x | 41.37% | ★★★★★☆ |

THG | NA | 0.4x | 33.43% | ★★★★★☆ |

Bytes Technology Group | 28.4x | 6.4x | 13.29% | ★★★★☆☆ |

Ultimate Products | 10.4x | 0.8x | 11.50% | ★★★★☆☆ |

Savills | 36.2x | 0.7x | 25.82% | ★★★☆☆☆ |

Robert Walters | 20.6x | 0.3x | 35.56% | ★★★☆☆☆ |

Henry Boot | 10.5x | 0.8x | -107.18% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.6x | 38.88% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Assura

Simply Wall St Value Rating: ★★★★☆☆

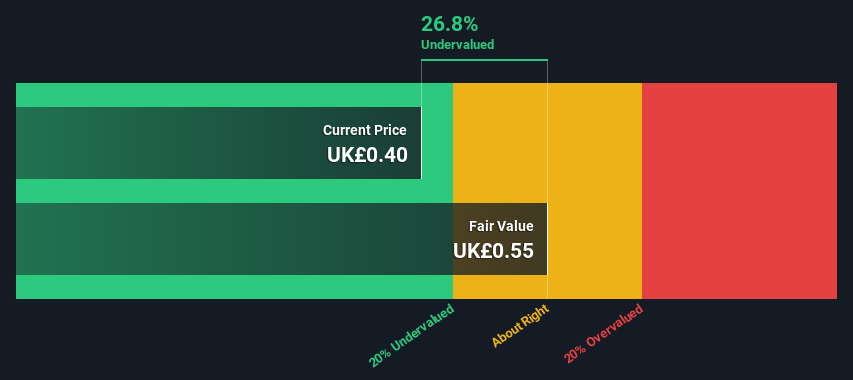

Overview: Assura is a UK-based healthcare real estate investment trust (REIT) specializing in primary care facilities, with a market capitalization of approximately £1.47 billion.

Operations: The entity generates revenue primarily through its core operations, with a recent reported figure of £157.8 million. It has maintained a high gross profit margin consistently above 90%, evidencing strong cost management relative to its revenue generation.

PE: -41.5x

Assura's strategic moves and insider confidence signal potential for growth despite a recent net loss. With a significant reduction in losses from GBP 119.2 million to GBP 28.8 million year-on-year and a forecasted earnings increase of 40.26% annually, the company is poised for recovery. Recently, insiders have shown their belief in the firm’s trajectory through share purchases, underscoring their commitment to its success. Additionally, a new GBP 250 million joint venture aimed at expanding NHS infrastructure underlines Assura's proactive approach in a vital sector, promising further stability and growth opportunities.

Click here to discover the nuances of Assura with our detailed analytical valuation report.

Evaluate Assura's historical performance by accessing our past performance report.

Aston Martin Lagonda Global Holdings

Simply Wall St Value Rating: ★★★★☆☆

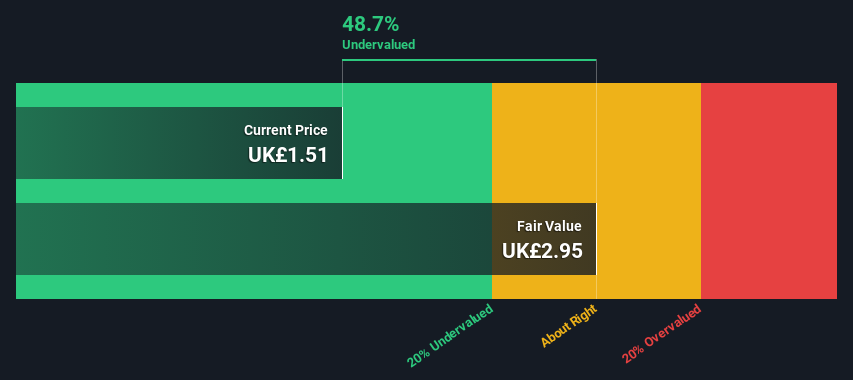

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance sports cars, with a market capitalization of approximately £1.07 billion.

Operations: Automotive revenue reached £1.60 billion, with a gross profit margin of 39.70%. The company recorded a net income of -£293.20 million during the same period.

PE: -4.2x

Aston Martin Lagonda demonstrates a compelling narrative for those eyeing potential in overlooked equities, particularly given its recent insider confidence, where key figures have recently purchased shares. Despite a challenging Q1 with sales dropping to £267.7 million and net losses widening to £138.9 million, the company's reliance on external borrowing—a riskier funding method—has not deterred insiders. Furthermore, with earnings expected to surge by 82% annually, Aston Martin's strategic direction under newly elected director Daniel Li could harness this momentum for recovery and growth.

CLS Holdings

Simply Wall St Value Rating: ★★★★★☆

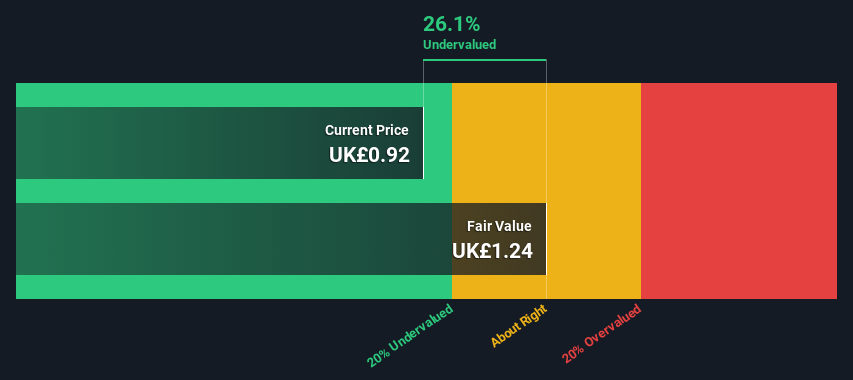

Overview: CLS Holdings is a diversified real estate investment company with operations in the United Kingdom, Germany, and France.

Operations: The company generates revenue primarily through investment properties located in the United Kingdom, Germany, and France, with a significant portion of its income derived from the UK segment (£68.7 million). Its gross profit margin has shown a trend of fluctuation over recent periods, registering at 0.76% in the latest data point.

PE: -1.5x

CLS Holdings, a lesser-known entity in the UK market, recently showcased insider confidence with significant share purchases. Despite challenges in covering interest payments with earnings, insiders have demonstrated belief in the company's potential by buying shares. With earnings expected to surge by 104% annually, this financial trajectory suggests a promising future. Moreover, during an April shareholder call, strategic plans were discussed that may further influence growth and stability. This blend of insider activity and future earnings growth paints CLS Holdings as an intriguing prospect within its sector.

Next Steps

Reveal the 32 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:AGR LSE:AML and LSE:CLI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance