Exploring Undervalued Small Caps With Insider Buying In The United Kingdom July 2024

Amidst a backdrop of fluctuating performances in major indices, with the FTSE 100 showing signs of recovery after a losing streak, investors are closely monitoring market dynamics. The broader sentiment and economic indicators suggest cautious optimism as we explore potential opportunities within the realm of undervalued small-cap stocks in the United Kingdom, particularly those with insider buying which may signal confidence in long-term value.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.7x | 0.5x | 42.86% | ★★★★★★ |

Norcros | 7.7x | 0.5x | 44.28% | ★★★★★☆ |

GB Group | NA | 3.1x | 23.04% | ★★★★★☆ |

THG | NA | 0.4x | 41.56% | ★★★★★☆ |

Bytes Technology Group | 27.3x | 6.2x | -7.94% | ★★★★☆☆ |

CVS Group | 20.4x | 1.1x | 43.28% | ★★★★☆☆ |

M&C Saatchi | NA | 0.5x | 48.87% | ★★★★☆☆ |

Robert Walters | 19.6x | 0.2x | 40.72% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -45.26% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.8x | 38.20% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

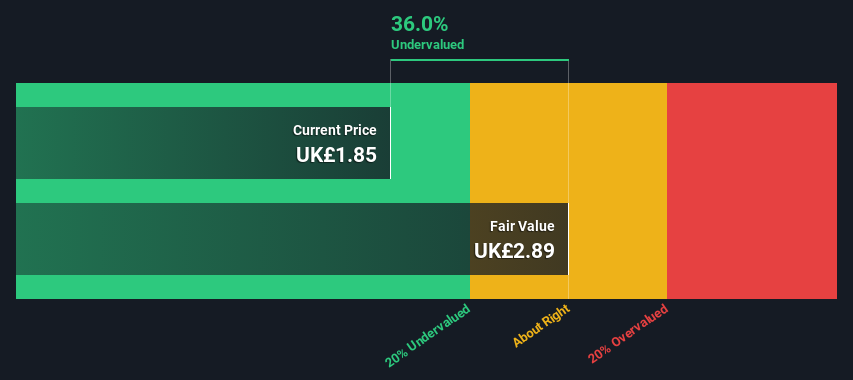

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, and processing of silver and gold, primarily operating through its key assets in Inmaculada, San Jose, and Pallancata with a market capitalization of approximately $1 billion.

Operations: San Jose, Inmaculada, and Pallancata are the primary revenue-contributing segments for this entity, generating $242.46 million, $396.64 million, and $54.05 million respectively. The gross profit margin as of the last reported period stands at 26.46%.

PE: -22.5x

Recently, Hochschild Mining showcased strong insider confidence as Eduardo Navarro acquired 148,000 shares, signaling trust in the firm's prospects. This move aligns with their robust Q1 performance where gold and silver production increased year-over-year, suggesting operational efficiency. The company also anticipates producing up to 360,000 gold equivalent ounces this year. With earnings expected to grow significantly and relying solely on external borrowing for funding, Hochschild presents a compelling narrative in the landscape of undervalued entities within the UK market.

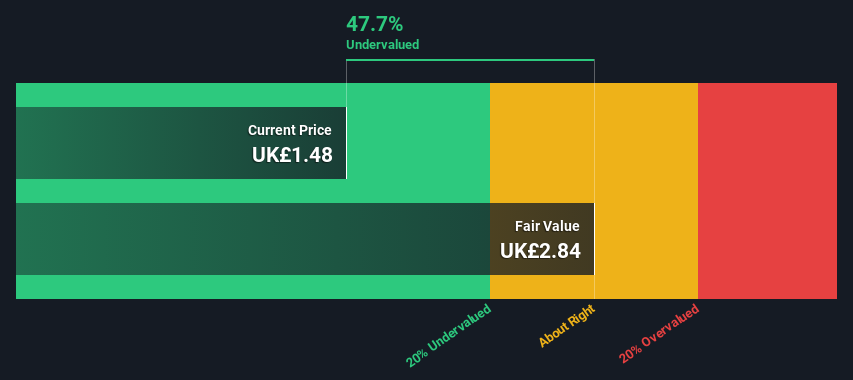

Kier Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a construction and infrastructure services provider, operating primarily in the sectors of property, corporate, construction, and infrastructure services with a market capitalization of approximately £241 million.

Operations: The entity primarily generates revenue through its Construction and Infrastructure Services segments, contributing £1.86 billion and £1.87 billion respectively, with a gross profit margin recently noted at approximately 8.67%. General & Administrative expenses have been consistently near the £250 million mark across recent periods.

PE: 16.2x

Kier Group, a notable player in the UK's small-cap landscape, demonstrates potential through its earnings forecast to grow at 23.17% annually. Recently, insiders have shown their confidence in the firm's trajectory by purchasing shares, underscoring a positive outlook. Despite relying solely on external borrowing—a higher risk funding method—the company maintains high-quality earnings with minimal one-off items affecting its financial results. This blend of insider activity and solid growth prospects paints Kier as an intriguing option for those eyeing underpriced opportunities.

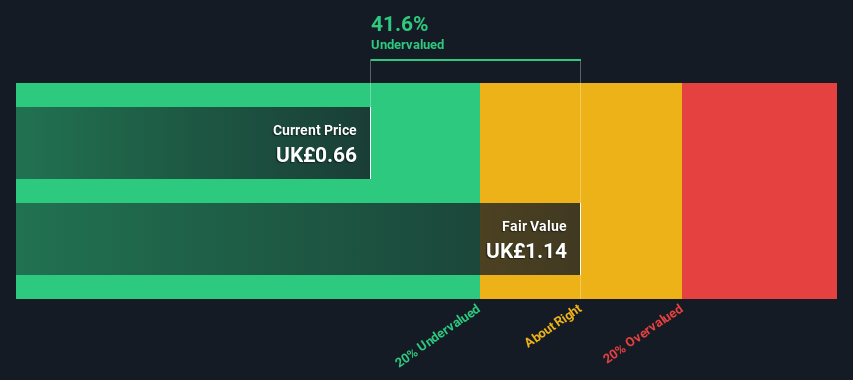

THG

Simply Wall St Value Rating: ★★★★★☆

Overview: THG operates primarily in beauty, technology services, and nutrition sectors with a market capitalization of approximately £1.20 billion.

Operations: Beauty, Ingenuity, and Nutrition segments primarily drive the revenue, totaling £2.50 billion after adjusting for inter-group eliminations. The company's gross profit margin has fluctuated over recent years, with a notable figure of 41.83% in the latest reporting period.

PE: -3.6x

Amidst a challenging landscape, THG's recent activities underscore its potential resilience and appeal. Despite ongoing unprofitability, insider confidence is evident as they recently purchased shares, signaling belief in the company's future. Additionally, activist investor Kelso Group has vocally supported THG’s valuation potential, suggesting significant undervaluation compared to its market cap. With revenue guidance projecting growth and the backing of key investors, THG stands out as a noteworthy entity in the UK market.

Seize The Opportunity

Reveal the 35 hidden gems among our Undervalued UK Small Caps With Insider Buying screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:HOC LSE:KIE and LSE:THG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance