Exploring Undervalued Small Caps With Insider Buying In The United Kingdom July 2024

As the United Kingdom's financial markets show signs of optimism, with the FTSE 100 indicating a positive start, investors are keenly watching small-cap stocks for potential growth opportunities. In this context, identifying undervalued small caps with insider buying can be particularly compelling, as these actions often signal confidence in the company's prospects from those who know it best.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.3x | 0.5x | 44.84% | ★★★★★★ |

Ultimate Products | 9.6x | 0.7x | 18.59% | ★★★★★☆ |

Norcros | 7.5x | 0.5x | 44.93% | ★★★★★☆ |

THG | NA | 0.4x | 43.15% | ★★★★★☆ |

Bytes Technology Group | 28.6x | 6.5x | 16.12% | ★★★★☆☆ |

CVS Group | 21.1x | 1.2x | 41.64% | ★★★★☆☆ |

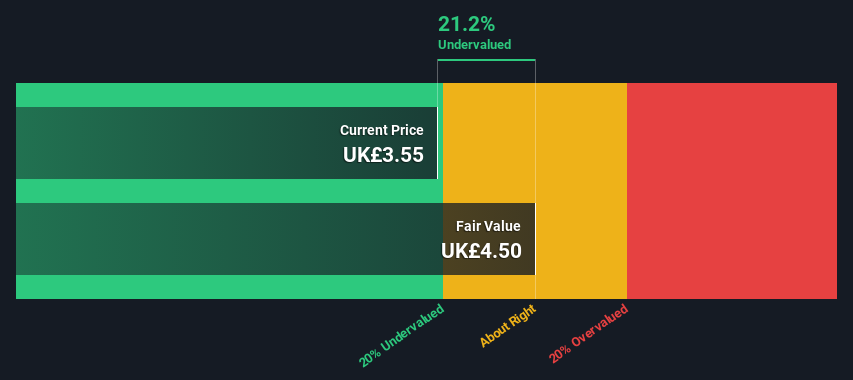

GB Group | NA | 3.2x | 21.21% | ★★★★☆☆ |

Robert Walters | 20.6x | 0.3x | 38.41% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -47.20% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.7x | 38.81% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

GB Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: GB Group is a company specializing in fraud prevention, identity verification, and location services with a market capitalization of approximately £1.20 billion.

Operations: The company generates revenue from three primary segments: Fraud, Identity, and Location, with the Identity segment being the most significant at £156.06 million. Over recent periods, it has experienced a gross profit margin increase from 61.50% to 70.14%.

PE: -18.4x

GB Group, reflecting a compelling narrative among UK's lesser-known equities, recently showcased a significant reduction in net loss to £48.58 million from last year's £119.79 million, alongside maintaining steady sales around £277 million. This financial resilience is underscored by their expectation of mid-single-digit revenue growth and higher adjusted operating profits next year due to efficiency gains. Notably, insider confidence is evident as the board proposed an increased dividend payout, signaling strong governance and future prospects amidst executive transitions that promise fresh strategic insights.

Navigate through the intricacies of GB Group with our comprehensive valuation report here.

Explore historical data to track GB Group's performance over time in our Past section.

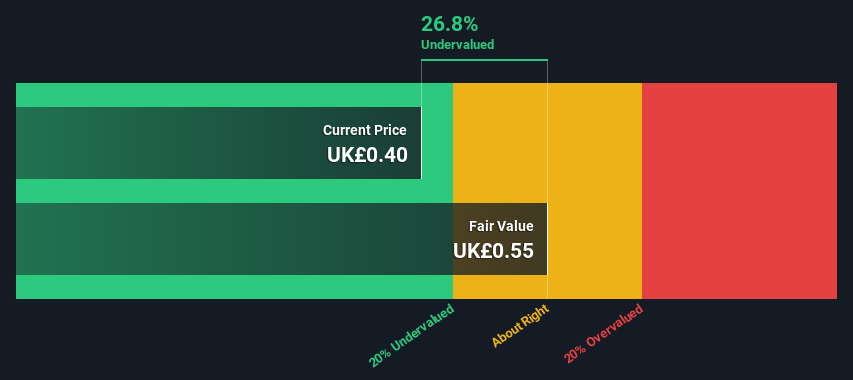

Assura

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a healthcare real estate investment trust that focuses on the acquisition, development, and management of primary care facilities in the UK, with a market capitalization of approximately £1.30 billion.

Operations: The core revenue segment of this entity generated £157.8 million, showcasing a gross profit margin of approximately 90.81%. This financial metric highlights the efficiency in managing production costs relative to revenue.

PE: -43.4x

Assura's recent strategic initiatives and financial maneuvers underscore its potential as an undervalued entity in the UK market. Recently, they entered a GBP 250 million joint venture to enhance NHS infrastructure, demonstrating a robust commitment to growth in healthcare real estate. Despite a net loss reported on May 21, their proactive dividend increase and insider confidence—highlighted by recent share purchases—suggest a positive outlook. This blend of financial activity and strategic partnerships positions Assura intriguingly for attentive investors.

Click here and access our complete valuation analysis report to understand the dynamics of Assura.

Evaluate Assura's historical performance by accessing our past performance report.

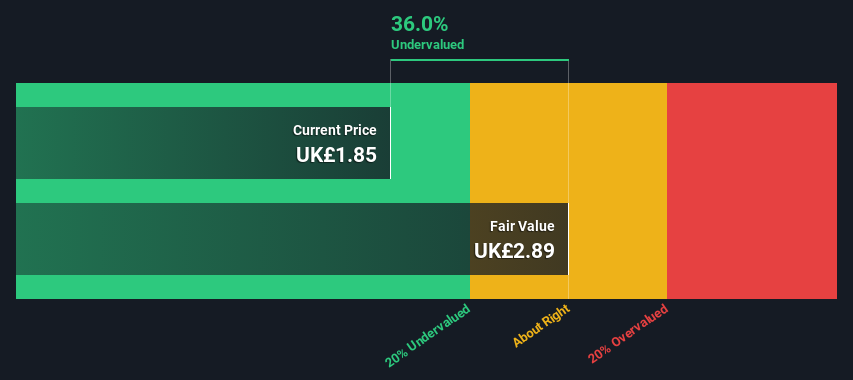

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, and processing of silver and gold, primarily operating through its significant assets in Inmaculada, San Jose, and Pallancata.

Operations: Inmaculada, San Jose, and Pallancata are key revenue contributors for the company, generating $396.64 million, $242.46 million, and $54.05 million respectively. The gross profit margin has shown a fluctuating trend over the periods observed, with recent figures around 24.71% to 26.46%.

PE: -21.8x

Hochschild Mining, a notable player in the mining sector, has recently shown promising growth prospects with its CEO Eduardo Navarro purchasing 148,000 shares for £235,320, signaling insider confidence. This purchase occurred amidst the company's announcement of expected gold production between 343,000 and 360,000 ounces for 2024. Despite a slight decrease in silver output compared to last year, gold production has notably increased from 46.44 koz to 53.79 koz in Q1. These figures suggest a strategic positioning that could intrigue those looking at underappreciated assets within the UK market.

Click to explore a detailed breakdown of our findings in Hochschild Mining's valuation report.

Gain insights into Hochschild Mining's past trends and performance with our Past report.

Next Steps

Discover the full array of 34 Undervalued Small Caps With Insider Buying right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:GBG LSE:AGR and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance