Exploring Undervalued Opportunities: Three German Exchange Stocks With Intrinsic Discounts Ranging From 16.9% to 39.1%

Amid a mixed performance in European markets, with Germany's DAX index showing modest gains, investors continue to navigate through a landscape marked by political and economic uncertainties. In such an environment, identifying undervalued stocks can offer potential opportunities for those looking to invest in assets that might be trading below their intrinsic value due to temporary market conditions or overlooked strengths.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €20.06 | €30.75 | 34.8% |

Stabilus (XTRA:STM) | €45.00 | €79.65 | 43.5% |

Novem Group (XTRA:NVM) | €5.40 | €10.11 | 46.6% |

PSI Software (XTRA:PSAN) | €22.70 | €43.73 | 48.1% |

Stratec (XTRA:SBS) | €46.80 | €81.54 | 42.6% |

SBF (DB:CY1K) | €3.42 | €5.75 | 40.6% |

MTU Aero Engines (XTRA:MTX) | €253.00 | €415.15 | 39.1% |

CHAPTERS Group (XTRA:CHG) | €23.80 | €46.83 | 49.2% |

Your Family Entertainment (DB:RTV) | €2.46 | €4.52 | 45.6% |

Redcare Pharmacy (XTRA:RDC) | €129.50 | €208.67 | 37.9% |

Let's uncover some gems from our specialized screener

adesso

Overview: Adesso SE is a company that offers IT services across Germany, Austria, Switzerland, and other international markets, with a market capitalization of approximately €556.18 million.

Operations: The company generates revenue primarily through two segments: IT Services, which brought in €1.31 billion, and IT Solutions, contributing €119.88 million.

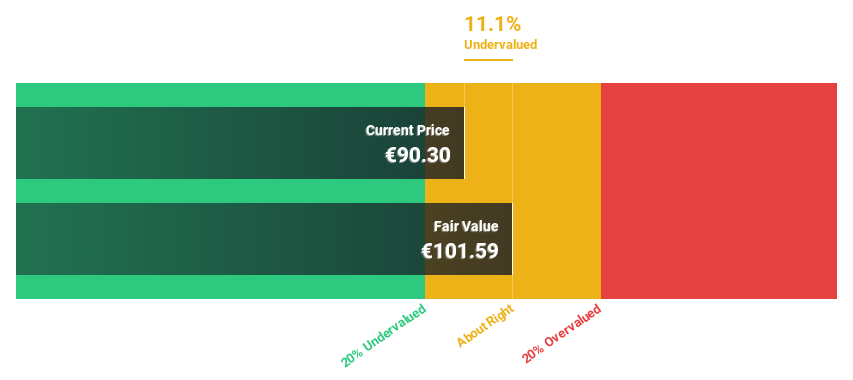

Estimated Discount To Fair Value: 16.9%

Adesso SE, priced at €82.7, trades below its fair value of €101.92, indicating potential undervaluation based on discounted cash flow analysis. While its revenue growth forecast of 11.9% per year outpaces the German market's 5.2%, it falls short of the high-growth benchmark of 20%. The company is expected to turn profitable within three years, with a projected low return on equity of 13.6%. Recent engagements include a presentation at Big Data & AI World Frankfurt, highlighting its active role in data and AI sectors.

MBB

Overview: MBB SE is a German-based company that specializes in acquiring and managing medium-sized businesses in the technology and engineering sectors, with a market capitalization of approximately €0.58 billion.

Operations: MBB SE generates revenue through three primary segments: Consumer Goods (€94.23 million), Technical Applications (€378.50 million), and Service & Infrastructure (€487.10 million).

Estimated Discount To Fair Value: 17.7%

MBB, priced at €102, is valued below its calculated fair value of €123.62, reflecting a potential undervaluation. Its earnings have surged by 63.9% over the past year and are expected to continue growing at 33.5% annually, outstripping the German market's forecast of 18.6%. However, its return on equity is projected to remain modest at 9.6%. Recent financials show a rebound with Q1 net income reaching €5.77 million, a significant recovery from last year's loss.

The analysis detailed in our MBB growth report hints at robust future financial performance.

Click to explore a detailed breakdown of our findings in MBB's balance sheet health report.

MTU Aero Engines

Overview: MTU Aero Engines AG operates in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines and industrial gas turbines globally, with a market capitalization of approximately €13.62 billion.

Operations: The company generates revenue primarily from two segments: Commercial Maintenance Business (MRO) with €4.35 billion and Commercial and Military Engine Business (OEM) contributing €1.27 billion.

Estimated Discount To Fair Value: 39.1%

MTU Aero Engines, with a current trading price of €253, appears undervalued against a fair value estimate of €415.15, suggesting significant potential based on discounted cash flows. Despite a slight dip in Q1 earnings to €126 million from €134 million year-over-year and EPS decreasing from €2.47 to €2.35, the company is poised for robust future growth. Revenue is expected to expand by 12.2% annually, outpacing the German market's 5.2%, with profitability forecasted within three years and an anticipated high return on equity of 20.3%.

Our growth report here indicates MTU Aero Engines may be poised for an improving outlook.

Click here to discover the nuances of MTU Aero Engines with our detailed financial health report.

Summing It All Up

Navigate through the entire inventory of 29 Undervalued German Stocks Based On Cash Flows here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADN1 XTRA:MBB and XTRA:MTX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance