Exploring Undervalued Opportunities On KRX With Discounts Ranging From 13.9% To 37.6%

In the last week, South Korea's stock market has remained flat, yet it has experienced a rise of 7.2% over the past 12 months with earnings expected to grow by 29% annually. In this context, identifying undervalued stocks can be particularly compelling as they may offer significant growth potential against current market trends.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Solum (KOSE:A248070) | ₩21050.00 | ₩41756.99 | 49.6% |

Protec (KOSDAQ:A053610) | ₩29050.00 | ₩57573.01 | 49.5% |

Caregen (KOSDAQ:A214370) | ₩23300.00 | ₩44549.16 | 47.7% |

Anapass (KOSDAQ:A123860) | ₩26200.00 | ₩48496.47 | 46% |

Global Tax Free (KOSDAQ:A204620) | ₩3555.00 | ₩6213.52 | 42.8% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49471.23 | 49.7% |

Revu (KOSDAQ:A443250) | ₩11550.00 | ₩20994.85 | 45% |

SK Biopharmaceuticals (KOSE:A326030) | ₩78900.00 | ₩149728.31 | 47.3% |

Hancom Lifecare (KOSE:A372910) | ₩4950.00 | ₩9784.18 | 49.4% |

NEXON Games (KOSDAQ:A225570) | ₩15320.00 | ₩28029.27 | 45.3% |

Let's review some notable picks from our screened stocks

ISU Petasys

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs), with a market capitalization of approximately ₩3.59 billion.

Operations: The company's revenue is primarily derived from the manufacture and sale of printed circuit boards (PCBs) on a global scale.

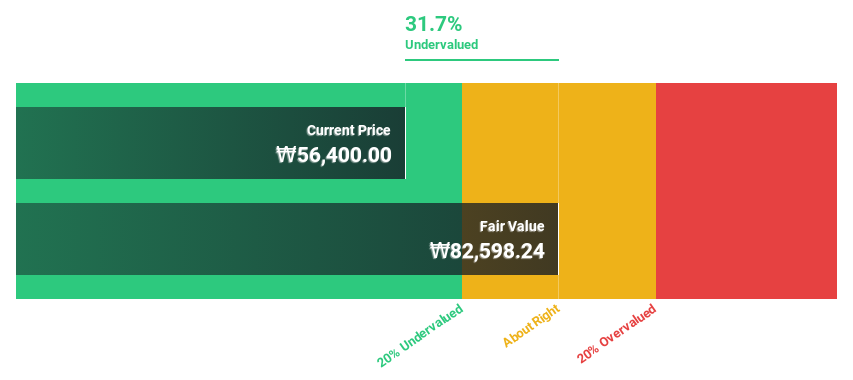

Estimated Discount To Fair Value: 37.6%

ISU Petasys, priced at ₩56700, is significantly undervalued by 37.6% compared to its fair value estimate of ₩90921.89. Despite this, the company's earnings are projected to surge by a robust 41.5% annually, outpacing the broader South Korean market's growth rate of 29.2%. Revenue is also expected to grow at 16.2% per year, again beating the market average of 10.7%. However, challenges include a highly volatile share price recently and profit margins that have declined from last year’s 15.1% to current levels around 7%. Additionally, debt levels are not comfortably covered by operating cash flows.

Samwha ElectricLtd

Overview: Samwha Electric Co., Ltd. is a company based in South Korea, specializing in the production of electrolytic capacitors, with operations both domestically and internationally, and has a market capitalization of approximately ₩453.05 billion.

Operations: The company's revenue from electronic components and parts totals approximately ₩206.44 billion.

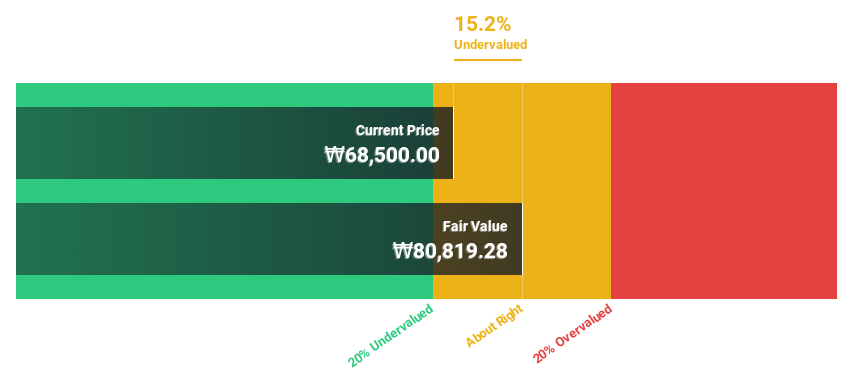

Estimated Discount To Fair Value: 15.2%

Samwha Electric Ltd, priced at ₩68,500, trades 15.2% below its estimated fair value of ₩80,819.28, indicating potential undervaluation. The company's revenue and earnings are expected to grow by 19% and 50.57% per year respectively, outperforming the South Korean market forecasts of 10.7% and 29.2%. Despite these positive indicators, investors should be cautious of the stock's high volatility in recent months.

Amorepacific

Overview: Amorepacific Corporation is a global company engaged in the research, development, manufacturing, and marketing of cosmetics and beauty products, with a market capitalization of approximately ₩10.26 billion.

Operations: The company generates its revenue through the research, development, manufacture, and marketing of cosmetics and beauty products globally.

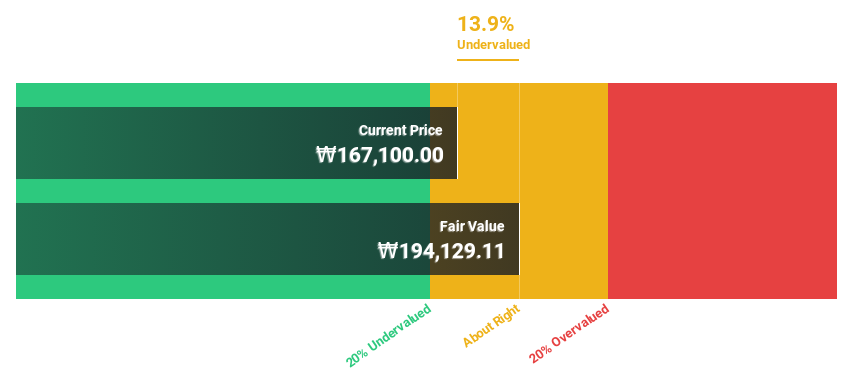

Estimated Discount To Fair Value: 13.9%

Amorepacific, with a current price of ₩167,100, is trading 13.9% below the estimated fair value of ₩194,129.11. The company's earnings are projected to grow by 38.24% annually, outstripping the South Korean market's expectation of 29.2%. However, its forecasted revenue growth at 14.1% per year is modest compared to its earnings growth rate and is expected to exceed the market average of 10.7%. Despite these positives, Amorepacific's return on equity is anticipated to be low at 8.6% in three years' time.

Click to explore a detailed breakdown of our findings in Amorepacific's balance sheet health report.

Key Takeaways

Click this link to deep-dive into the 38 companies within our Undervalued KRX Stocks Based On Cash Flows screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A007660KOSE:A009470 KOSE:A090430

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance