Exploring Undervalued Opportunities On The German Exchange With Discounts Ranging From 33.1% To 43.1%

Amid a mixed performance across major European stock indices, Germany's DAX index recently displayed resilience with a modest rise of 0.40%. This context sets the stage for investors to consider the potential of undervalued stocks within this relatively stable market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €19.22 | €32.82 | 41.4% |

Novem Group (XTRA:NVM) | €5.72 | €10.39 | 44.9% |

technotrans (XTRA:TTR1) | €17.80 | €29.20 | 39% |

Stratec (XTRA:SBS) | €45.60 | €81.23 | 43.9% |

MTU Aero Engines (XTRA:MTX) | €238.80 | €419.59 | 43.1% |

CHAPTERS Group (XTRA:CHG) | €24.00 | €46.83 | 48.7% |

SBF (DB:CY1K) | €3.40 | €5.75 | 40.9% |

Your Family Entertainment (DB:RTV) | €2.40 | €4.52 | 46.9% |

Dr. Hönle (XTRA:HNL) | €17.95 | €32.54 | 44.8% |

Redcare Pharmacy (XTRA:RDC) | €114.00 | €197.69 | 42.3% |

Here we highlight a subset of our preferred stocks from the screener

adidas

Overview: Adidas AG operates globally, designing, developing, producing, and marketing athletic and sports lifestyle products across multiple regions, with a market capitalization of approximately €39.82 billion.

Operations: The company generates its revenue from various regional markets, with €5.16 billion from North America, €3.20 billion from Greater China, and €2.31 billion from Latin America.

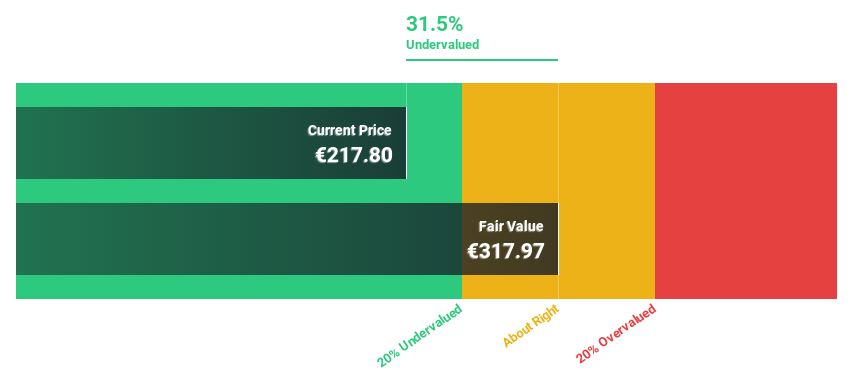

Estimated Discount To Fair Value: 33.1%

Adidas, currently trading at €223, is significantly undervalued based on a DCF valuation of €317.77, indicating a 29.8% potential upside. The company's earnings are expected to grow by 41.3% annually, outpacing the German market's 18.6%. Additionally, Adidas has recently turned profitable with a robust forecasted return on equity of 29.6%. Recent events include positive Q1 earnings with sales rising to €5.46 billion and net income reaching €170 million, marking a strong recovery from previous losses.

According our earnings growth report, there's an indication that adidas might be ready to expand.

Navigate through the intricacies of adidas with our comprehensive financial health report here.

MTU Aero Engines

Overview: MTU Aero Engines AG operates in the development, manufacture, marketing, and support of commercial and military aircraft engines and industrial gas turbines globally, with a market capitalization of approximately €12.85 billion.

Operations: The company's revenue is primarily generated from two segments: the Commercial Maintenance Business (MRO), which brought in €4.35 billion, and the Commercial and Military Engine Business (OEM), which contributed €1.27 billion.

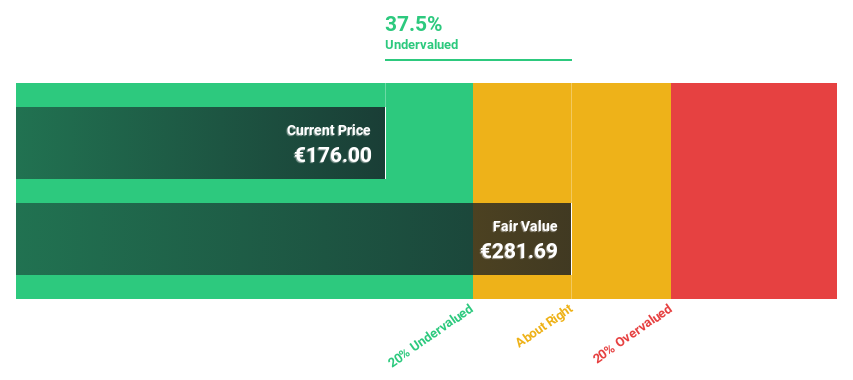

Estimated Discount To Fair Value: 43.1%

MTU Aero Engines, with a current trading price of €238.8, is positioned below its fair value estimated at €399.86, reflecting a substantial undervaluation based on discounted cash flow analysis. Despite a slight decline in net income and EPS as reported in Q1 2024 earnings, the company's revenue growth outpaces the German market average at 12.2% per year compared to 5.2%. Forecasted to turn profitable within three years, MTU also anticipates robust annual profit growth and a high return on equity of 20.3% in the near future.

SAP

Overview: SAP SE operates globally, offering a wide range of applications, technology, and services, with a market capitalization of approximately €219.63 billion.

Operations: The company generates €31.81 billion from its Applications, Technology & Services segment.

Estimated Discount To Fair Value: 33.7%

SAP, priced at €189.52, appears undervalued by 30.3% against a fair value of €271.78 based on cash flow analysis, despite recent strategic expansions and technological integrations aimed at enhancing manufacturing efficiencies and cloud ERP experiences. While SAP's revenue growth is projected to be modest compared to the broader market, its earnings are expected to increase significantly over the next three years. However, its forecasted return on equity remains relatively low at 16.1%.

Insights from our recent growth report point to a promising forecast for SAP's business outlook.

Take a closer look at SAP's balance sheet health here in our report.

Taking Advantage

Click here to access our complete index of 29 Undervalued German Stocks Based On Cash Flows.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADS XTRA:MTX and XTRA:SAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance