Exploring Undervalued Opportunities: 3 German Exchange Stocks With Intrinsic Discounts Up To 49.2%

Amid a backdrop of mixed performances across major European stock indexes, Germany's DAX index has shown resilience with a modest rise of 0.40%. This upward movement contrasts with the broader challenges seen in neighboring markets, setting a unique stage for investors looking at German equities. In such an environment, identifying undervalued stocks can be particularly compelling, as they may offer potential for significant appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €19.26 | €32.90 | 41.5% |

Novem Group (XTRA:NVM) | €5.50 | €10.21 | 46.1% |

Stabilus (XTRA:STM) | €43.50 | €79.13 | 45% |

PSI Software (XTRA:PSAN) | €21.90 | €43.65 | 49.8% |

Stratec (XTRA:SBS) | €45.60 | €81.37 | 44% |

MTU Aero Engines (XTRA:MTX) | €244.60 | €415.76 | 41.2% |

CHAPTERS Group (XTRA:CHG) | €23.80 | €46.83 | 49.2% |

SBF (DB:CY1K) | €3.48 | €5.77 | 39.7% |

Redcare Pharmacy (XTRA:RDC) | €108.20 | €208.66 | 48.1% |

Your Family Entertainment (DB:RTV) | €2.40 | €4.51 | 46.8% |

We'll examine a selection from our screener results

Basler

Overview: Basler Aktiengesellschaft specializes in developing, manufacturing, and selling digital cameras for professional users across Germany and globally, with a market capitalization of approximately €330.11 million.

Operations: The company generates revenue primarily through the sale of digital cameras, amounting to €190.30 million.

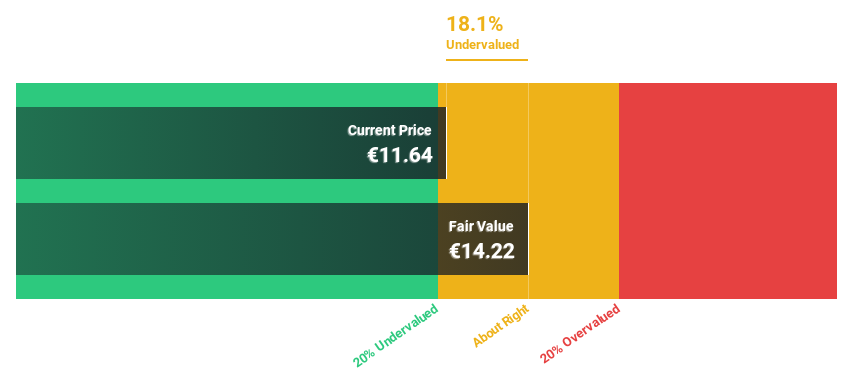

Estimated Discount To Fair Value: 27.1%

Basler, despite recent challenges with a first-quarter sales drop to €43.51 million and an increased net loss of €3.9 million, remains intriguing for cash flow-based valuation. Currently trading at €10.6, which is 27.1% below the estimated fair value of €14.55, Basler shows potential undervaluation based on DCF analysis. Expected to turn profitable within three years, its forecasted revenue growth at 13.2% per year outpaces the German market's 5.2%, although its projected Return on Equity is low at 9.2%.

Our growth report here indicates Basler may be poised for an improving outlook.

Delve into the full analysis health report here for a deeper understanding of Basler.

CHAPTERS Group

Overview: CHAPTERS Group AG operates in the DACH region, offering software solutions through its subsidiaries, with a market capitalization of approximately €0.43 billion.

Operations: The company generates €70.77 million from its data processing segment.

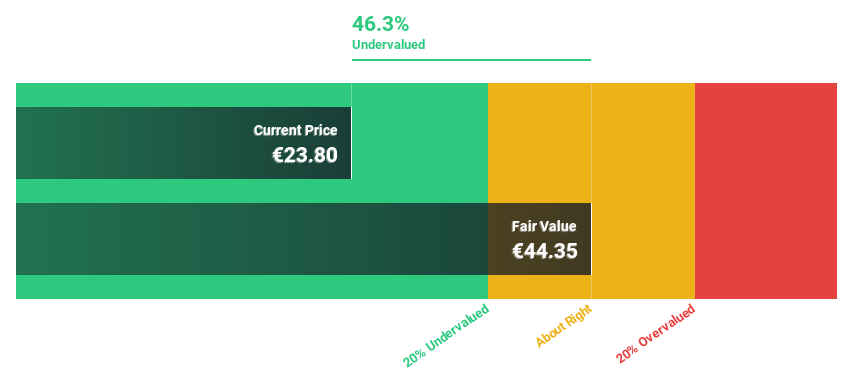

Estimated Discount To Fair Value: 49.2%

CHAPTERS Group AG, currently trading at €23.8, is significantly undervalued by cash flow metrics, with a fair value estimate of €46.83. Despite a recent net loss reduction to €4.08 million from last year's €5.89 million on revenues of €70.77 million, the company is poised for substantial growth with expected revenue increases of 20.8% annually and profitability within three years. However, shareholder dilution occurred through a recent private placement raising €52 million at €24.70 per share.

Stratec

Overview: Stratec SE designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences, operating in Germany, the European Union, and internationally, with a market cap of approximately €0.56 billion.

Operations: The company generates its revenue through the design and manufacture of automation and instrumentation solutions primarily for in-vitro diagnostics and life sciences across Germany, the European Union, and other global markets.

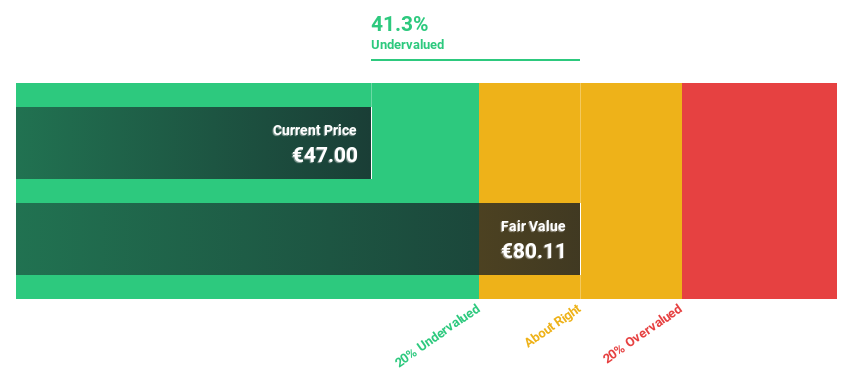

Estimated Discount To Fair Value: 44%

Stratec SE, priced at €45.6, is considered undervalued with a fair value estimate of €81.37, reflecting a 44% discount. Despite a decline in net profit margin from 7.5% to 4.8% over the past year and debt not well covered by operating cash flow, the company is forecasted to experience robust earnings growth at an annual rate of 21.85%. Recent presentations at significant industry conferences may bolster investor confidence as Stratec navigates its financial challenges and capitalizes on anticipated revenue growth of 7.8% per year.

The growth report we've compiled suggests that Stratec's future prospects could be on the up.

Dive into the specifics of Stratec here with our thorough financial health report.

Make It Happen

Click this link to deep-dive into the 29 companies within our Undervalued German Stocks Based On Cash Flows screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BSL XTRA:CHG and XTRA:SBS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance