Exploring Undervalued Indian Exchange Stocks With Discounts Ranging From 25.5% To 46.3%

The Indian stock market has shown robust growth, rising by 1.7% in the last week and an impressive 45% over the past year, with expectations of earnings growing by 16% annually in the coming years. In this climate, identifying undervalued stocks can offer investors potential opportunities for significant value, especially when market performance indicates strong underlying economic momentum.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Updater Services (NSEI:UDS) | ₹303.25 | ₹540.89 | 43.9% |

IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹427.35 | ₹636.71 | 32.9% |

Rajesh Exports (NSEI:RAJESHEXPO) | ₹284.25 | ₹496.46 | 42.7% |

Strides Pharma Science (NSEI:STAR) | ₹941.85 | ₹1664.05 | 43.4% |

Vedanta (NSEI:VEDL) | ₹457.85 | ₹733.98 | 37.6% |

Mahindra Logistics (NSEI:MAHLOG) | ₹545.20 | ₹906.63 | 39.9% |

Delhivery (NSEI:DELHIVERY) | ₹398.05 | ₹741.73 | 46.3% |

PVR INOX (NSEI:PVRINOX) | ₹1470.25 | ₹2549.99 | 42.3% |

TV18 Broadcast (NSEI:TV18BRDCST) | ₹45.55 | ₹71.69 | 36.5% |

Godrej Properties (NSEI:GODREJPROP) | ₹3301.10 | ₹5737.83 | 42.5% |

We'll examine a selection from our screener results

Delhivery

Overview: Delhivery Limited offers supply chain solutions across various sectors including e-commerce, FMCG, and manufacturing in India, with a market capitalization of approximately ₹294 billion.

Operations: The company generates ₹81.42 billion from logistics services tailored to diverse industries such as e-commerce, FMCG, and manufacturing.

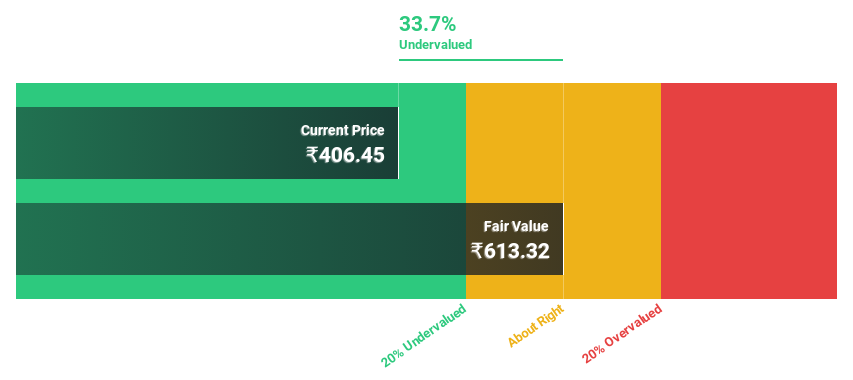

Estimated Discount To Fair Value: 46.3%

Delhivery, currently priced at ₹398.05, is significantly undervalued based on DCF models with an estimated fair value of ₹741.73, indicating a potential undervaluation of over 20%. Despite a recent executive departure and net losses reducing year-over-year in Q4 2024, Delhivery is expected to turn profitable within three years. The company's revenue growth outpaces the Indian market average at 14.4% annually compared to 9.6%, supported by strategic expansions like its new subsidiary for drone technology and enhanced B2B operations for SUGAR Cosmetics.

Godrej Properties

Overview: Godrej Properties Limited focuses on real estate construction and development in India, with a market capitalization of approximately ₹91.79 billion.

Operations: The company generates its revenue primarily from real estate, contributing ₹29.95 billion, and a smaller segment in hospitality, which adds ₹0.41 billion.

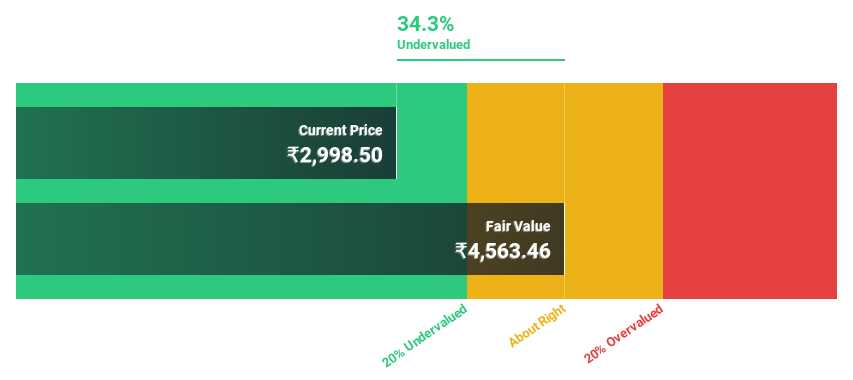

Estimated Discount To Fair Value: 42.5%

Godrej Properties, with a current price of ₹3301.1, appears undervalued compared to the DCF-derived fair value of ₹5737.83. Despite trading 42.5% below this estimate, its financial performance shows promise with significant revenue growth at 31.7% annually—surpassing the Indian market's 9.6%. However, concerns linger as its debt is poorly covered by operating cash flow and its Return on Equity is expected to remain low at 14.1% in three years' time, despite robust earnings growth forecasts of 35.72% annually.

RITES

Overview: RITES Limited offers consultancy, engineering, and project management services across various sectors including railways, highways, and renewable energy, with a market cap of approximately ₹168.30 billion.

Operations: RITES Limited generates revenue through several segments, including domestic consultancy at ₹11.94 billion, domestic turnkey construction projects at ₹9.03 billion, domestic leasing at ₹1.38 billion, export sales at ₹1.03 billion, and consultancy abroad at ₹0.95 billion.

Estimated Discount To Fair Value: 25.5%

RITES, priced at ₹700.35, trades significantly below its estimated fair value of ₹939.54, indicating potential undervaluation based on discounted cash flows. Despite a modest dividend yield of 2.57% that is not well-covered by earnings or cash flows, the company's revenue and earnings growth are projected to outpace the broader Indian market with forecasts of 13.4% and 18.5% respectively per year. Recent strategic MoUs with entities like DMRC and DVC highlight expanding operational scope which could support future financial performance.

Key Takeaways

Click through to start exploring the rest of the 13 Undervalued Indian Stocks Based On Cash Flows now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:DELHIVERY NSEI:GODREJPROP and NSEI:RITES.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance