Exploring Undervalued Gems On SGX Frasers Logistics & Commercial Trust And Two Other Stocks

As global financial systems experiment with the potential integration of digital currencies, the Singapore market remains a focal point for investors looking to capitalize on emerging trends and technological advancements. In this context, identifying undervalued stocks becomes crucial as it offers an opportunity to invest in assets that may benefit from evolving economic conditions and regulatory frameworks.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.03 | SGD7.81 | 48.4% |

17LIVE Group (SGX:LVR) | SGD0.765 | SGD1.52 | 49.7% |

Hongkong Land Holdings (SGX:H78) | US$3.25 | US$5.64 | 42.4% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.965 | SGD1.63 | 40.7% |

Seatrium (SGX:5E2) | SGD1.51 | SGD2.44 | 38.2% |

Nanofilm Technologies International (SGX:MZH) | SGD0.735 | SGD1.35 | 45.4% |

Here we highlight a subset of our preferred stocks from the screener

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust, managing 107 industrial and commercial properties valued at approximately S$6.4 billion across Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market capitalization of about S$3.63 billion.

Operations: The trust generates revenue from a portfolio of industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

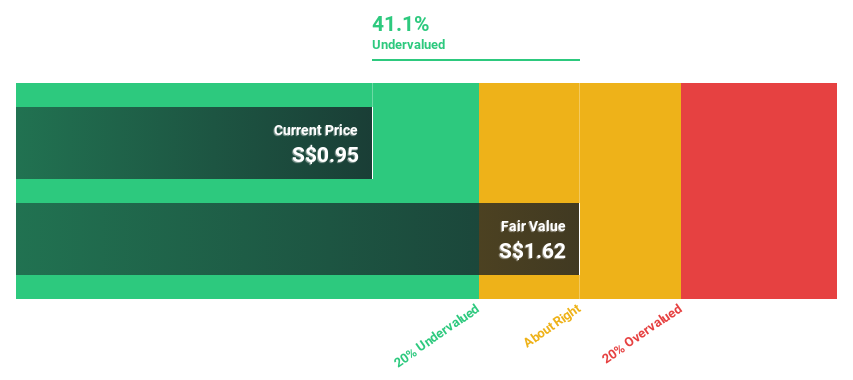

Estimated Discount To Fair Value: 40.7%

Frasers Logistics & Commercial Trust, trading at S$0.97, is noted to be significantly undervalued based on discounted cash flow analysis, with an estimated fair value of S$1.62. Despite a recent dip in net income from S$118.07 million to S$93.59 million and a decrease in dividends, the trust's revenue growth is expected to outpace the Singapore market average at 6% annually compared to 3.7%. However, concerns include a low forecasted return on equity of 5.9% and dividends that show signs of instability.

Hongkong Land Holdings

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia, and other international locations with a market capitalization of approximately $7.11 billion.

Operations: The company's revenue is derived from two primary segments: Investment Properties, which generated $1.08 billion, and Development Properties, contributing $0.76 billion.

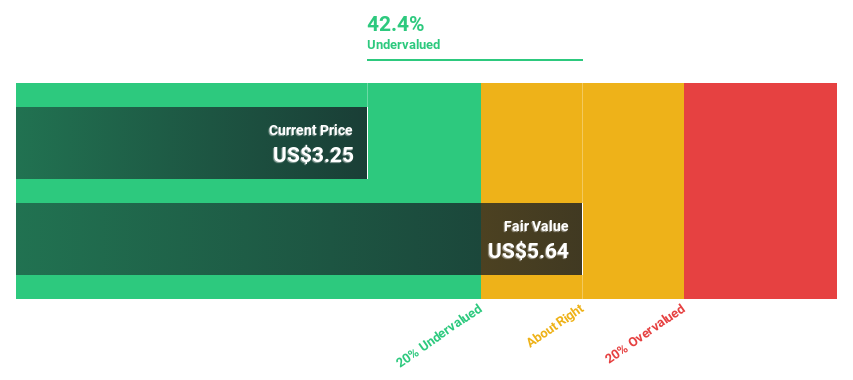

Estimated Discount To Fair Value: 42.4%

Hongkong Land Holdings, priced at US$3.25, is currently undervalued by 42.4%, with a fair value estimated at US$5.64. The company's revenue growth forecast of 5.5% per year surpasses Singapore's average of 3.7%. However, its dividend yield of 6.77% is poorly supported by earnings, and the expected return on equity in three years is low at 2.4%. Despite these challenges, earnings are projected to increase significantly over the next three years.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of approximately SGD 12.57 billion.

Operations: The company's revenue is generated from three primary segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

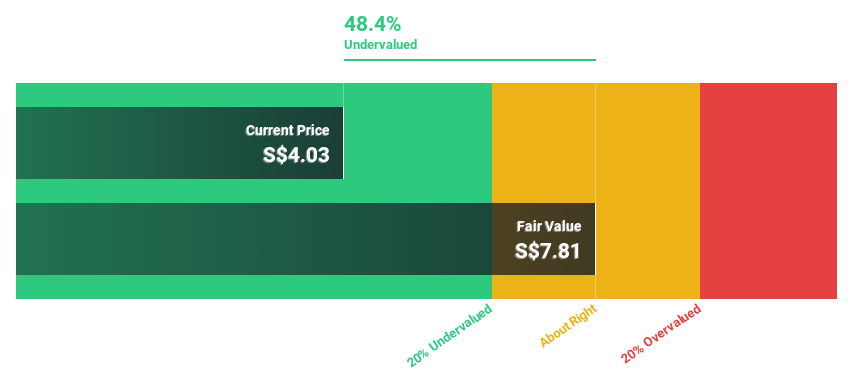

Estimated Discount To Fair Value: 48.4%

Singapore Technologies Engineering, with its recent share repurchase initiative and consistent dividend payments, signals a proactive approach to shareholder value. The company's revenue and earnings growth are projected at 6.7% and 11.5% per year respectively, outpacing the Singapore market averages. However, it carries a high level of debt which might raise concerns about financial stability despite a robust forecasted return on equity of 27.4%. This mixed financial health suggests careful consideration for investors looking at cash flow-based valuations.

Next Steps

Embark on your investment journey to our 6 Undervalued SGX Stocks Based On Cash Flows selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BUOUSGX:H78 and SGX:S63

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance