Exploring Undervalued Chinese Stocks On The Shanghai Stock Exchange With Intrinsic Discounts Ranging From 19.6% To 42.4%

Amid a backdrop of global economic uncertainties, Chinese stocks have shown mixed performance with concerns about the slowing economy impacting investor sentiment. As investors navigate these challenging market conditions, identifying undervalued stocks could present opportunities for those looking for potential growth at discounted valuations.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥166.06 | CN¥329.02 | 49.5% |

Uni-Trend Technology (China) (SHSE:688628) | CN¥31.54 | CN¥64.23 | 50.9% |

Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.81 | CN¥34.14 | 47.8% |

Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥24.23 | CN¥47.00 | 48.5% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥14.25 | CN¥29.20 | 51.2% |

DongHua Testing Technology (SZSE:300354) | CN¥31.51 | CN¥57.97 | 45.6% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥32.90 | CN¥66.56 | 50.6% |

China Film (SHSE:600977) | CN¥10.97 | CN¥20.21 | 45.7% |

Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.43 | CN¥18.84 | 49.9% |

Levima Advanced Materials (SZSE:003022) | CN¥13.73 | CN¥27.45 | 50% |

Let's review some notable picks from our screened stocks

SKSHU PaintLtd

Overview: SKSHU Paint Co., Ltd., operating under the 3trees brand, engages in the production and sale of paints, coatings, and building materials primarily in China, with a market capitalization of approximately CN¥20.96 billion.

Operations: The company generates its revenue from the sale of paints, coatings, and building materials.

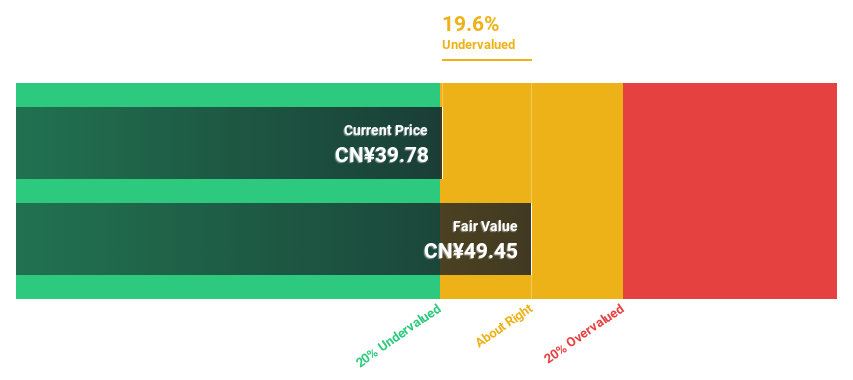

Estimated Discount To Fair Value: 19.6%

SKSHU Paint Co., Ltd. is currently trading at CN¥39.78, below the estimated fair value of CN¥49.45, suggesting undervaluation based on discounted cash flow analysis. Despite this, the company's revenue growth forecast of 13.5% per year lags slightly behind the broader Chinese market's 13.7%. Additionally, while SKSHU's earnings are expected to increase by a notable 44% annually over the next three years, surpassing market growth expectations, its profit margins have decreased from last year and interest payments are not well covered by earnings, indicating potential financial strain.

JinGuan Electric

Overview: JinGuan Electric Co., Ltd. specializes in the research, development, and manufacturing of lightning arresters in China, with a market capitalization of approximately CN¥1.98 billion.

Operations: JinGuan Electric generates CN¥614.19 million from its electric equipment segment.

Estimated Discount To Fair Value: 34.7%

JinGuan Electric, priced at CN¥14.33, is significantly undervalued with a fair value of CN¥21.95. The company's recent earnings report showed a substantial increase in sales and net income, with revenue jumping to CN¥128.72 million from CN¥85.92 million year-over-year and net income more than doubling to CN¥20.57 million. Despite these gains, the dividend coverage by cash flows remains weak at 3.49%. Earnings are expected to grow very large annually over the next three years, outpacing the Chinese market's average growth significantly.

Shenzhen Sunline Tech

Overview: Shenzhen Sunline Tech Co., Ltd. specializes in providing banking software and technology services to global banking and finance clients, with a market capitalization of approximately CN¥5.39 billion.

Operations: The company generates revenue primarily from the provision of banking software and technology services to its global financial clients.

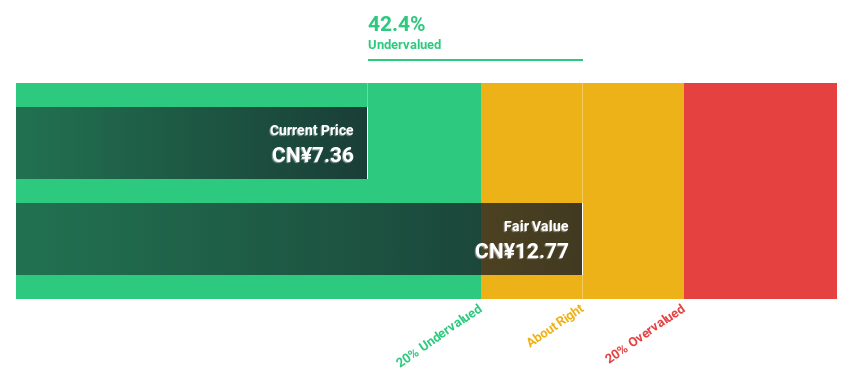

Estimated Discount To Fair Value: 42.4%

Shenzhen Sunline Tech Co., Ltd., trading at CN¥7.36, is positioned below its estimated fair value of CN¥12.8, reflecting a significant undervaluation based on discounted cash flows. The company's earnings have grown by 28.2% over the past year and are expected to increase by 33.8% annually, outperforming the Chinese market's forecasted growth. However, its Return on Equity is projected to be low at 10.4% in three years, indicating potential concerns about profitability efficiency despite strong revenue and earnings growth forecasts.

Summing It All Up

Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 101 more companies for you to explore.Click here to unveil our expertly curated list of 104 Undervalued Chinese Stocks Based On Cash Flows.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603737SHSE:688517 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance