Exploring UK Exchange: 3 Stocks With Intrinsic Value Discounts Ranging From 11.1% to 49.1%

As the FTSE 100 faces a potential break in its three-month winning streak amidst regulatory scrutiny and political uncertainties, investors are closely monitoring the UK market for opportunities. In such times, identifying stocks with intrinsic value discounts can be particularly compelling, offering a buffer against market volatility and potential growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

TBC Bank Group (LSE:TBCG) | £25.60 | £48.78 | 47.5% |

Kier Group (LSE:KIE) | £1.37 | £2.72 | 49.6% |

Morgan Advanced Materials (LSE:MGAM) | £3.155 | £6.11 | 48.4% |

Mercia Asset Management (AIM:MERC) | £0.30 | £0.58 | 48.6% |

BATM Advanced Communications (LSE:BVC) | £0.1585 | £0.30 | 47.5% |

Loungers (AIM:LGRS) | £2.66 | £5.22 | 49.1% |

John Wood Group (LSE:WG.) | £2.036 | £4.00 | 49.1% |

Deliveroo (LSE:ROO) | £1.296 | £2.47 | 47.5% |

Elementis (LSE:ELM) | £1.49 | £2.82 | 47.2% |

M&C Saatchi (AIM:SAA) | £2.02 | £3.97 | 49.1% |

We're going to check out a few of the best picks from our screener tool

Fintel

Overview: Fintel Plc operates as a provider of intermediary services and distribution channels to the retail financial services sector in the UK, with a market capitalization of approximately £318.89 million.

Operations: The company generates its revenue primarily through three core areas: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

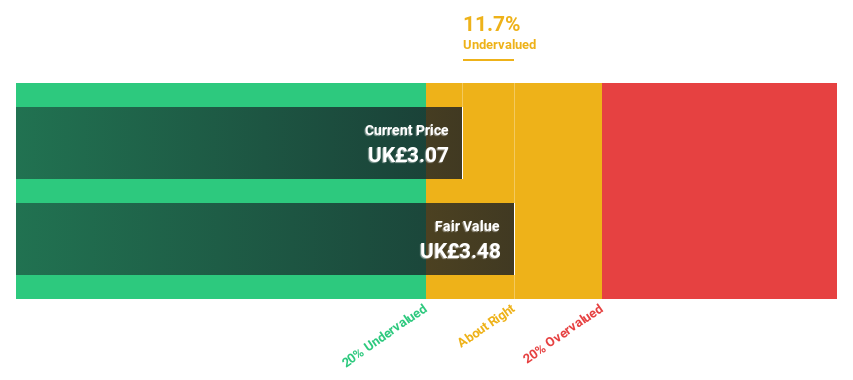

Estimated Discount To Fair Value: 11.7%

Fintel, a UK-based company, is currently trading at £3.07, below the estimated fair value of £3.48, suggesting undervaluation based on discounted cash flows. Despite a low forecasted return on equity at 12.8% in three years, Fintel's earnings are expected to grow by 23.9% annually, outpacing the UK market's average of 12.5%. However, revenue growth projections are modest at 8.6% annually and recent dividend increases to 2.35 pence per share highlight a stable financial stance amidst significant insider selling over the past quarter.

M&C Saatchi

Overview: M&C Saatchi plc is a global advertising and marketing communications services provider, operating across the United Kingdom, Europe, the Middle East, Africa, Asia Pacific, and the Americas with a market capitalization of approximately £246.96 million.

Operations: The company operates across various global regions, generating revenue through advertising and marketing communications services.

Estimated Discount To Fair Value: 49.1%

M&C Saatchi, with a current trading price of £2.02, appears undervalued compared to the estimated fair value of £3.97 based on discounted cash flows. The company is poised for a turnaround with an expected profitability within three years and a forecasted high return on equity of 38.8%. However, it faces challenges with projected annual revenue declines of 13.4%. Recent executive changes, including appointing Simon Fuller as CFO, signal potential strategic shifts to address these financial headwinds.

Victorian Plumbing Group

Overview: Victorian Plumbing Group plc is an online retailer specializing in bathroom products and accessories in the United Kingdom, with a market capitalization of approximately £300.29 million.

Operations: The company generates its revenue primarily through online sales, totaling £282.90 million.

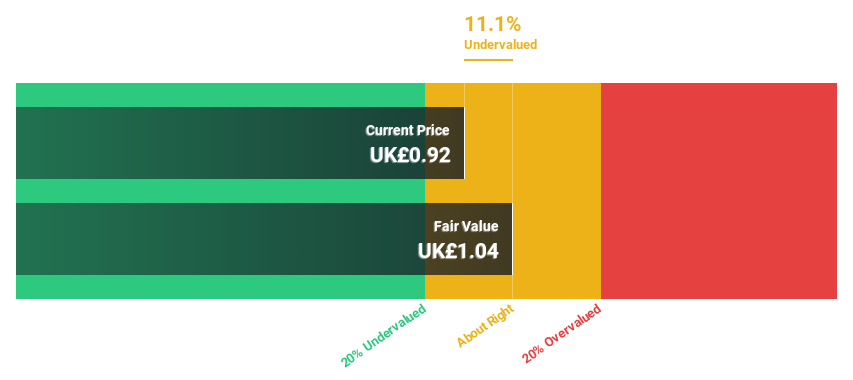

Estimated Discount To Fair Value: 11.1%

Victorian Plumbing Group, trading at £0.92, is below its fair value of £1.04 and analysts predict a 26.9% price increase. Despite a slight sales dip to £144.6 million in H1 2024 from £146.8 million the previous year, net income rose to £4.5 million from £4.2 million, indicating resilient profitability with high-quality earnings largely derived from non-cash sources. Expected to outperform with a revenue growth forecast of 9.9% per year and profit growth at 33.9% annually, it surpasses UK market averages significantly.

Summing It All Up

Discover the full array of 63 Undervalued UK Stocks Based On Cash Flows right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:FNTLAIM:SAA and AIM:VIC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance