Exploring TSX Stocks With Estimated Intrinsic Value Discounts Ranging From 19.6% To 34.1%

Amid shifting economic signals, with the Bank of Canada initiating interest rate cuts and potential further easing anticipated, investors may find the Canadian market ripe for reevaluation. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling as they may offer noteworthy opportunities for those looking to diversify or adjust their portfolios in light of evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$180.00 | CA$313.94 | 42.7% |

Trisura Group (TSX:TSU) | CA$41.15 | CA$80.18 | 48.7% |

Decisive Dividend (TSXV:DE) | CA$7.225 | CA$11.76 | 38.6% |

Kinaxis (TSX:KXS) | CA$160.27 | CA$262.56 | 39% |

Kraken Robotics (TSXV:PNG) | CA$1.16 | CA$2.24 | 48.2% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Green Thumb Industries (CNSX:GTII) | CA$15.22 | CA$28.18 | 46% |

Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Kits Eyecare (TSX:KITS) | CA$9.00 | CA$15.43 | 41.7% |

Capstone Copper (TSX:CS) | CA$10.36 | CA$16.77 | 38.2% |

Here's a peek at a few of the choices from the screener.

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe, with a market capitalization of approximately CA$85.83 billion.

Operations: The company generates CA$8.84 billion in revenue primarily from its software and programming segment.

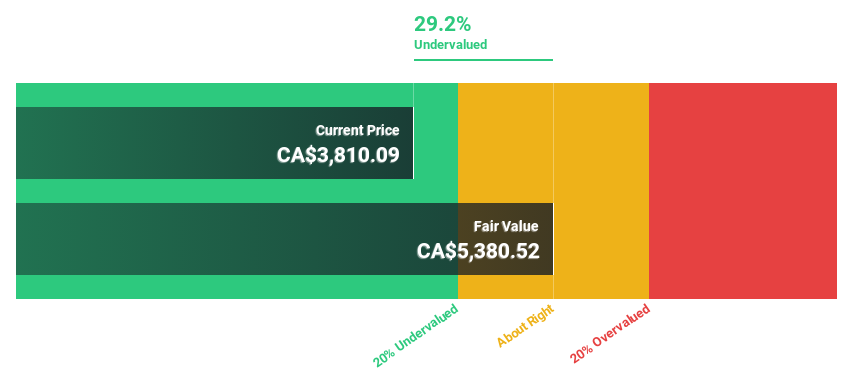

Estimated Discount To Fair Value: 26.1%

Constellation Software, priced at CA$4115.18, appears undervalued based on a DCF valuation of CA$5568.83, trading 26.1% below its estimated fair value. Despite significant insider selling recently, the company's strong fundamentals are evident with expected annual earnings growth of 24.4% and revenue growth at 16.1%, both outpacing the Canadian market forecasts of 15% and 7.3%, respectively. However, it carries a high level of debt which could be a concern for risk-averse investors.

Endeavour Mining

Overview: Endeavour Mining plc, along with its subsidiaries, operates as a gold mining company in West Africa and has a market capitalization of approximately CA$7.46 billion.

Operations: The company generates its revenue from four main gold mines: Ity Mine contributing $653.70 million, Mana Mine at $292.70 million, Houndé Mine with $611.30 million, and Sabodala Massawa Mine adding $548.40 million.

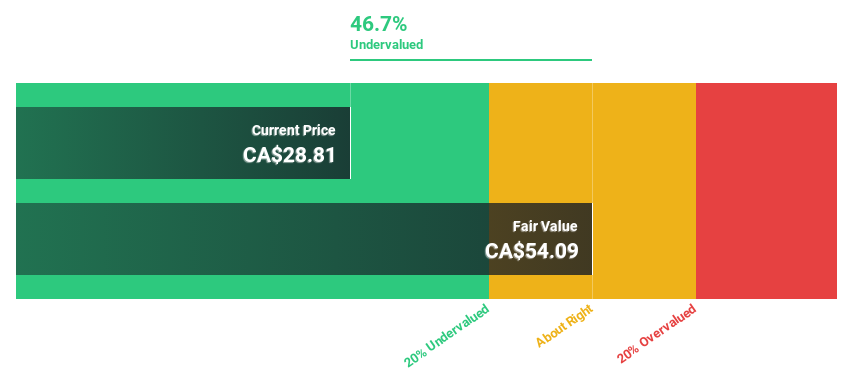

Estimated Discount To Fair Value: 34.1%

Endeavour Mining, trading at CA$31.85, is considered undervalued against a fair value estimate of CA$48.36 based on discounted cash flow analysis. Despite recent operational challenges marked by a net loss in Q1 2024 and elevated AISC, the company's aggressive expansion and exploration efforts, particularly at the Lafigué mine which began production ahead of schedule, underscore its growth potential. Analysts forecast significant revenue growth of 9.8% annually and anticipate profitability within three years, supporting a positive outlook on its valuation recovery.

Energy Fuels

Overview: Energy Fuels Inc. operates in the United States, focusing on the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties with a market cap of approximately CA$1.36 billion.

Operations: The company generates revenue primarily from miscellaneous metals and mining activities, totaling CA$43.74 million.

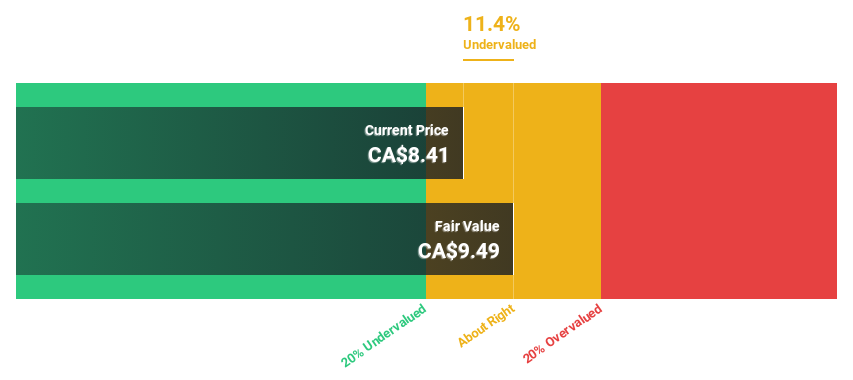

Estimated Discount To Fair Value: 19.6%

Energy Fuels, priced at CA$8.83, trades below its discounted cash flow estimated fair value of CA$10.98, reflecting a potential undervaluation. Despite recent exclusion from several Russell indexes, the company is poised for substantial growth with expected revenue increases of 40.8% annually and forecasted profitability within three years. Its strategic venture in Australia to enhance uranium and rare earth element production underscores its expansion strategy amidst market challenges, aligning with future clean energy demands.

The growth report we've compiled suggests that Energy Fuels' future prospects could be on the up.

Dive into the specifics of Energy Fuels here with our thorough financial health report.

Where To Now?

Click this link to deep-dive into the 25 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CSU TSX:EDV and TSX:EFR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance