Exploring Top Dividend Stocks In Sweden For June 2024

As global markets navigate through a mix of economic signals, Sweden's market remains a point of interest for investors looking for stable dividend yields. Amidst this backdrop, understanding the characteristics of top-performing dividend stocks becomes crucial, especially in an environment where careful selection aligns with long-term investment stability and income generation.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.26% | ★★★★★★ |

Betsson (OM:BETS B) | 6.30% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.30% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.25% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.12% | ★★★★★☆ |

Duni (OM:DUNI) | 4.77% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.04% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.59% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.28% | ★★★★★☆ |

Bahnhof (OM:BAHN B) | 4.09% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

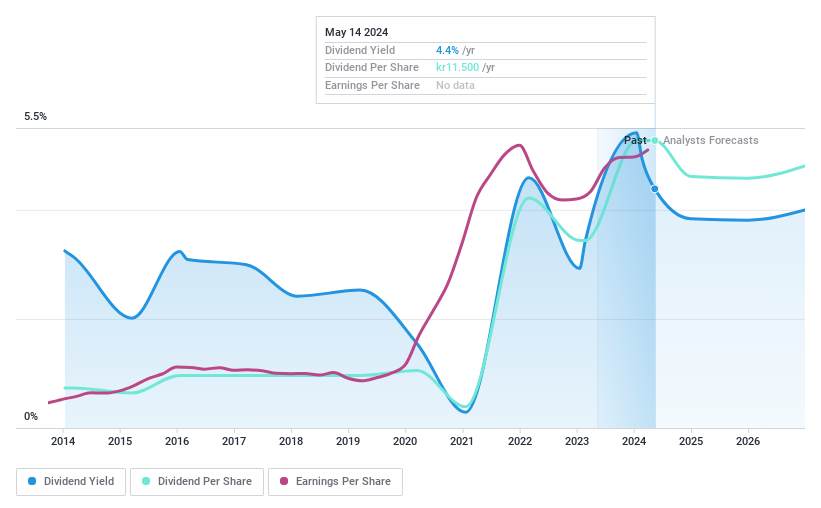

Avanza Bank Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB, along with its subsidiaries, provides savings, pension, and mortgage products in Sweden and has a market capitalization of approximately SEK 43.40 billion.

Operations: Avanza Bank Holding AB generates its revenue primarily from commercial operations, totaling SEK 3.84 billion.

Dividend Yield: 4.3%

Avanza Bank Holding's dividend yield stands at 4.28%, ranking in the top 25% of Swedish dividend payers, with a history of increasing dividends over the past decade. Despite this, its dividend payments have shown volatility and inconsistency. The company's recent performance includes a net income rise to SEK 555 million in Q1 2024, up from SEK 501 million year-over-year, supported by significant customer growth and robust net inflows totaling SEK 34.9 billion in 2024.

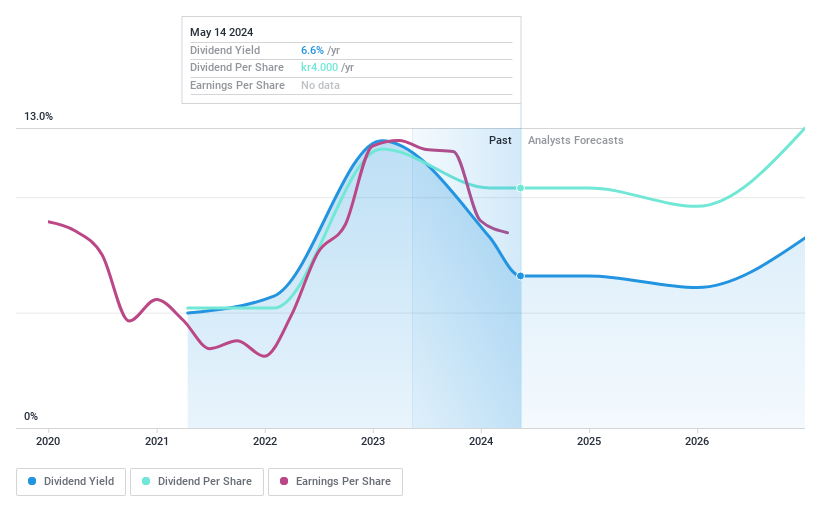

Nordic Paper Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates in the production and sale of natural greaseproof and kraft paper across Sweden, Italy, Germany, other parts of Europe, the United States, and internationally with a market capitalization of approximately SEK 3.37 billion.

Operations: Nordic Paper Holding AB generates its revenue primarily from two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper, contributing SEK 2.19 billion.

Dividend Yield: 7.9%

Nordic Paper Holding's recent dividend reduction to SEK 4 per share reflects a cautious approach amid financial results showing a dip in Q1 2024 sales to SEK 1.21 billion from SEK 1.31 billion year-over-year, and net income decreasing to SEK 149 million from SEK 173 million. Despite this, the dividend yield remains competitive at 7.92%, supported by a cash payout ratio of 78%. However, the company's high debt levels and unstable dividend history since it has been paying dividends for only three years suggest potential concerns for long-term sustainability.

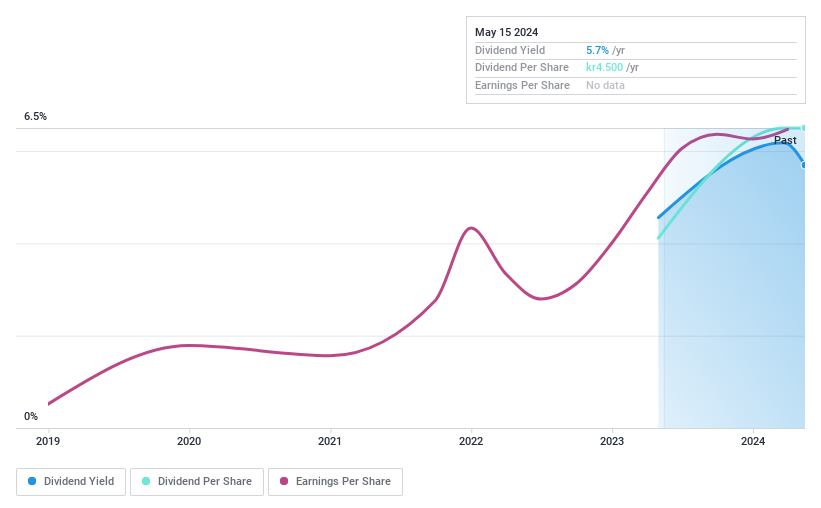

Solid Försäkringsaktiebolag

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates in the non-life insurance sector, offering products to private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 16.18 billion.

Operations: Solid Försäkringsaktiebolag generates its revenues primarily through three key segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag, recently initiating dividends, declared SEK 4.50 per share at its AGM on April 25, 2024. With a dividend yield of 5.2%, it ranks well in the Swedish market. The payout ratio stands at a sustainable 50.2%, with earnings and cash flows sufficiently covering this distribution (cash payout ratio of 86.5%). Despite trading at a significant discount to fair value and showing robust earnings growth of 21.4% last year, its short dividend history raises questions about future reliability and growth potential.

Key Takeaways

Explore the 22 names from our Top Dividend Stocks screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:AZA OM:NPAPER and OM:SFAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance