Exploring Top Dividend Stocks For May 2024

As global markets show signs of resilience, with indices like the S&P 500 nearing record highs and various regions exhibiting robust economic signals, investors might find it prudent to consider the stability offered by dividend stocks. In light of current market dynamics, a good dividend stock typically features strong fundamentals and a consistent payout history, which can be particularly appealing in times of economic uncertainty or modest growth forecasts.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.47% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.57% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.64% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.42% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.06% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.94% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.50% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.78% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.38% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.29% | ★★★★★★ |

Click here to see the full list of 1808 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

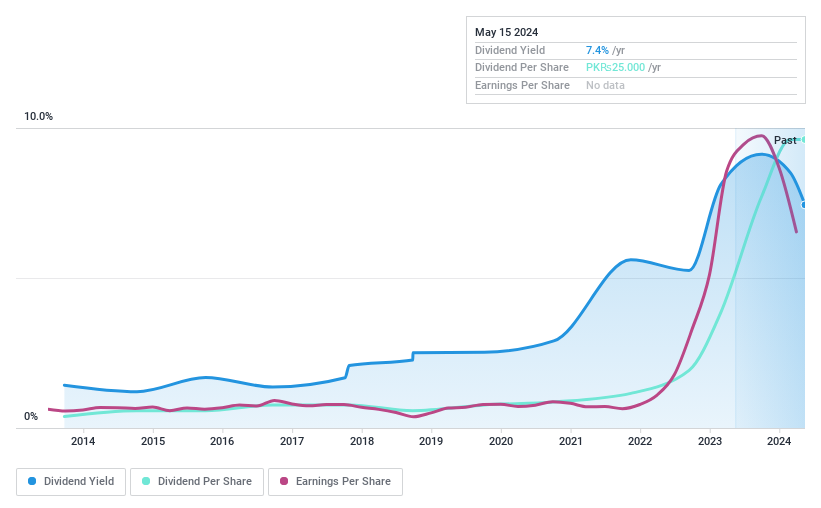

Pakistan National Shipping

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pakistan National Shipping Corporation operates globally in the shipping industry along with its subsidiaries and has a market capitalization of approximately PKR 44.39 billion.

Operations: Pakistan National Shipping Corporation generates its revenue primarily from global shipping operations.

Dividend Yield: 7.4%

Pakistan National Shipping Corporation (PNSC) reported a decline in quarterly and nine-month revenues and net income as of March 31, 2024, with significant drops from the previous year's figures. Despite this downturn, PNSC maintains a low dividend payout ratio at 9.6%, ensuring dividends are well-covered by earnings. However, its dividend yield of 7.44% is modest compared to the top payers in Pakistan's market. The company has increased its dividends over the past decade but has shown volatility and unreliability in its dividend payments during this period.

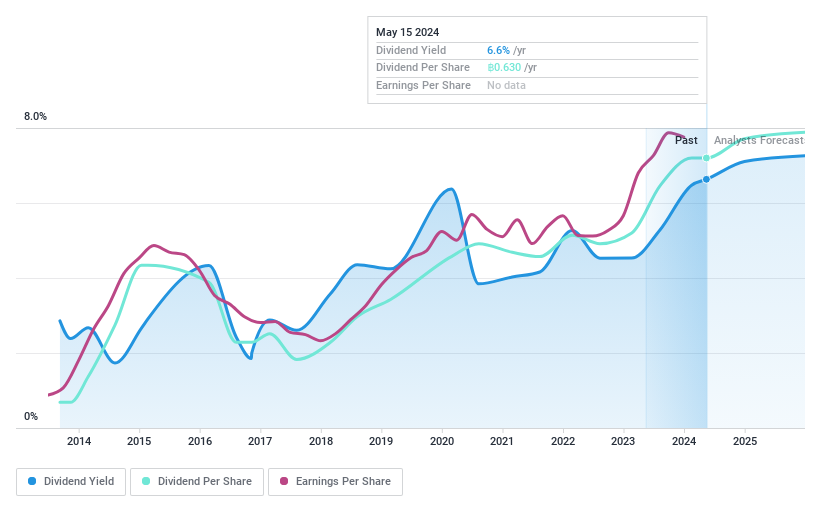

Union Auction

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Union Auction Public Company Limited operates in Thailand, offering auction services for various assets, with a market capitalization of approximately THB 5.23 billion.

Operations: Union Auction Public Company Limited generates revenue primarily through its auction services, totaling THB 1.00 billion, and transportation and other related services amounting to THB 0.23 billion.

Dividend Yield: 6.6%

Union Auction's dividend yield stands at 6.63%, placing it among the top 25% of dividend payers in the Thai market. Despite this, its dividends are not well-supported by earnings, with a payout ratio of 100%. However, cash flows are more reassuring with a cash payout ratio at 58.9%. The company has increased its dividends over the last decade but has also experienced volatility in payments during this period. Recent shareholder meetings confirmed significant dividend distributions closely aligned with net profits for 2023.

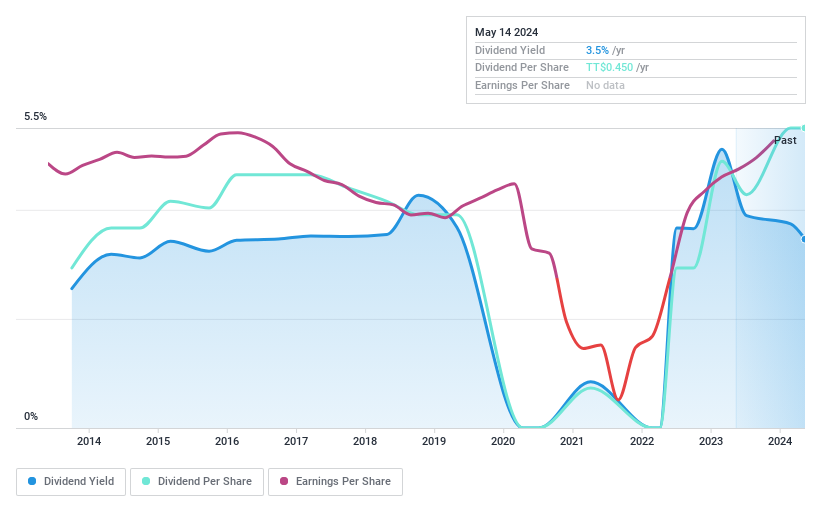

Prestige Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prestige Holdings Limited is a restaurant management company based in Trinidad and Tobago, with operations extending internationally, and has a market capitalization of TTD 797.03 million.

Operations: Prestige Holdings Limited generates TTD 1.33 billion in revenue primarily from its restaurant management operations.

Dividend Yield: 3.5%

Prestige Holdings Limited's recent financial performance shows robust growth, with sales reaching TTD 1.33 billion and net income up to TTD 56.01 million, marking significant year-over-year improvements. Despite a low dividend yield of 3.46% compared to the top TT market payers, its dividends are well-supported by both earnings and cash flows, with payout ratios of 49.3% and 33.5% respectively. However, the company has a history of unstable and unreliable dividend payments over the past decade, coupled with a highly volatile share price recently.

Taking Advantage

Dive into all 1808 of the Top Dividend Stocks we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KASE:PNSC SET:AUCT and TTSE:PHL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance