Exploring Top Dividend Stocks On The ASX In June 2024

As the ASX200 shows a robust uptick, closing almost a percent higher with notable gains in sectors like Consumer Staples and Energy, the Australian market presents an intriguing landscape for investors. In this context, understanding the attributes of strong dividend stocks becomes crucial, especially considering current market dynamics and upcoming listings such as Guzman y Gomez.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.59% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.80% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.04% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.72% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.65% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.31% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.52% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.10% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.16% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.66% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

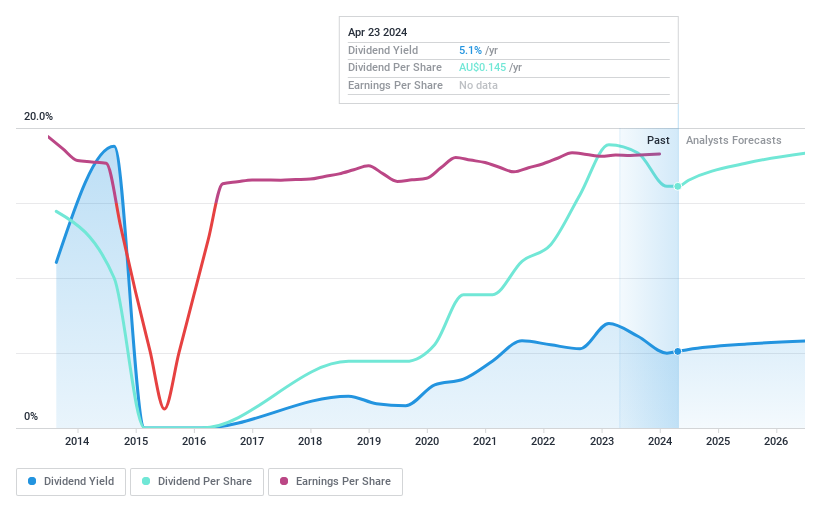

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited operates in Australia, offering a wide range of contract services to the resources and infrastructure sectors, with a market capitalization of approximately A$1.40 billion.

Operations: NRW Holdings Limited generates its revenue primarily from three segments: Mining (A$1.49 billion), MET (A$739.07 million), and Civil (A$593.62 million).

Dividend Yield: 4.7%

NRW Holdings offers a dividend yield of 4.71%, which is below the top tier in the Australian market. Despite a volatile dividend history over the past decade, recent earnings growth at 15.8% per year and trading at 26.1% below estimated fair value suggest potential value. Dividends are supported by a payout ratio of 74% from earnings and 68.6% from cash flow, indicating sustainability despite past fluctuations in dividend reliability.

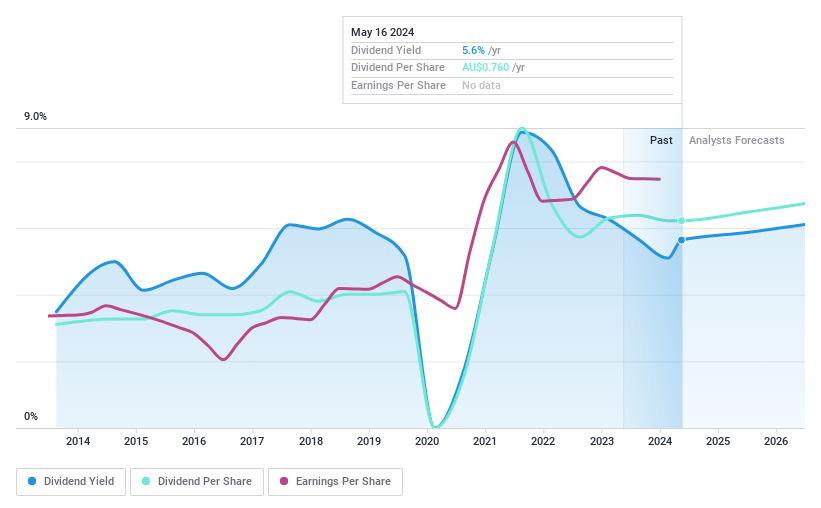

Super Retail Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Super Retail Group Limited operates in Australia and New Zealand, specializing in the retail of auto, sports, and outdoor leisure products with a market capitalization of A$2.96 billion.

Operations: Super Retail Group Limited generates revenue through its segments: Rebel with A$1.30 billion, Super Cheap Auto at A$1.48 billion, and Boating, Camping and Fishing (excluding Macpac) contributing A$876 million.

Dividend Yield: 5.8%

Super Retail Group's dividend has grown over the past decade, yet it remains lower than many top Australian dividend stocks at 5.81%. The company trades at a significant discount, 58.4% below estimated fair value, and maintains a sustainable payout with earnings covering 65.5% and cash flows covering 28.6% of dividends. However, its dividend history shows instability and unreliability, reflecting a pattern of volatility in payments despite recent management changes with the appointment of Anna Sandham as Company Secretary on March 25, 2024.

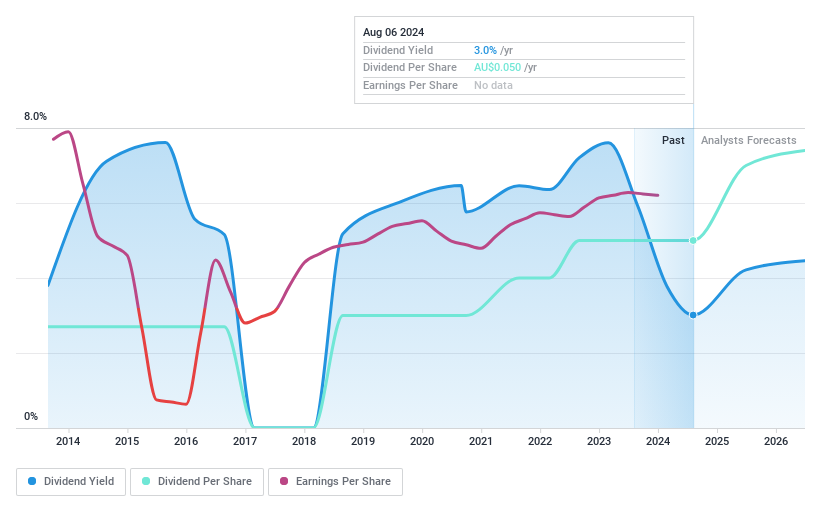

Southern Cross Electrical Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, operating in Australia, offers electrical, instrumentation, communication, and maintenance services with a market capitalization of A$427.72 million.

Operations: Southern Cross Electrical Engineering Limited generates A$464.88 million from its provision of electrical services.

Dividend Yield: 3.1%

Southern Cross Electrical Engineering has seen earnings grow at 13.3% annually over the past five years, with forecasts suggesting a 23.62% growth per year moving forward. While dividends are covered by both earnings (66.5% payout ratio) and cash flows (78.2% cash payout ratio), the company's dividend track record is unstable, showing volatility and unreliable payments over the last decade. Recently added to the S&P/ASX Emerging Companies Index, its current dividend yield stands at 3.08%, relatively low compared to leading Australian dividend stocks.

Next Steps

Reveal the 27 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NWH ASX:SXE and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance