Exploring Tohokushinsha Film And Two More Top Dividend Stocks In Japan

As Japan's stock markets navigate mixed signals, with the Nikkei 225 showing modest gains amidst a strengthening yen and supportive services sector data, investors are keenly observing market dynamics. In this context, dividend stocks like Tohokushinsha Film offer a particular appeal due to their potential for providing steady income in an environment where economic indicators and central bank policies suggest cautious optimism.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.78% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.66% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.55% | ★★★★★★ |

Globeride (TSE:7990) | 3.62% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.54% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.47% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.13% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

Innotech (TSE:9880) | 4.08% | ★★★★★★ |

Click here to see the full list of 389 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Tohokushinsha Film

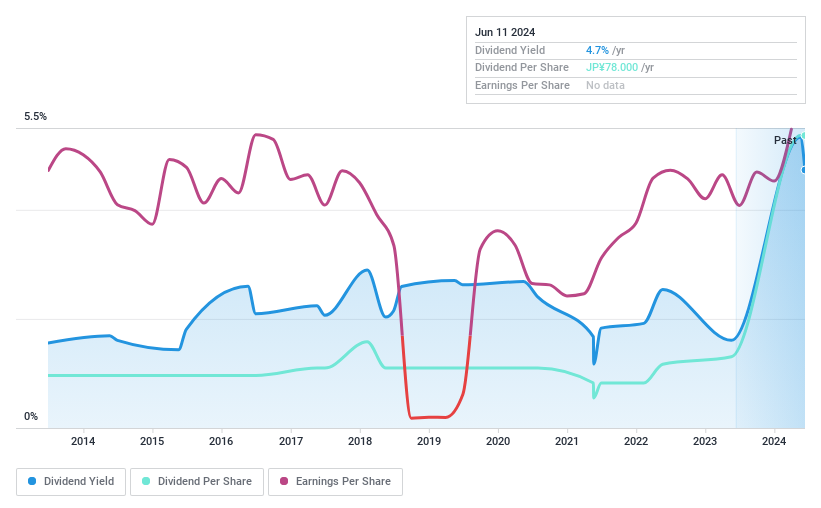

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tohokushinsha Film Corporation, with a market capitalization of ¥74.12 billion, operates as a media business company in Japan, engaging in a range of activities including film production and distribution.

Operations: Tohokushinsha Film Corporation generates its revenue through activities such as film production and distribution in Japan.

Dividend Yield: 4.7%

Tohokushinsha Film has demonstrated a mixed performance in its dividend strategy. While the company's dividends are supported by both earnings and cash flows, with a payout ratio of 28.4% and a cash payout ratio of 63.4%, its dividend history shows volatility over the past decade. Recently, Tohokushinsha announced significant increases in its year-end dividend for FY 2024 to JPY 78 per share, up from JPY 19 previously; however, it anticipates reducing this to JPY 20 per share by the end of FY 2025. This fluctuation suggests potential instability in future payouts despite current coverage levels.

Cosmo Energy Holdings

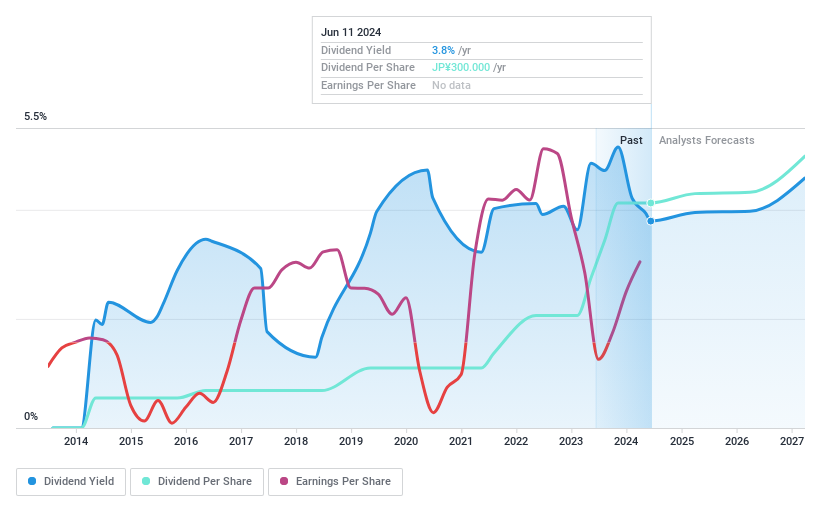

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cosmo Energy Holdings Co., Ltd. operates in the oil industry both in Japan and internationally, with a market capitalization of approximately ¥691.99 billion.

Operations: Cosmo Energy Holdings Co., Ltd. generates revenue primarily from its Oil Business at ¥2.45 billion, followed by the Petrochemical Business at ¥0.36 billion, Oil Exploration and Production at ¥0.13 billion, and Renewable Energy Business at ¥0.01 billion.

Dividend Yield: 3.8%

Cosmo Energy Holdings maintains a stable dividend, with a recent increase to JPY 150 per share from JPY 75 last year. The dividends are well-supported by earnings and cash flows, with payout ratios of 32% and 25.9% respectively. Despite being valued 41.4% below its estimated fair value and offering a competitive yield of 3.79%, the company forecasts a slight earnings decline over the next three years. Additionally, it has initiated a share repurchase program, buying back shares worth ¥23 billion to enhance shareholder returns.

Aichi

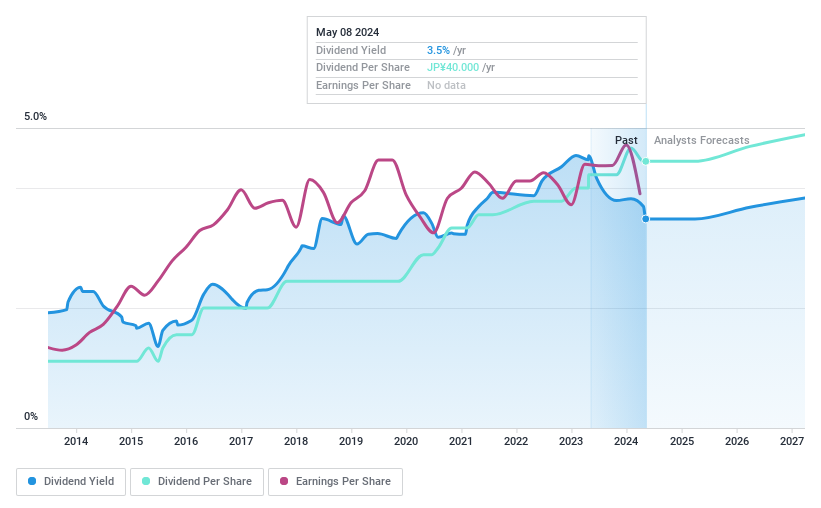

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aichi Corporation specializes in manufacturing and selling mechanized vehicles for various industries including electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail sectors globally, with a market capitalization of ¥91.78 billion.

Operations: Aichi Corporation generates its revenue by producing and marketing mechanized vehicles primarily for sectors such as electric utilities, telecommunications, construction, cargo handling, shipbuilding, and rail on a global scale.

Dividend Yield: 3.2%

Aichi's dividend history shows inconsistency, with significant fluctuations over the past decade, including annual drops exceeding 20%. Despite a low yield of 3.25%, not competitive with the top quartile in Japan, dividends are sustainably funded by earnings and cash flows, evidenced by payout ratios of 56.9% and 49.4% respectively. Additionally, Aichi trades at a substantial discount of 42.4% below its estimated fair value, suggesting potential for valuation correction despite its unsteady dividend performance.

Unlock comprehensive insights into our analysis of Aichi stock in this dividend report.

Our expertly prepared valuation report Aichi implies its share price may be lower than expected.

Next Steps

Take a closer look at our Top Dividend Stocks list of 389 companies by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2329TSE:5021 TSE:6345 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance