Exploring Three US Growth Companies With Substantial Insider Ownership

Amidst a backdrop of fluctuating markets and evolving economic indicators, the U.S. stock market has shown resilience in various sectors despite recent downturns in tech giants. As investors navigate through these uncertain times, understanding the role of insider ownership in growth companies becomes increasingly relevant. In this environment, companies with substantial insider ownership can be appealing as they often indicate a leadership team deeply invested in the company's long-term success. This alignment between management and shareholder interests is particularly noteworthy given current market dynamics.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 86.5% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Iovance Biotherapeutics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology company focused on developing and commercializing cell therapies for metastatic melanoma and other solid tumors in the United States, with a market capitalization of approximately $2.52 billion.

Operations: The company focuses on the development and commercialization of cell therapies for treating metastatic melanoma and other solid tumors.

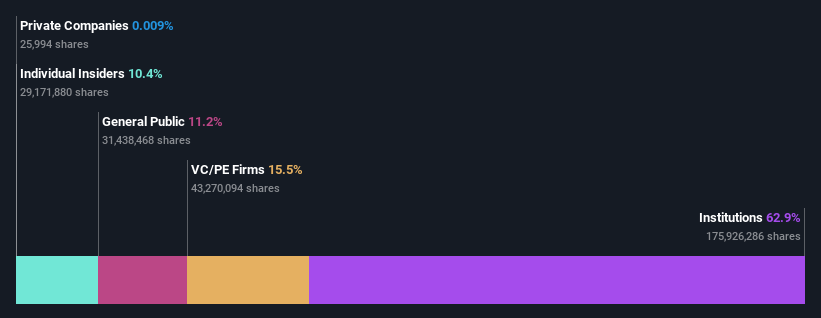

Insider Ownership: 10.4%

Iovance Biotherapeutics, a company in the spotlight for its high insider ownership, illustrates both the potential and challenges typical of growth-oriented biotech firms. Recently, Iovance reported modest quarterly revenue of US$0.715 million and a reduced net loss compared to last year. Despite these financial hurdles, including a substantial net loss of US$112.98 million, the firm is actively engaging in industry conferences and has resolved legal issues by agreeing to governance changes and settling lawsuits. Optimistically, Iovance's revenue is projected to grow significantly at 46.8% annually, outpacing general market trends with expectations of profitability within three years.

Frontier Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market capitalization of approximately $1.17 billion.

Operations: The primary revenue stream, totaling $3.61 billion, is derived from providing air transportation for passengers.

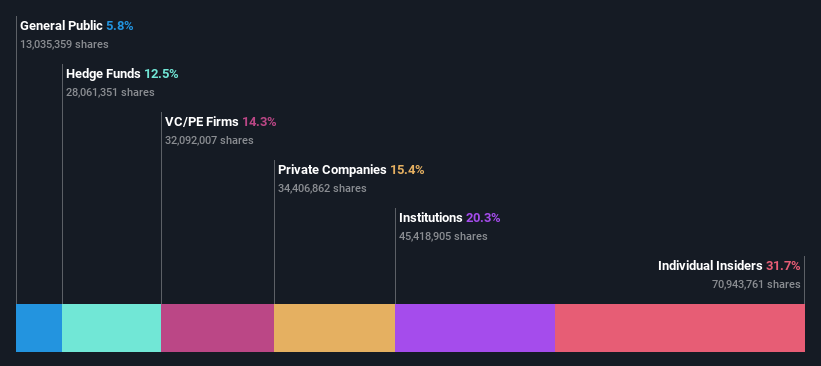

Insider Ownership: 31.7%

Frontier Group Holdings, despite a recent uptick in revenue to US$865 million, faced a doubled net loss of US$26 million in Q1 2024. Insider transactions have not shown substantial buying activity over the past three months, indicating mixed confidence from those within. However, Frontier anticipates robust capacity growth between 12% and 15% year-over-year into 2024, aligning with expectations of becoming profitable within the next three years. The company's strategic presentations and guidance suggest an aggressive pursuit of growth despite current financial volatilities.

Marcus & Millichap

Simply Wall St Growth Rating: ★★★★★☆

Overview: Marcus & Millichap, Inc., a company specializing in real estate investment brokerage and financing services for commercial properties in the United States and Canada, has a market capitalization of approximately $1.25 billion.

Operations: The company generates its revenue primarily from the delivery of commercial real estate services, totaling $620.24 million.

Insider Ownership: 37%

Marcus & Millichap, despite trading at 58.5% below its estimated fair value, faces challenges with a recent net loss of US$9.99 million in Q1 2024 and a basic loss per share from continuing operations increasing to US$0.26. However, the company shows promise with an expected revenue growth rate of 23.3% per year and earnings forecasted to grow significantly at 159.68% annually. Insider activity has been mixed, with more substantial selling than buying over the past three months, reflecting varied confidence levels internally.

Key Takeaways

Delve into our full catalog of 175 Fast Growing US Companies With High Insider Ownership here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:IOVA NasdaqGS:ULCC and NYSE:MMI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance