Exploring Three US Growth Companies With High Insider Ownership

The United States market has shown robust growth, climbing 1.3% in the last week and achieving a 21% increase over the past year, with earnings expected to grow by 15% annually. In such a thriving environment, companies with high insider ownership can be particularly appealing as they often reflect a management team deeply invested in the company's success.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.7% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 18.1% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Underneath we present a selection of stocks filtered out by our screen.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

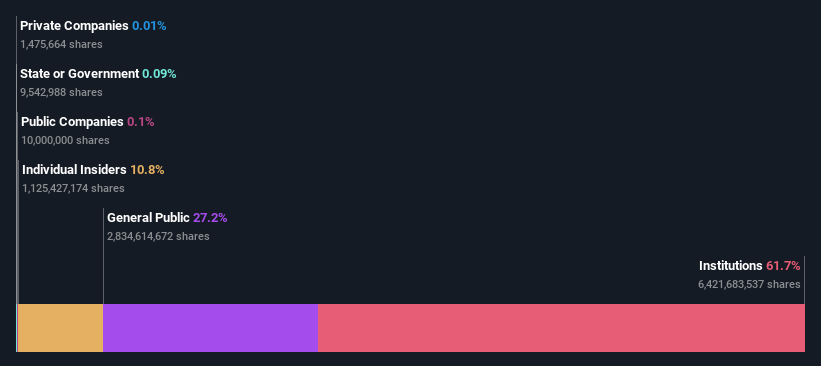

Overview: Amazon.com, Inc. operates as a global e-commerce giant, offering retail goods, advertising services, and subscriptions both online and through physical stores, with a market capitalization of approximately $1.95 trillion.

Operations: The company's revenue is divided into three primary segments: North America generates $362.29 billion, International contributes $134.01 billion, and Amazon Web Services (AWS) brings in $94.44 billion.

Insider Ownership: 10.8%

Amazon.com has demonstrated robust growth with earnings increasing significantly over the past year and forecasts suggest continued strong performance. While insider trading data is not available for the recent three months, Amazon's strategic moves, including potential acquisitions and expansions into new product categories with companies like Revolution Beauty, indicate proactive management. However, its forecasted return on equity is relatively low at 18.1%, which could be a concern for potential growth sustainability. Despite these challenges, Amazon remains a compelling case within high-growth sectors due to its aggressive expansion strategies and market penetration.

Zscaler

Simply Wall St Growth Rating: ★★★★★☆

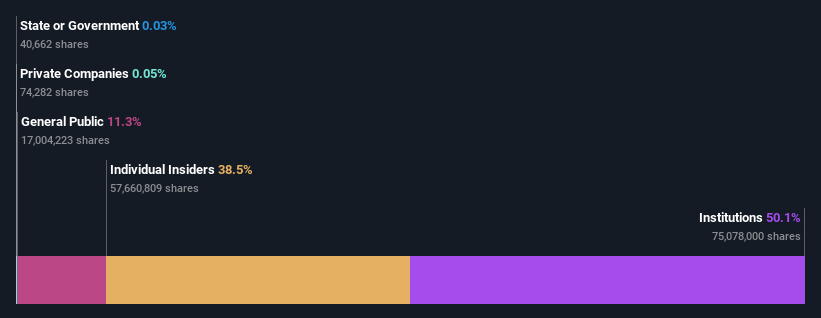

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $27.80 billion.

Operations: The company primarily generates revenue through the sale of subscription services to its cloud platform and related support services, totaling approximately $2.03 billion.

Insider Ownership: 38.1%

Zscaler has shown significant financial improvement with a swing to net income in Q3 2024 and a robust sales increase, highlighting its growth trajectory. Recent strategic moves, including partnerships with Wipro and Google, alongside potential acquisitions, underscore its aggressive expansion strategy. However, despite high insider ownership hinting at confidence from within, the forecasted revenue growth rate slightly below 20% per year may temper expectations for some investors looking for rapid top-line expansion.

Palantir Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding counterterrorism efforts globally, with a market capitalization of approximately $51.51 billion.

Operations: The company generates revenue through two primary segments: Commercial, which brought in $1.07 billion, and Government, contributing $1.27 billion.

Insider Ownership: 13.4%

Palantir Technologies has recently become profitable, with significant earnings growth expected at 24.38% annually, outpacing the US market forecast. However, its return on equity is projected to remain low at 17%. Despite no substantial insider trading reported in the past three months, Palantir's revenue growth is also anticipated to exceed the market average. Recent expansions in AI partnerships, including with Tampa General Hospital and Eaton for operational enhancements, underline its strategic focus on integrating advanced technology across various sectors.

Make It Happen

Investigate our full lineup of 183 Fast Growing US Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AMZN NasdaqGS:ZS and NYSE:PLTR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance