Exploring Three Undervalued US Stocks With Intrinsic Discounts Ranging From 16.3% To 41.1%

As the third quarter of 2024 begins, U.S. stocks have shown resilience with modest gains despite ongoing concerns about interest rate policies and sector imbalances. In such a market, identifying undervalued stocks can offer investors potential opportunities for growth, especially when intrinsic values suggest significant discounts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | $75.80 | $151.58 | 50% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.3637 | $32.12 | 49.1% |

Oddity Tech (NasdaqGM:ODD) | $39.17 | $76.33 | 48.7% |

Victory Capital Holdings (NasdaqGS:VCTR) | $47.57 | $92.59 | 48.6% |

Array Technologies (NasdaqGM:ARRY) | $9.57 | $18.57 | 48.5% |

Daqo New Energy (NYSE:DQ) | $14.31 | $27.78 | 48.5% |

AppLovin (NasdaqGS:APP) | $84.82 | $166.05 | 48.9% |

Viant Technology (NasdaqGS:DSP) | $10.37 | $20.07 | 48.3% |

HeartCore Enterprises (NasdaqCM:HTCR) | $0.709 | $1.40 | 49.5% |

APi Group (NYSE:APG) | $36.33 | $70.88 | 48.7% |

We'll examine a selection from our screener results

Adobe

Overview: Adobe Inc. operates globally as a diversified software company, with a market capitalization of approximately $246.33 billion.

Operations: The company's revenue is primarily derived from three segments: Digital Media generating $15.03 billion, Digital Experience at $5.11 billion, and Publishing and Advertising contributing $0.28 billion.

Estimated Discount To Fair Value: 16.3%

Adobe, valued at US$560.01, is trading under its estimated fair value of US$668.92, suggesting potential undervaluation based on cash flows. Recent AI innovations in Adobe Acrobat and robust Q2 earnings growth highlight its strong market position and innovation-driven strategy. However, with a forecasted annual profit growth of 17.4%, it slightly lags behind more aggressive growth benchmarks. Insider selling over the past quarter raises caution despite these positive indicators.

Intuit

Overview: Intuit Inc. operates globally, offering financial management and compliance products and services to consumers, small businesses, self-employed individuals, and accounting professionals with a market capitalization of approximately $183.72 billion.

Operations: The company's revenue is primarily derived from its Small Business and Self-Employed segment at $9.11 billion, followed by Consumer at $4.46 billion, Credit Karma at $1.65 billion, and Pro-Tax at $0.60 billion.

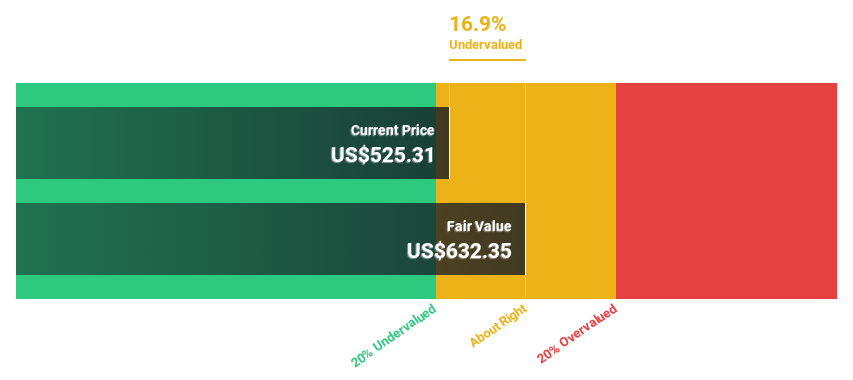

Estimated Discount To Fair Value: 26.2%

Intuit, priced at US$650.77, is positioned below its calculated fair value of US$881.34, indicating a significant undervaluation based on cash flow assessments. This financial software company has demonstrated robust earnings growth of 37.2% over the past year and anticipates continued revenue expansion at 11.4% annually. Recent strategic moves include launching advanced AI-driven revenue intelligence technology and expanding market presence through partnerships like the NHL deal in Canada, enhancing its competitive edge while maintaining strong projected earnings growth and high return on equity forecasts.

The growth report we've compiled suggests that Intuit's future prospects could be on the up.

Delve into the full analysis health report here for a deeper understanding of Intuit.

Oracle

Overview: Oracle Corporation provides a wide range of products and services for enterprise IT environments globally, with a market capitalization of approximately $389.13 billion.

Operations: The company's revenue is primarily generated from three segments: Hardware ($3.07 billion), Services ($5.43 billion), and Cloud and License ($44.46 billion).

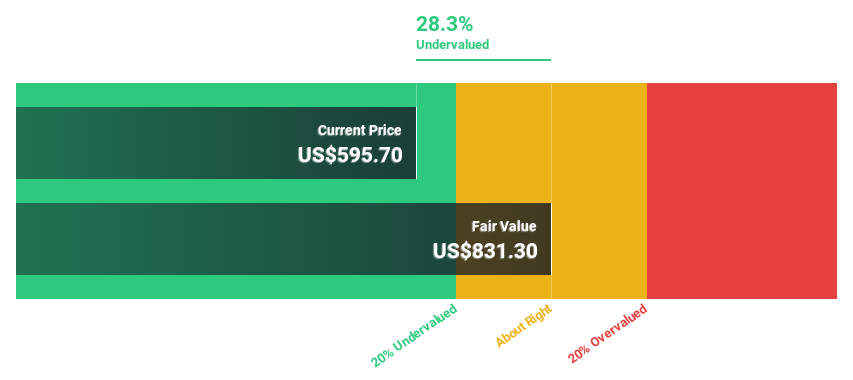

Estimated Discount To Fair Value: 41.1%

Oracle, currently priced at US$143.09, is trading 41.1% below its estimated fair value of US$243.13, signaling a significant undervaluation based on discounted cash flow analysis. The company's earnings are expected to grow by 15.87% annually, outpacing the US market forecast of 14.7%. Despite a high level of debt, Oracle boasts an exceptionally high projected return on equity of 46.2% in three years and maintains good value relative to industry peers. Recent innovations like HeatWave GenAI enhance its competitive position by integrating advanced AI capabilities directly into database services for enhanced enterprise data handling and security without extra costs or complexity.

Summing It All Up

Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Undervalued US Stocks Based On Cash Flows.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:ADBE NasdaqGS:INTU and NYSE:ORCL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance