Exploring Three Undervalued Small Caps With Insider Action In The United Kingdom

As the UK economy shows signs of resilience with positive GDP figures and a buoyant FTSE 100, investors are keenly watching market dynamics and potential opportunities. In this context, exploring undervalued small-cap stocks with recent insider activity could offer interesting prospects, especially given the broader market sentiment and economic indicators.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Ultimate Products | 9.4x | 0.7x | 20.35% | ★★★★★★ |

Norcros | 7.9x | 0.5x | 43.52% | ★★★★★☆ |

GB Group | NA | 3.2x | 22.45% | ★★★★★☆ |

THG | NA | 0.4x | 40.66% | ★★★★★☆ |

Bytes Technology Group | 26.9x | 6.1x | -6.53% | ★★★★☆☆ |

CVS Group | 20.3x | 1.1x | 43.37% | ★★★★☆☆ |

M&C Saatchi | NA | 0.6x | 48.52% | ★★★★☆☆ |

Robert Walters | 19.6x | 0.2x | 40.76% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -46.02% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.8x | 44.72% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

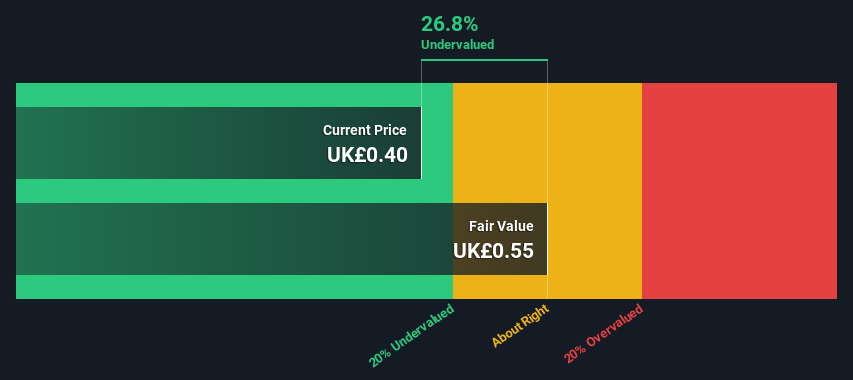

Assura

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a healthcare real estate investment trust (REIT) that focuses on the development, investment, and management of primary care facilities across the UK, with a market capitalization of approximately £1.70 billion.

Operations: Core generated £157.80 million in revenue, with a gross profit margin of 90.81% as of the latest reporting period. This reflects a cost of goods sold (COGS) totaling £14.50 million, alongside operating expenses amounting to £14.00 million within the same timeframe.

PE: -44.0x

Assura's recent strategic alliance with Universities Superannuation Scheme Limited, forming a £250 million joint venture to enhance NHS infrastructure, underscores its commitment to growth in healthcare property investment. This partnership, coupled with a significant reduction in net losses from £119.2 million to £28.8 million year-over-year and an anticipated earnings growth of 40.91%, signals strong future prospects. Additionally, insider confidence is evident as they recently purchased shares, aligning their interests with shareholders and betting on the company's success strategy focused on long-term value creation through direct NHS leases and inflation-linked rents.

Delve into the full analysis valuation report here for a deeper understanding of Assura.

Evaluate Assura's historical performance by accessing our past performance report.

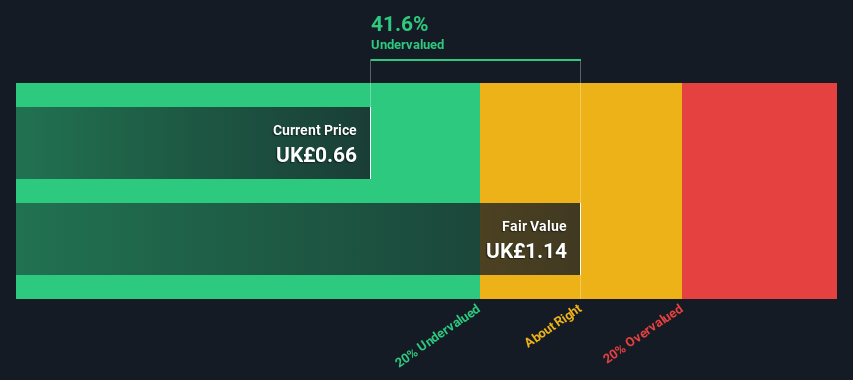

Kier Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a construction and infrastructure services provider with operations spanning property development, building, and civil engineering, boasting a market capitalization of approximately £0.24 billion.

Operations: With a diverse revenue model spanning Construction and Infrastructure Services, the company generated £3.72 billion in its latest reporting period, showcasing a gross profit of £322.70 million. The gross profit margin has seen fluctuations over recent periods, registering at 8.68% as of the latest data point.

PE: 16.3x

Kier Group, a notable player in the UK's small-cap landscape, recently saw significant insider confidence with key stakeholders bolstering their positions through recent share purchases. With earnings expected to rise by 23% annually, this reflects a strong growth trajectory despite some financial results being skewed by one-off items. The company operates on high-risk external borrowing rather than customer deposits, indicating a reliance on volatile funding sources. This mix of insider buying and challenging capital structure presents Kier as an intriguing prospect for those eyeing potential in undervalued entities.

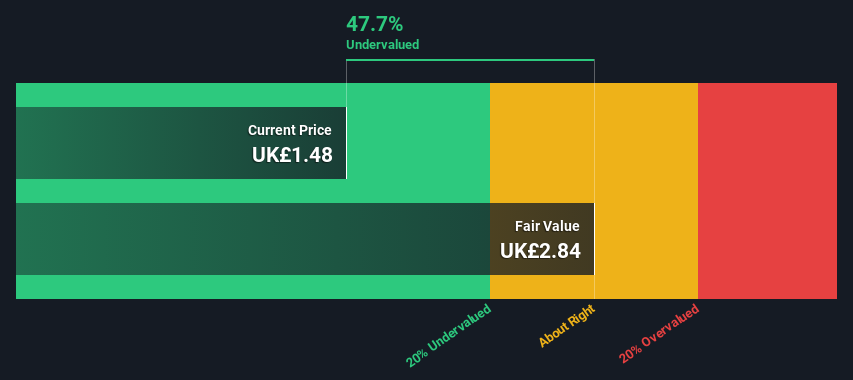

THG

Simply Wall St Value Rating: ★★★★★☆

Overview: THG is a diversified e-commerce company operating in beauty, nutrition, and technology sectors with a market capitalization of approximately £1.08 billion.

Operations: The company's gross profit margin has fluctuated over the years, peaking at 0.46% in 2018 and showing a decline to around 0.42% by the end of 2023. Revenue growth has been substantial, escalating from £184.31 million in 2013 to £2.05 billion by late 2023, despite net income remaining negative in recent periods due to increasing operating expenses and non-operating losses.

PE: -3.7x

Amidst investor activism, THG has been highlighted by Kelso Group as significantly undervalued compared to its market cap, advocating for a strategic shift to unlock value. Despite current unprofitability and reliance on external borrowing, insider confidence is evident as they recently purchased shares, signaling belief in the company's prospects. With anticipated revenue growth between 2% and 5% in H1 2024 and higher in H2 due to new contracts and brand expansions, THG's financial trajectory appears poised for improvement.

Dive into the specifics of THG here with our thorough valuation report.

Gain insights into THG's historical performance by reviewing our past performance report.

Seize The Opportunity

Discover the full array of 33 Undervalued UK Small Caps With Insider Buying right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:AGR LSE:KIE and LSE:THG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance