Exploring Three Undervalued Small Caps In The United Kingdom With Insider Action

As the United Kingdom braces for heightened market volatility ahead of the July 4 election, with recent economic indicators showing a mixed bag of results, investors are closely monitoring small-cap stocks for potential opportunities. In this context, understanding what constitutes a good stock can be crucial, especially when insider actions suggest confidence in the undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.2x | 0.5x | 45.21% | ★★★★★★ |

Ultimate Products | 10.3x | 0.8x | 12.97% | ★★★★★☆ |

Norcros | 7.5x | 0.5x | 44.81% | ★★★★★☆ |

THG | NA | 0.4x | 43.03% | ★★★★★☆ |

Bytes Technology Group | 28.3x | 6.4x | 17.25% | ★★★★☆☆ |

CVS Group | 21.6x | 1.2x | 40.48% | ★★★★☆☆ |

J D Wetherspoon | 21.2x | 0.4x | -57.95% | ★★★★☆☆ |

Savills | 36.6x | 0.7x | 28.30% | ★★★☆☆☆ |

Robert Walters | 20.8x | 0.3x | 37.76% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.7x | 38.65% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

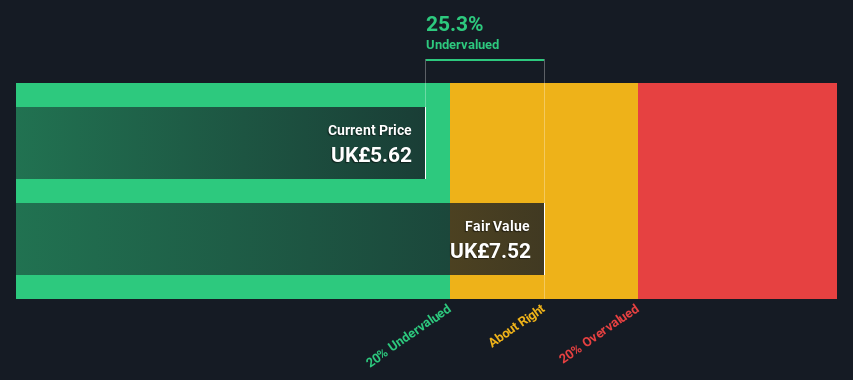

Polar Capital Holdings

Simply Wall St Value Rating: ★★★★★☆

Overview: Polar Capital Holdings is a specialist, investment management company with a market capitalization of approximately £0.56 billion.

Operations: The Investment Management Business generates revenue primarily through management fees, evidenced by a consistent gross profit margin averaging approximately 92.5% over recent periods. Notably, operating expenses have been managed within a range of £90 million to £120 million in the latest fiscal quarters.

PE: 13.7x

Polar Capital Holdings, a distinguished player among UK's smaller companies, recently affirmed its commitment to shareholder returns by maintaining its dividend at 46.0 pence. With a revenue jump to £197.59 million and net income rising to £40.79 million for the fiscal year ending March 2024, their financial health appears robust. Insider confidence is evidenced by recent strategic appointments, enhancing governance and potentially steering future growth. This trajectory is supported by an earnings forecast projecting an annual growth of nearly 12%, positioning Polar Capital as a compelling entity in its sector with promising prospects.

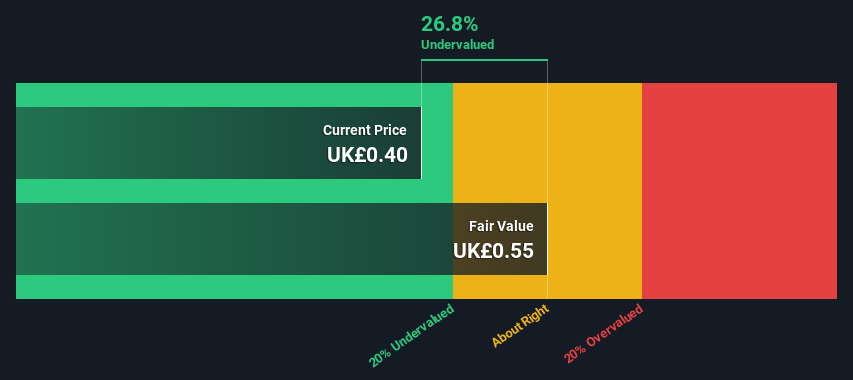

Assura

Simply Wall St Value Rating: ★★★★☆☆

Overview: Assura is a healthcare real estate investment trust specializing in the ownership, operation, and development of primary care facilities across the UK, with a market capitalization of approximately £1.76 billion.

Operations: The business generates revenue primarily through its core operations, with a consistent gross profit margin averaging approximately 92.4% over recent years. Notably, the company has managed to maintain high gross profitability despite fluctuations in net income margins due to varying non-operating expenses.

PE: -41.7x

Recently, Assura has demonstrated notable insider confidence with strategic share purchases, underscoring the belief in its growth prospects. This aligns with their recent formation of a £250 million joint venture aimed at enhancing NHS infrastructure, reflecting a robust commitment to long-term value creation. Despite a challenging year with a net loss reduction to £28.8 million from £119.2 million, the company's revenue growth and forward-looking initiatives like this partnership indicate potential for substantial development in the healthcare sector.

Navigate through the intricacies of Assura with our comprehensive valuation report here.

Assess Assura's past performance with our detailed historical performance reports.

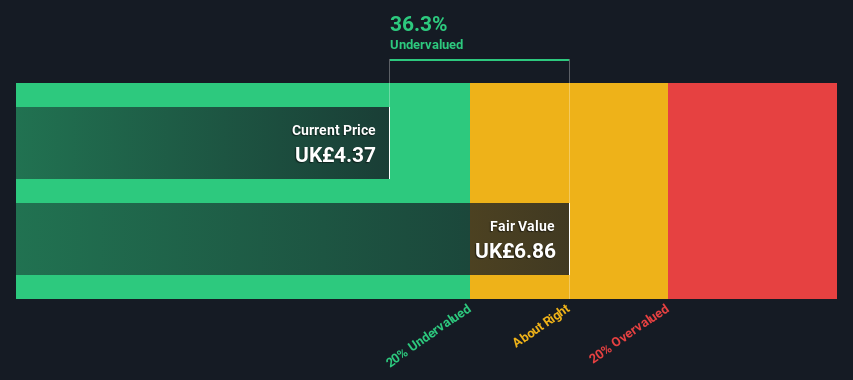

Robert Walters

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Robert Walters is a professional recruitment consultancy operating globally, with a focus on placing candidates in specialist sectors, and has a market capitalization of approximately £407 million.

Operations: Robert Walters and its division, Resource Solutions, generated revenues of £836 million and £228.1 million respectively. The company's gross profit margin has demonstrated a trend of fluctuation, with a notable figure of 36.43% in the most recent period reported.

PE: 20.8x

Recently, insider confidence in Robert Walters has been demonstrated through share purchases, signaling a strong belief in the company's prospects. Despite relying entirely on external borrowing—a higher risk funding method—Robert Walters is poised for growth with earnings expected to rise by 29% annually. However, its profit margins have dipped from 3.6% to 1.3% over the past year. At its latest AGM, a dividend of £0.17 per share was affirmed, reflecting a commitment to shareholder returns amidst challenging conditions.

Click here to discover the nuances of Robert Walters with our detailed analytical valuation report.

Evaluate Robert Walters' historical performance by accessing our past performance report.

Make It Happen

Get an in-depth perspective on all 36 Undervalued Small Caps With Insider Buying by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:POLR LSE:AGR and LSE:RWA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance