Exploring Three TSX Stocks With Intrinsic Value Discounts Ranging From 25.4% To 41.4%

As the Canadian stock market experiences a robust first half of 2024, with solid gains and a positive economic outlook, investors are keenly observing how different sectors are performing. In this environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling, especially in a market that has demonstrated strong historical returns following such promising starts.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

Calibre Mining (TSX:CXB) | CA$1.81 | CA$3.61 | 49.8% |

Trisura Group (TSX:TSU) | CA$41.38 | CA$80.18 | 48.4% |

Kinaxis (TSX:KXS) | CA$161.83 | CA$263.98 | 38.7% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Kraken Robotics (TSXV:PNG) | CA$1.12 | CA$2.21 | 49.2% |

Endeavour Mining (TSX:EDV) | CA$28.94 | CA$52.62 | 45% |

Green Thumb Industries (CNSX:GTII) | CA$15.12 | CA$28.12 | 46.2% |

Jamieson Wellness (TSX:JWEL) | CA$29.30 | CA$49.99 | 41.4% |

Kits Eyecare (TSX:KITS) | CA$8.59 | CA$15.47 | 44.5% |

Capstone Copper (TSX:CS) | CA$9.84 | CA$17.58 | 44% |

We'll examine a selection from our screener results

Africa Oil

Overview: Africa Oil Corp. operates as an oil and gas exploration and production company in Kenya, Nigeria, and South Africa, with a market capitalization of approximately CA$1.08 billion.

Operations: The company generates its revenue through oil and gas exploration and production activities in Kenya, Nigeria, and South Africa.

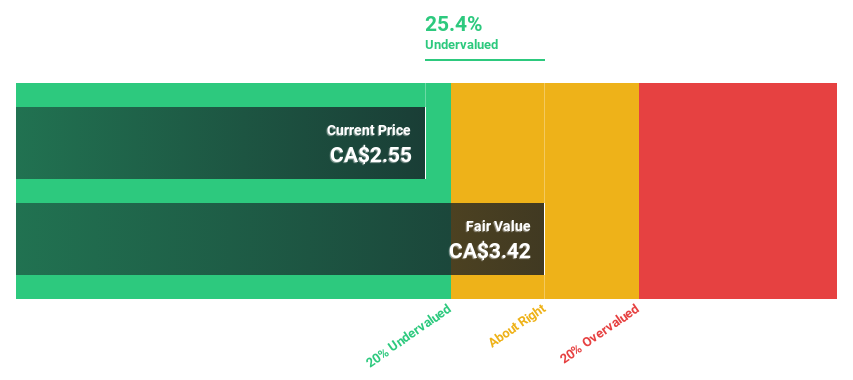

Estimated Discount To Fair Value: 25.4%

Africa Oil, priced at CA$2.55, is currently undervalued by over 20% compared to its estimated fair value of CA$3.42, primarily due to its strong revenue growth forecast of 22% annually—significantly outpacing the Canadian market average of 7.3%. Despite this potential, the company's dividend coverage by cash flows remains weak and its return on equity in three years is expected to be low at 13.8%. Recent corporate activities include a significant share buyback and changes in executive leadership, highlighting active management efforts amid fluctuating earnings and production levels.

Jamieson Wellness

Overview: Jamieson Wellness Inc. operates in the health products industry, focusing on the development, manufacturing, distribution, marketing, and sale of both branded and customer-branded products for humans across Canada, the United States, China, and other international markets with a market cap of approximately CA$1.20 billion.

Operations: The company generates revenue through two primary segments: Jamieson Brands, which brings in CA$558.41 million, and Strategic Partners, contributing CA$109.08 million.

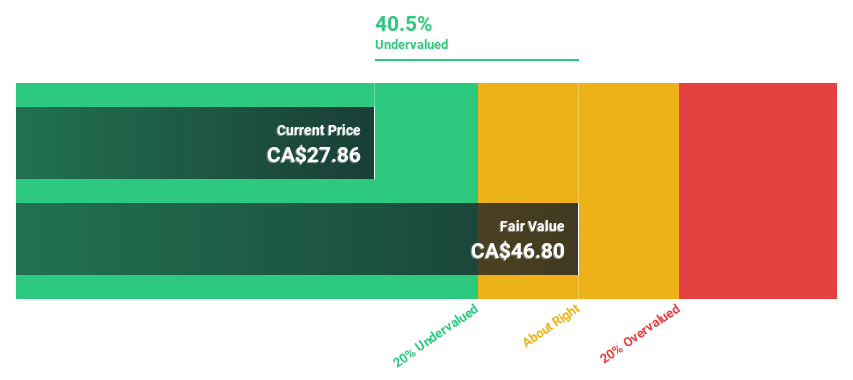

Estimated Discount To Fair Value: 41.4%

Jamieson Wellness, with a current trading price of CA$29.3, is significantly undervalued by over 20%, as its fair value is estimated at CA$49.99. Despite a challenging quarter with sales down and a net loss reported, the company's earnings are expected to grow by 43.1% annually, surpassing the Canadian market average. However, its dividends appear unsustainable due to poor cash flow coverage. The firm maintains positive revenue guidance for 2024 but struggles with debt coverage from operating cash flows.

Kinaxis

Overview: Kinaxis Inc. offers cloud-based subscription software designed to enhance supply chain operations across the United States, Europe, Asia, and Canada, with a market capitalization of approximately CA$4.47 billion.

Operations: The company generates revenue primarily through its software and programming segment, which amounted to $445.21 million.

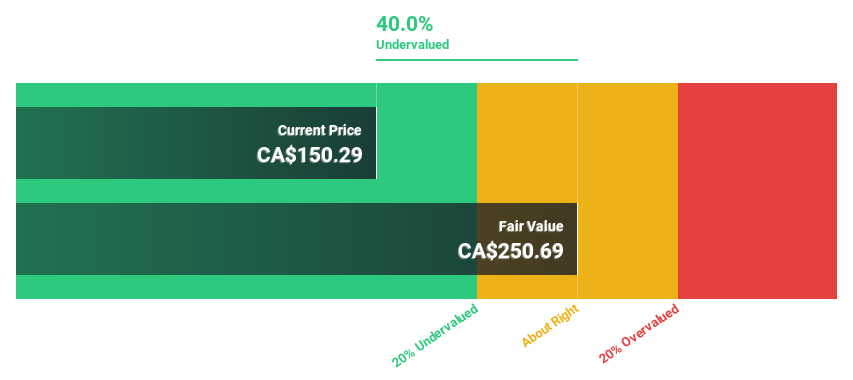

Estimated Discount To Fair Value: 38.7%

Kinaxis, priced at CA$161.83, trades 38.7% below its estimated fair value of CA$263.98, highlighting potential undervaluation based on discounted cash flows. Recent strategic board appointments and the launch of the AI-driven Maestro platform underscore its commitment to innovation in supply chain management. Analysts predict a 20.2% price increase and forecast robust earnings growth at 51.1% annually, outpacing the Canadian market's average significantly, despite notable insider selling in the past quarter which could signal caution.

Taking Advantage

Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 23 more companies for you to explore.Click here to unveil our expertly curated list of 26 Undervalued TSX Stocks Based On Cash Flows.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AOI TSX:JWEL and TSX:KXS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance