Exploring Three Top Dividend Stocks In Japan

Amidst a backdrop of modest weekly losses for Japan's major indices and potential shifts in monetary policy, investors are closely observing the market dynamics. In this context, understanding the characteristics of top dividend stocks becomes crucial, especially in a market where economic indicators and central bank policies may influence investment decisions.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.48% | ★★★★★★ |

Globeride (TSE:7990) | 3.56% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.45% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.51% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.43% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.41% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.80% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.37% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.11% | ★★★★★★ |

Innotech (TSE:9880) | 4.15% | ★★★★★★ |

Click here to see the full list of 328 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Mars Group Holdings

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mars Group Holdings Corporation operates in various sectors including amusement, automatic recognition systems, and hotel and restaurant industries primarily in Japan, with a market capitalization of ¥60.57 billion.

Operations: Mars Group Holdings Corporation generates its revenue primarily from the amusement, automatic recognition systems, and hotel and restaurant sectors.

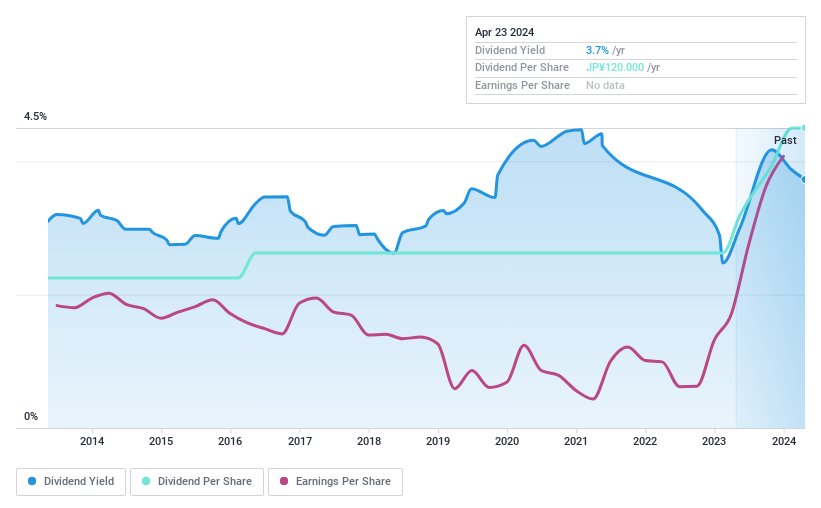

Dividend Yield: 3.6%

Mars Group Holdings offers a solid dividend yield of 3.55%, ranking in the top 25% in the Japanese market. Its dividends are well-supported, with a payout ratio of 21% and cash payout ratio of 66.5%, indicating sustainability from both earnings and cash flow perspectives. The company's earnings have seen significant growth, up by 212.7% over the past year, enhancing its ability to maintain and potentially increase dividends despite some shareholder dilution within the year.

NEW ART HOLDINGS

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NEW ART HOLDINGS Co., Ltd. specializes in the bridal jewelry sector in Japan, with a market capitalization of ¥27.32 billion.

Operations: NEW ART HOLDINGS Co., Ltd. focuses on the bridal jewelry sector in Japan.

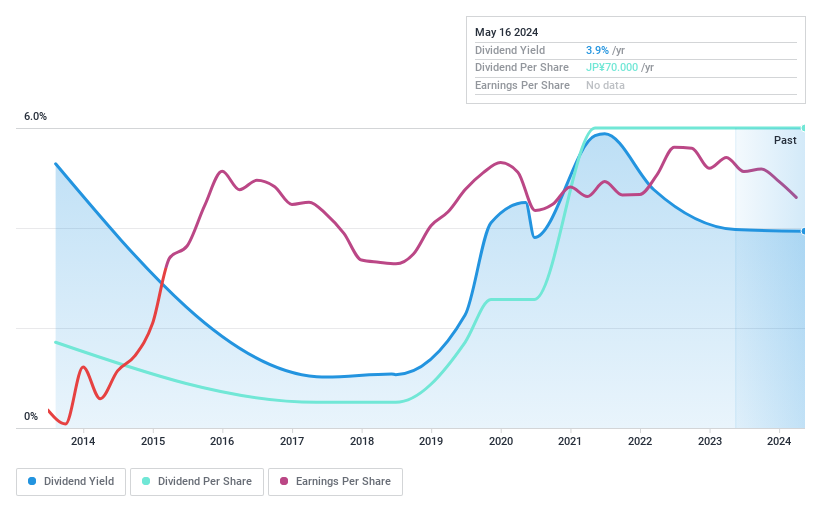

Dividend Yield: 3.9%

NEW ART HOLDINGS offers a dividend yield of 3.94%, placing it among the top 25% in Japan. However, its high cash payout ratio of 312.7% and earnings payout ratio of 80.9% raise concerns about the sustainability of its dividends. The company has maintained stable dividends over the past decade and even increased them, despite a recent decline in profit margins from 8% to 5.1%. Additionally, its financial position is burdened by significant debt levels.

Click to explore a detailed breakdown of our findings in NEW ART HOLDINGS' dividend report.

The valuation report we've compiled suggests that NEW ART HOLDINGS' current price could be inflated.

Credit Saison

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credit Saison Co., Ltd. operates in leasing, finance, real estate, entertainment, and payment services both in Japan and internationally, with a market capitalization of approximately ¥527.88 billion.

Operations: Credit Saison Co., Ltd. engages in diverse sectors, including leasing, finance, real estate, entertainment, and payment solutions across global markets.

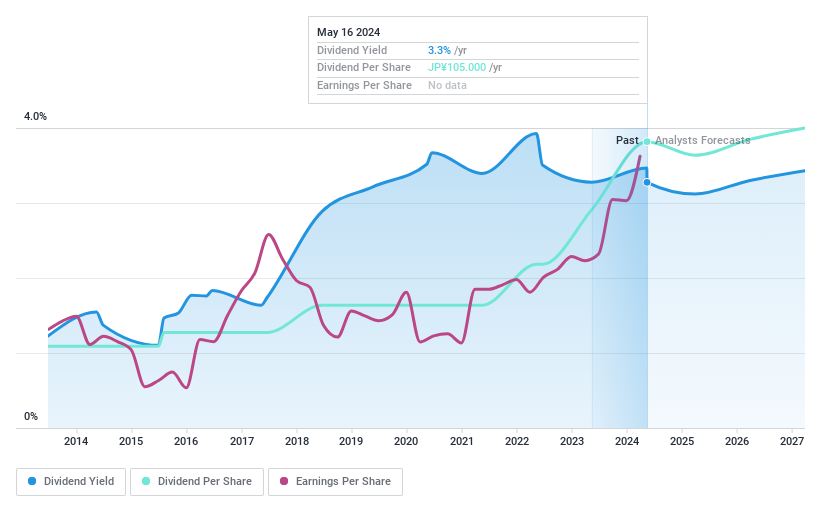

Dividend Yield: 3.3%

Credit Saison's dividend yield of 3.28% ranks well within Japan’s top quartile, and its payments have shown stability and growth over the past decade. However, the dividends are not supported by free cash flow, and earnings are projected to decline by 8.6% annually over the next three years. Recently, Credit Saison announced a significant share buyback program and increased its annual dividend from JPY 70 to JPY 105 per share, indicating a potential focus on shareholder returns despite financial challenges.

Where To Now?

Click this link to deep-dive into the 328 companies within our Top Dividend Stocks screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:6419 TSE:7638 and TSE:8253.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance