Exploring Three Swiss Dividend Stocks With Yields Up To 4.6%

The Switzerland market recently displayed a downturn, influenced by ongoing concerns about U.S. interest rate forecasts, with the benchmark SMI index closing lower. Amid these wider market movements, dividend stocks continue to attract attention as potentially stable investments in fluctuating economic conditions.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Roche Holding (SWX:ROG) | 4.17% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.62% | ★★★★★★ |

Vontobel Holding (SWX:VONN) | 5.48% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.38% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.58% | ★★★★★☆ |

EFG International (SWX:EFGN) | 4.49% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.65% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.66% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 4.89% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

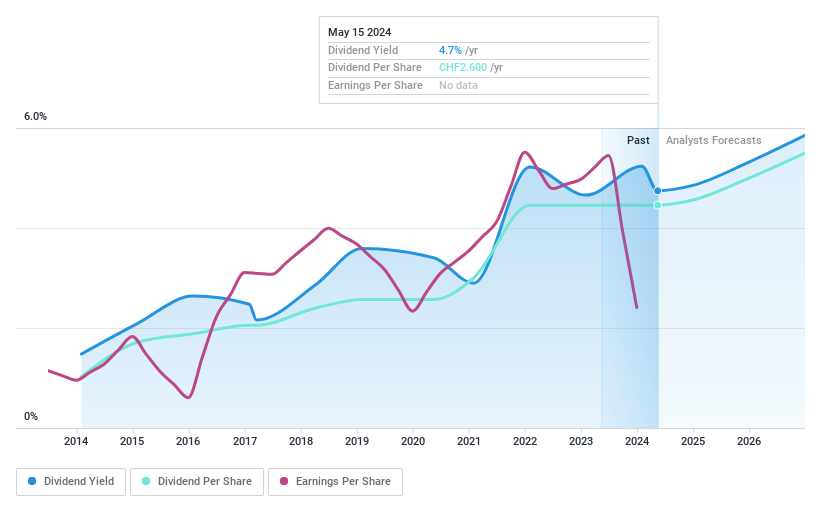

Julius Bär Gruppe

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG is a global wealth management firm operating in Switzerland, Europe, the Americas, and Asia, with a market capitalization of approximately CHF 11.44 billion.

Operations: Julius Bär Gruppe AG generates CHF 3.24 billion from its private banking segment.

Dividend Yield: 4.7%

Julius Bär Gruppe has seen a steady increase in dividend payments over the past decade, maintaining a stable dividend per share. However, the bank faces challenges with a high bad loans ratio at 2% and an insufficient allowance for bad loans at 92%, reflecting potential risk in its loan portfolio. Currently, dividends are not well covered by earnings, with a payout ratio of 117.8%, and profit margins have declined from 24.6% to 14%. Despite these concerns, dividends are expected to be better covered in three years with a forecasted payout ratio of 50.6%. Recent executive changes include appointing Benjamin Sim as group head Greater China Singapore and Malcolm Tay as group head of South-east Asia, indicating strategic regional focus shifts.

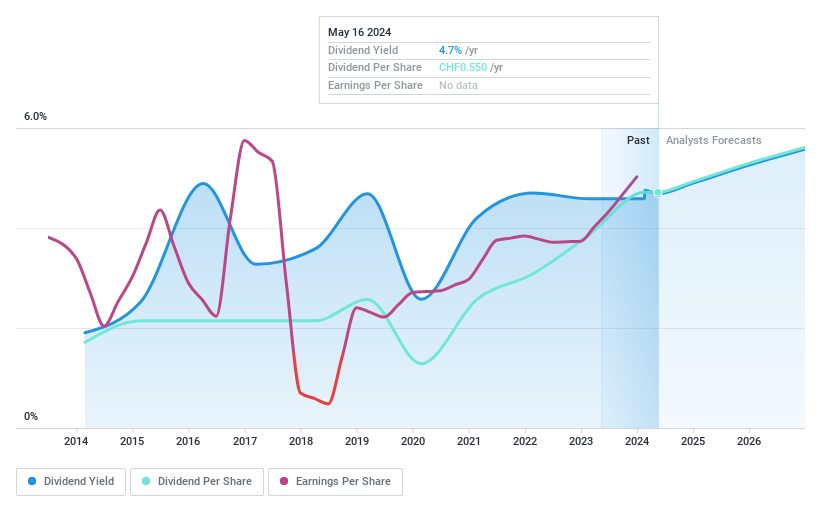

EFG International

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG operates in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 3.69 billion.

Operations: EFG International AG generates revenue through various geographical and functional segments, including CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, CHF 133.20 million from the Americas, and smaller contributions of CHF 122.40 million from Investment and Wealth Solutions and CHF 83 million from Global Markets & Treasury.

Dividend Yield: 4.5%

EFG International offers a dividend yield of 4.49%, ranking in the top 25% of Swiss dividend payers, with a history of increasing dividends over the past decade. Despite this, its dividend track record has been volatile. The company's dividends are currently well-covered by earnings with a payout ratio of 58.5%, and this is expected to continue based on three-year forecasts. However, concerns arise from its high bad loans ratio at 2.5% and inconsistent earnings growth, with only a modest forecasted annual increase of 3.78%. Recently, EFG extended its buyback plan until July 2024, potentially supporting shareholder returns amidst these challenges.

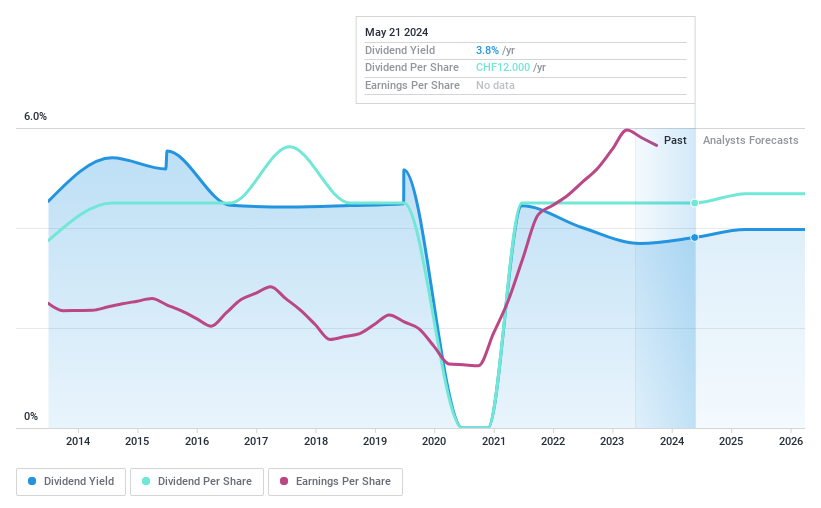

Carlo Gavazzi Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carlo Gavazzi Holding AG specializes in designing, manufacturing, and selling electronic control components for the building and industrial automation markets, with a market capitalization of approximately CHF 219.61 million.

Operations: Carlo Gavazzi Holding AG generates its revenue by designing, manufacturing, and marketing electronic control components specifically for the building and industrial automation sectors.

Dividend Yield: 3.9%

Carlo Gavazzi Holding exhibits a stable dividend coverage with a payout ratio of 31.8% and cash payout ratio of 47.6%, ensuring dividends are well-supported by both earnings and cash flows. Over the last decade, dividends have increased, though the yield of 3.88% trails behind Switzerland's top dividend payers at 4.1%. Despite trading below its estimated fair value by 25.6%, investors should note the company's history of unstable and unreliable dividend payments marked by significant fluctuations over the past ten years.

Taking Advantage

Delve into our full catalog of 27 Top Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BAER SWX:EFGN and SWX:GAV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance