Exploring Three Prominent Dividend Stocks In June 2024

The United States stock market has experienced a robust increase, rising 23% over the last 12 months with earnings projected to grow by 15% annually. In such a thriving environment, dividend stocks that consistently deliver returns can be particularly appealing to investors looking for steady income in addition to growth potential.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.72% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.96% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.84% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.13% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.93% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.83% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.88% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.76% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.86% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.96% | ★★★★★☆ |

Click here to see the full list of 214 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Citizens Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Citizens Financial Services, Inc., a bank holding company, offers a range of banking products and services to individual, business, governmental, and institutional clients with a market capitalization of approximately $206.87 million.

Operations: Citizens Financial Services, Inc. generates its revenue primarily through community banking, contributing $91.23 million.

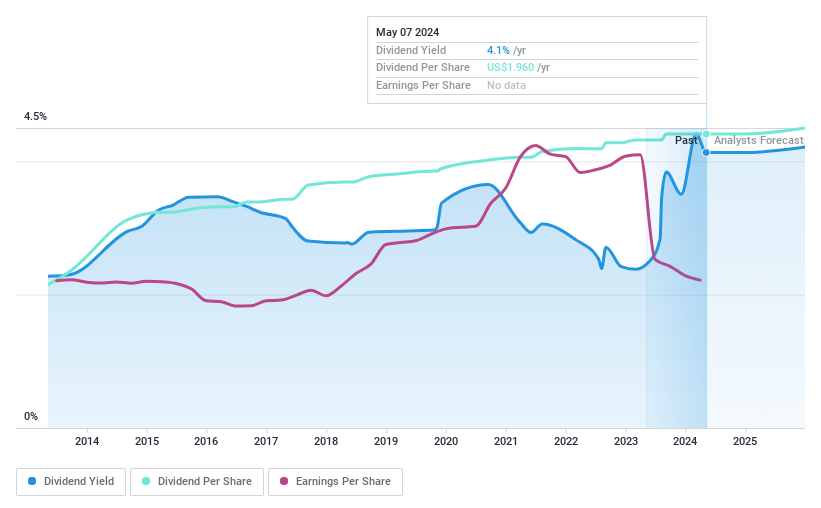

Dividend Yield: 4.4%

Citizens Financial Services has maintained a consistent dividend yield of 4.41%, supported by a payout ratio of 49.5%, indicating that its dividends are well-covered by earnings. Despite trading at 62.5% below estimated fair value and experiencing shareholder dilution over the past year, the company has demonstrated reliable and growing dividend payments for the past decade. However, it faces challenges with decreased profit margins from 35.6% to 19.7% year-over-year and significant one-off items affecting financial results, casting some concerns on future earnings stability.

Union Bankshares

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Union Bankshares, Inc. serves as the bank holding company for Union Bank, offering a range of retail, commercial, and municipal banking products and services in northern Vermont and New Hampshire, with a market capitalization of approximately $103.49 million.

Operations: Union Bankshares, Inc. generates its revenue primarily through its Community Bank segment, which contributed $47.75 million.

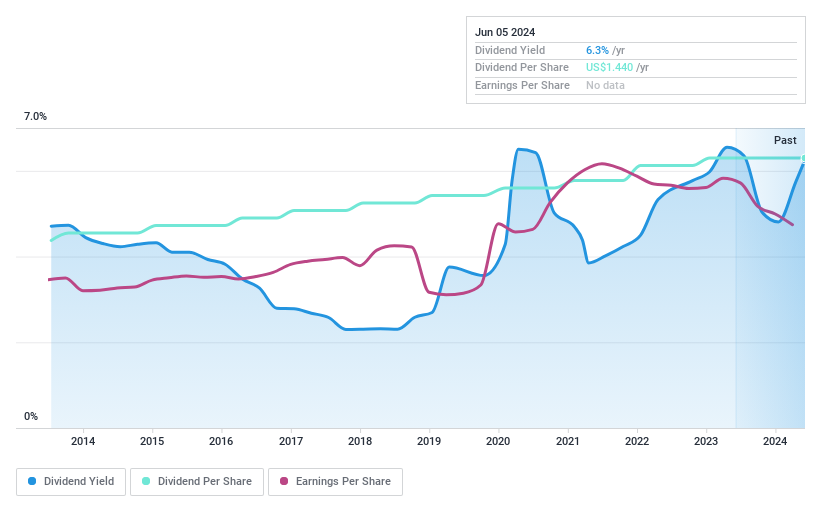

Dividend Yield: 6.3%

Union Bankshares has declared a consistent quarterly dividend of US$0.36 per share, reflecting its commitment to returning value to shareholders. Despite a decrease in net interest income and net income in the first quarter of 2024, the company maintains a high dividend yield of 6.26%, which is above average in the U.S. market. While its dividends have shown growth over the past decade, recent earnings reports suggest caution, with earnings not fully covering dividend payouts. The stock trades at 52.7% below its estimated fair value, potentially offering an attractive entry point for investors focused on income generation through dividends.

Click here to discover the nuances of Union Bankshares with our detailed analytical dividend report.

Cohen & Steers

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cohen & Steers, Inc. is a publicly owned asset management holding company with a market capitalization of approximately $3.55 billion.

Operations: Cohen & Steers, Inc. generates its revenue primarily through asset management, contributing approximately $486.27 million.

Dividend Yield: 3.3%

Cohen & Steers has experienced a mixed performance in terms of dividend reliability, with a history of both increases and volatility over the past decade. Recently, the company declared a quarterly dividend of US$0.59 per share, payable on May 23, 2024. Despite this regular payout, its dividend yield stands at 3.34%, which is below the top quartile of U.S. dividend payers at 4.73%. The dividends are currently well-covered by earnings and cash flows with both ratios just under 89%. However, significant insider selling in the last three months could signal caution among investors about the company's future prospects.

Next Steps

Explore the 214 names from our Top Dividend Stocks screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:CZFS NasdaqGM:UNB and NYSE:CNS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance