Exploring Three Prominent Dividend Stocks In The United Kingdom

The United Kingdom's financial markets, particularly the FTSE 100, are currently navigating a challenging period marked by consecutive days of losses, reflecting broader global economic pressures and uncertainties. In such a volatile environment, dividend stocks can be appealing for their potential to offer investors steady income streams and relative stability.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.22% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.35% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.26% | ★★★★★☆ |

DCC (LSE:DCC) | 3.47% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.09% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.69% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.67% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.06% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.92% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.43% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Arbuthnot Banking Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arbuthnot Banking Group PLC, operating primarily in the United Kingdom, offers a range of private and commercial banking products and services with a market capitalization of approximately £154.30 million.

Operations: Arbuthnot Banking Group's revenue is generated through various segments, including Wealth Management (£11.33 million), ALL Other Divisions (£15.01 million), Mortgage Portfolios (£3.42 million), Asset Alliance Group (AAG) (£11.90 million), Renaissance Asset Finance (RAF) (£7.10 million), Banking excluding Wealth Management (£115.52 million), Arbuthot Specialist Finance Limited (ASFL) (£0.81 million), and Arbuthnot Commercial Asset Based Lending (ACABL) (£15.32 million).

Dividend Yield: 4.9%

Arbuthnot Banking Group PLC has demonstrated a significant increase in net income, rising to £35.38 million in 2023 from £16.46 million the previous year, supporting a higher dividend payout of 46 pence per share compared to 42 pence in 2022. Despite this growth, the company's dividend history remains volatile and unreliable over the past decade. The low price-to-earnings ratio at 4.4x suggests good value relative to peers, but concerns persist with a high level of bad loans at 3.8%. Dividends are well-covered by earnings with a payout ratio of only 20.6%, though its yield is below the top UK dividend payers at just under 5%.

London Security

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc is an investment holding company that manufactures, sells, and rents fire protection equipment across several European countries, with a market capitalization of approximately £373.93 million.

Operations: London Security plc generates £219.71 million in revenue from the provision and maintenance of fire protection and security equipment.

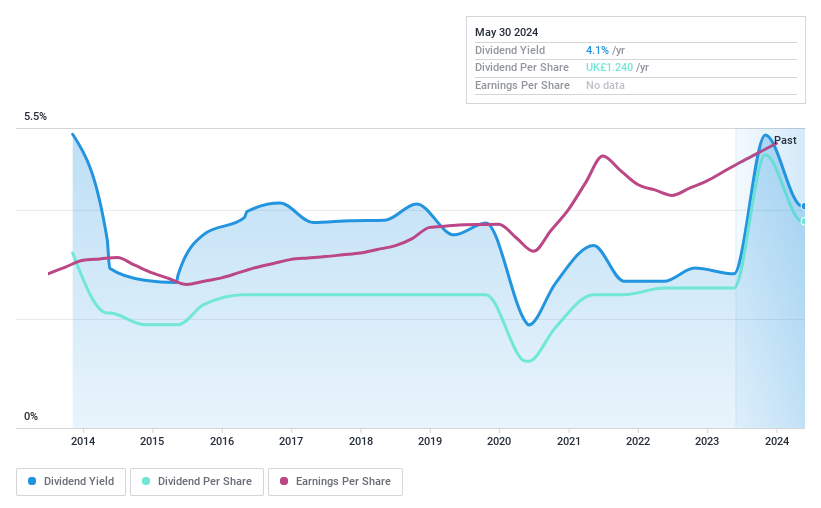

Dividend Yield: 4.1%

London Security's dividend history shows inconsistency with volatile payments over the past decade, despite a recent affirmation to maintain its final dividend at £0.42 per share for 2023. While dividends are supported by both earnings and cash flows, with payout ratios of 65.3% and 79.8% respectively, the yield of 4.07% remains below the top quartile in the UK market at 5.68%. Additionally, earnings have grown by 15.2% over the past year, and its price-to-earnings ratio stands favorable at 16.1x compared to the UK market average of 17.2x.

Get an in-depth perspective on London Security's performance by reading our dividend report here.

Our valuation report here indicates London Security may be overvalued.

ME Group International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc is a company based in the United Kingdom that operates, sells, and services a variety of instant-service equipment, with a market capitalization of approximately £0.64 billion.

Operations: ME Group International plc generates revenue primarily from its Personal Services segment, totaling £297.66 million.

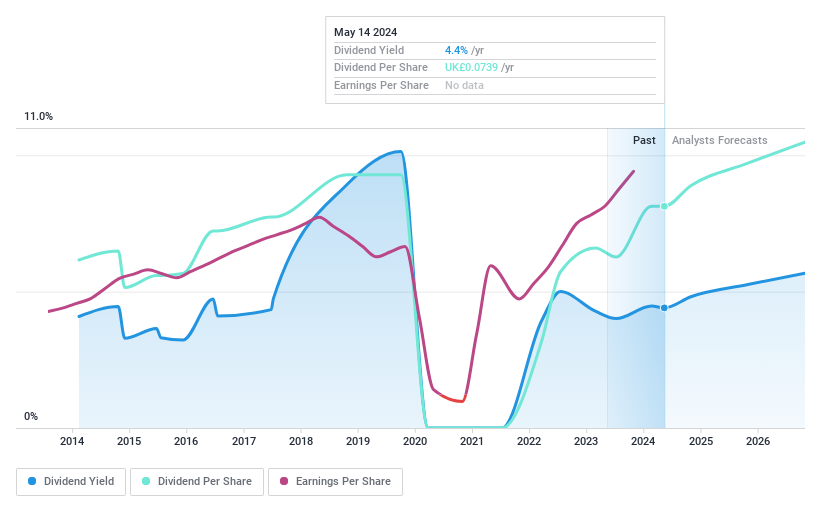

Dividend Yield: 4.3%

ME Group International plc recently increased its dividend to 4.42 pence per share, payable on 23 May 2024, reflecting a commitment to shareholder returns despite a history of unstable dividends over the past decade. Trading at 59.3% below estimated fair value and with earnings forecasted to grow by 6.72% annually, the company shows potential for value appreciation. However, its current dividend yield of 4.35% lags behind the UK market's top quartile average of 5.68%. Dividends are reasonably covered by earnings and cash flows, with payout ratios at 55.2% and cash payout ratio at 82.6%, respectively.

Key Takeaways

Navigate through the entire inventory of 56 Top Dividend Stocks here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:ARBB AIM:LSC and LSE:MEGP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance