Exploring Three Leading Growth Companies With Significant Insider Ownership

As global markets experience mixed signals, with some regions showing growth and others grappling with economic challenges, investors are continually seeking stable investment opportunities. In this context, companies with significant insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Gaming Innovation Group (OB:GIG) | 13.5% | 36.2% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

Let's dive into some prime choices out of from the screener.

Unisem (M) Berhad

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Unisem (M) Berhad, together with its subsidiaries, offers semiconductor assembly and test services across Asia, Europe, and the United States, with a market capitalization of MYR 6.73 billion.

Operations: The company generates MYR 1.45 billion from the manufacturing of semiconductor devices and related services.

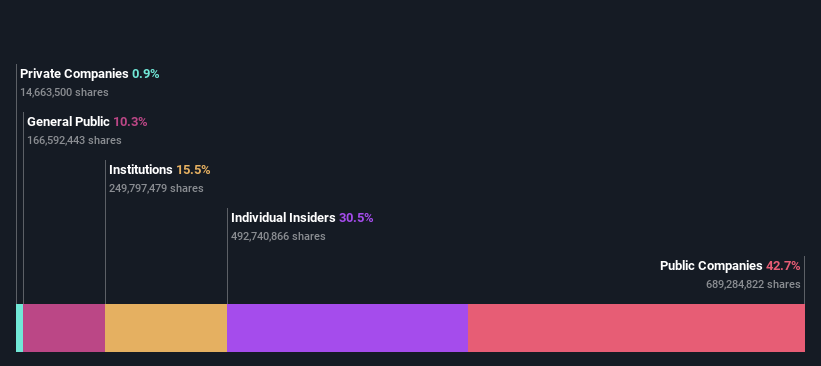

Insider Ownership: 30.5%

Earnings Growth Forecast: 32.9% p.a.

Unisem (M) Berhad, a company with high insider ownership, is poised for notable growth with earnings expected to increase by 32.95% annually, outpacing the Malaysian market's 12.3%. Despite this robust profit outlook, its dividend sustainability is under scrutiny as the current yield of 1.88% is poorly covered by both earnings and cash flows. Recent financial performance reveals a slight dip in net income and EPS in Q1 2024 compared to the previous year, alongside a modest revenue growth from MYR 354.05 million to MYR 364.77 million.

Click to explore a detailed breakdown of our findings in Unisem (M) Berhad's earnings growth report.

Our expertly prepared valuation report Unisem (M) Berhad implies its share price may be too high.

Crystal Growth & Energy EquipmentLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crystal Growth & Energy Equipment Ltd, operating under the ticker SHSE:688478, specializes in the production of energy equipment with a market capitalization of approximately CN¥4.04 billion.

Operations: The company generates its revenue from the production of energy equipment.

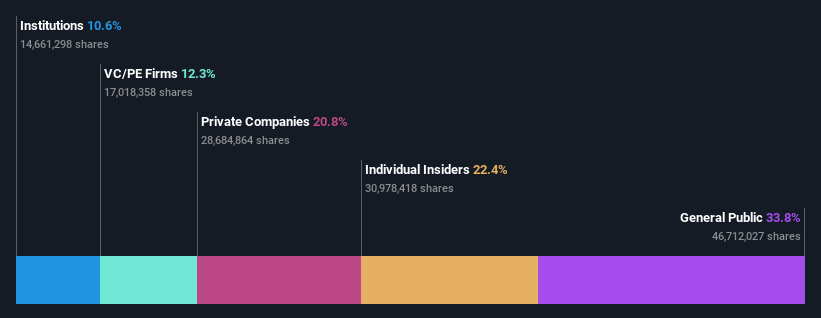

Insider Ownership: 22.4%

Earnings Growth Forecast: 27.2% p.a.

Crystal Growth & Energy Equipment Ltd. has demonstrated strong growth, with earnings up by 134.3% over the past year and revenue forecasted to increase at 32.7% annually, significantly outpacing the CN market's 13.8%. Despite these gains, its return on equity is expected to remain low at 9.5% in three years, and its dividend coverage is weak due to inadequate cash flow support. Recent significant events include a substantial first-quarter earnings improvement and inclusion in major Shanghai Stock Exchange indices.

Bona Film Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is a company based in China, primarily focused on film production and distribution, with a market capitalization of approximately CN¥7.62 billion.

Operations: The company operates primarily in the film production and distribution sector.

Insider Ownership: 21.8%

Earnings Growth Forecast: 78.8% p.a.

Bona Film Group is poised for notable growth, with revenue expected to increase by 30.4% annually, significantly surpassing the Chinese market's forecast of 13.8%. This growth trajectory is supported by a recent expansion in its partnership with IMAX, set to enhance its cinema experience offerings across China. However, the company's return on equity is projected to be modest at 7.1% in three years, despite turning profitable within the same timeframe and showing strong earnings growth at an annual rate of 78.84%.

Next Steps

Get an in-depth perspective on all 1471 Fast Growing Companies With High Insider Ownership by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KLSE:UNISEM SHSE:688478 and SZSE:001330.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance