Exploring Three Japanese Growth Companies With High Insider Ownership On The Tokyo Stock Exchange

Amidst a backdrop of modest weekly declines in Japan's major indices and ongoing discussions around potential interest rate adjustments by the Bank of Japan, investors remain attuned to shifts within the Tokyo Stock Exchange. In such an environment, examining growth companies with high insider ownership could provide valuable insights, as these firms often demonstrate alignment between management’s interests and those of shareholders, potentially fostering greater resilience and long-term strategic focus under uncertain economic conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.5% | 27.2% |

Medley (TSE:4480) | 34.1% | 28.4% |

Hottolink (TSE:3680) | 27% | 57.3% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

Micronics Japan (TSE:6871) | 15.3% | 37.4% |

ExaWizards (TSE:4259) | 24.8% | 84.3% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 78.4% |

CYBERDYNE (TSE:7779) | 38.9% | 72.3% |

We're going to check out a few of the best picks from our screener tool.

Lifedrink Company

Simply Wall St Growth Rating: ★★★★☆☆

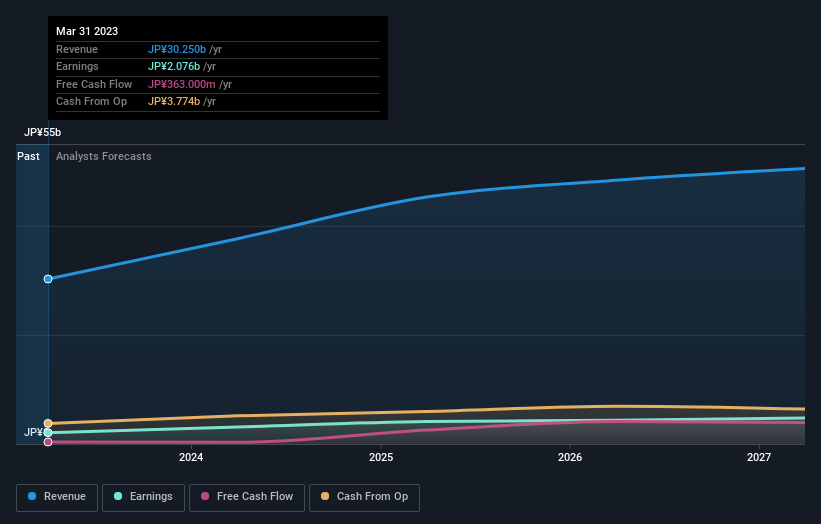

Overview: Lifedrink Company, Inc. is a Japanese beverage manufacturer with a market capitalization of approximately ¥75.60 billion.

Operations: The company generates revenue primarily through its Drinks and Leaf Tea segment, which posted earnings of ¥30.25 billion.

Insider Ownership: 16.8%

Earnings Growth Forecast: 16.1% p.a.

Lifedrink Company, a growth-oriented firm in Japan with high insider ownership, is expected to see its revenue grow by 11.3% annually, outpacing the Japanese market average of 4.4%. Earnings are also set to increase by 16.12% per year, which is higher than the market's 9.2%. Despite these positive growth indicators, the company carries a high level of debt and experiences significant share price volatility. However, it is currently trading at an attractive valuation, being 18% below estimated fair value.

Click to explore a detailed breakdown of our findings in Lifedrink Company's earnings growth report.

Kusuri No Aoki Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kusuri No Aoki Holdings Co., Ltd. operates primarily in Japan, focusing on the retail of pharmaceuticals, cosmetics, and daily goods with a market capitalization of approximately ¥280.29 billion.

Operations: The company primarily generates its revenue from the retail sale of pharmaceuticals, cosmetics, and daily goods in Japan.

Insider Ownership: 28.9%

Earnings Growth Forecast: 21.8% p.a.

Kusuri No Aoki Holdings, a Japanese growth company with high insider ownership, is projected to experience a robust earnings growth of 21.8% annually, significantly outpacing the broader market's 9.2%. Despite this strong growth forecast, its revenue increase is more modest at 7% per year and profit margins have declined from last year. The stock is currently considered undervalued, trading 22.6% below its estimated fair value with expectations of a price increase by 22.3%.

Japan Electronic Materials

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Electronic Materials Corporation, with a market capitalization of ¥43.25 billion, specializes in the production and distribution of probe cards and electron tube parts both domestically and globally.

Operations: The company specializes in the production and distribution of probe cards and electron tube parts, serving markets both in Japan and internationally.

Insider Ownership: 15%

Earnings Growth Forecast: 34.4% p.a.

Japan Electronic Materials, amidst a volatile share price, is forecasted to see its earnings surge by 34.36% annually, outstripping Japan's market growth significantly. However, its revenue growth at 7.7% per year, while above the national average of 4.4%, does not reach the high-growth benchmark of 20%. Additionally, profit margins have decreased from last year’s 12.1% to a current 4.7%, indicating potential efficiency or cost management issues despite strong insider ownership and earnings potential.

Dive into the specifics of Japan Electronic Materials here with our thorough growth forecast report.

Seize The Opportunity

Gain an insight into the universe of 103 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2585 TSE:3549 and TSE:6855.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance