Exploring Three Japanese Growth Companies With High Insider Ownership On The Tokyo Stock Exchange

Japan's stock markets have shown a mix of dynamics recently, with the Nikkei 225 Index experiencing a slight decline while the broader TOPIX Index recorded gains. This mixed performance comes amid ongoing discussions about monetary policy adjustments by the Bank of Japan, which continues to shape investor sentiment. In such an environment, exploring growth companies with high insider ownership could provide interesting insights, as these firms often demonstrate alignment between management and shareholder interests, potentially leading to prudent long-term decision-making in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.6% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 82.6% |

Let's uncover some gems from our specialized screener.

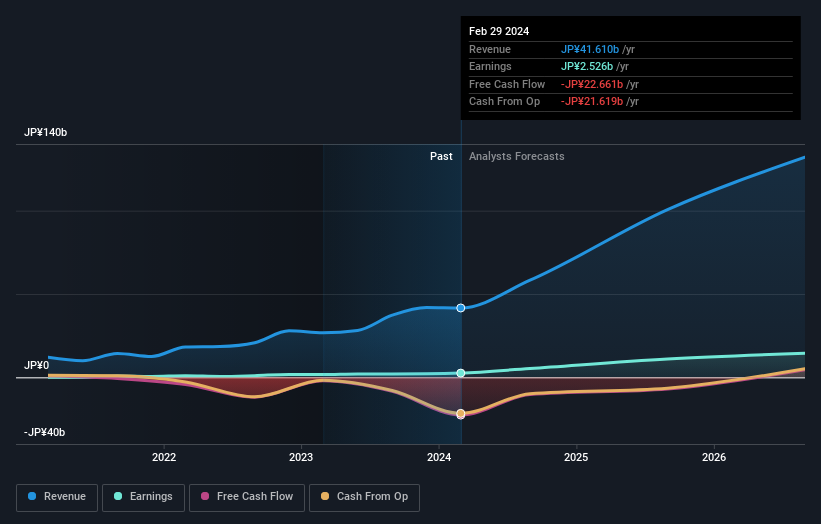

Kasumigaseki CapitalLtd

Simply Wall St Growth Rating: ★★★★★★

Overview: Kasumigaseki Capital Ltd, operating in Japan, specializes in real estate consulting with a market capitalization of approximately ¥150.08 billion.

Operations: The firm operates primarily in real estate consulting in Japan.

Insider Ownership: 34.8%

Return On Equity Forecast: 37% (2027 estimate)

Kasumigaseki CapitalLtd, while trading at 38.8% below its estimated fair value, shows promising growth prospects with earnings forecasted to increase by 44.65% annually and revenue growth expected at 33.7% per year, significantly outpacing the Japanese market average. Despite high volatility in its share price and recent shareholder dilution, the company benefits from strong insider ownership and is projected to achieve a robust Return on Equity of 36.7%. However, its debt levels are concerning as they are not well covered by operating cash flow.

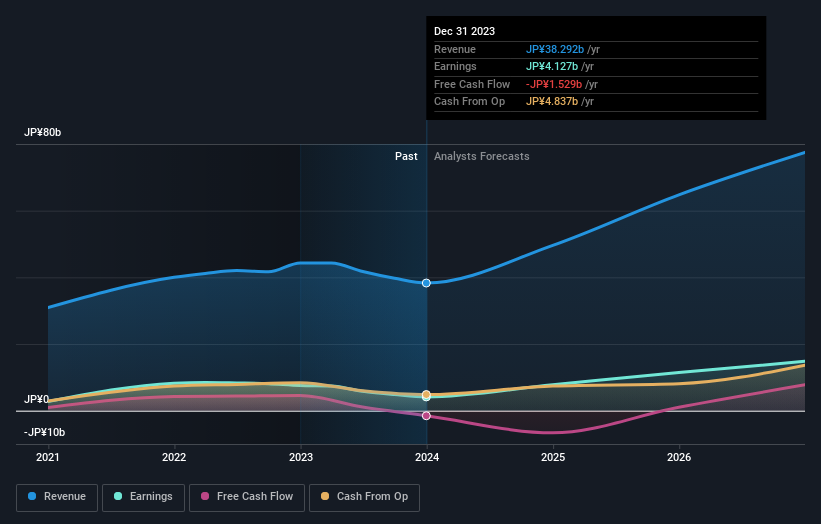

Micronics Japan

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. specializes in developing, manufacturing, and selling testing and measurement equipment for semiconductors and LCD systems globally, with a market capitalization of approximately ¥224.54 billion.

Operations: The company's revenue is primarily derived from the sale of semiconductor and LCD testing and measurement equipment.

Insider Ownership: 15.3%

Return On Equity Forecast: 26% (2027 estimate)

Micronics Japan is poised for notable growth, with earnings expected to surge by 39.73% annually, outstripping the Japanese market's average. Its revenue growth forecast at 23.3% per year also exceeds the market norm significantly. Despite trading at a substantial 42.4% below its estimated fair value and experiencing high share price volatility, the company maintains a solid projected Return on Equity of 26.5%. However, it faces challenges with declining profit margins from 16.7% to 10.6% over the past year.

The valuation report we've compiled suggests that Micronics Japan's current price could be inflated.

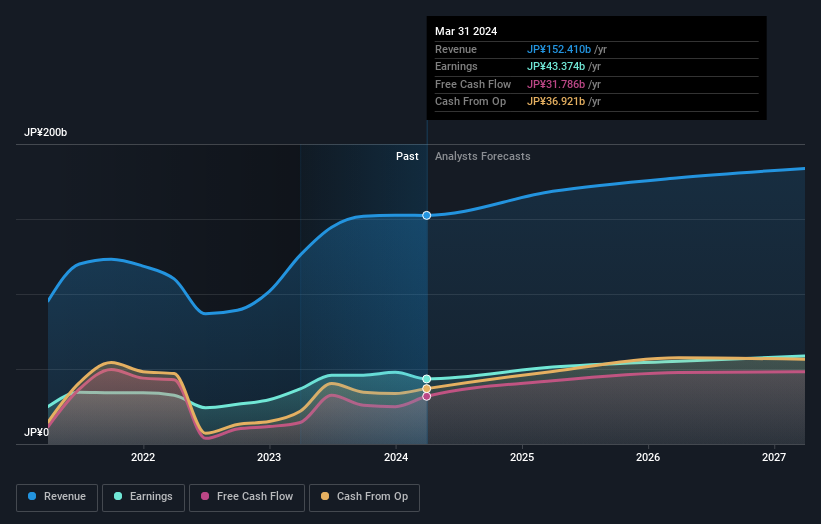

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company based in Japan that specializes in the planning, development, manufacturing, selling, and distribution of home video games, online games, mobile games, and arcade games with a market cap of approximately ¥1.26 trillion.

Operations: The company generates revenue through the sale and distribution of video games for home use, online platforms, mobile devices, and arcades both domestically and internationally.

Insider Ownership: 11.5%

Return On Equity Forecast: 21% (2027 estimate)

Capcom, a growth-oriented company in Japan, shows promising financial trends with earnings having increased by 18.1% over the past year. Its revenue is expected to grow at 5.8% annually, slightly above the Japanese market average of 4%. While this growth rate does not reach the high threshold of 20%, Capcom's projected Return on Equity stands strong at 20.7%. Despite lacking recent insider transactions, these indicators suggest a robust potential for sustained profitability and shareholder value enhancement.

Next Steps

Unlock our comprehensive list of 105 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3498 TSE:6871 and TSE:9697.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance