Exploring Three Japanese Dividend Stocks In May 2024

As of May 2024, Japanese equities have shown resilience, with the Nikkei 225 Index gaining 1.5% despite economic challenges and a range-bound yen influenced by global interest rate dynamics. This backdrop sets an interesting stage for investors considering dividend stocks in Japan, where stability and consistent returns become particularly appealing in uncertain economic times.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.48% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.42% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.56% | ★★★★★★ |

Nihon Parkerizing (TSE:4095) | 3.33% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 3.49% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.45% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.44% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.38% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.13% | ★★★★★★ |

Innotech (TSE:9880) | 4.00% | ★★★★★★ |

Click here to see the full list of 363 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

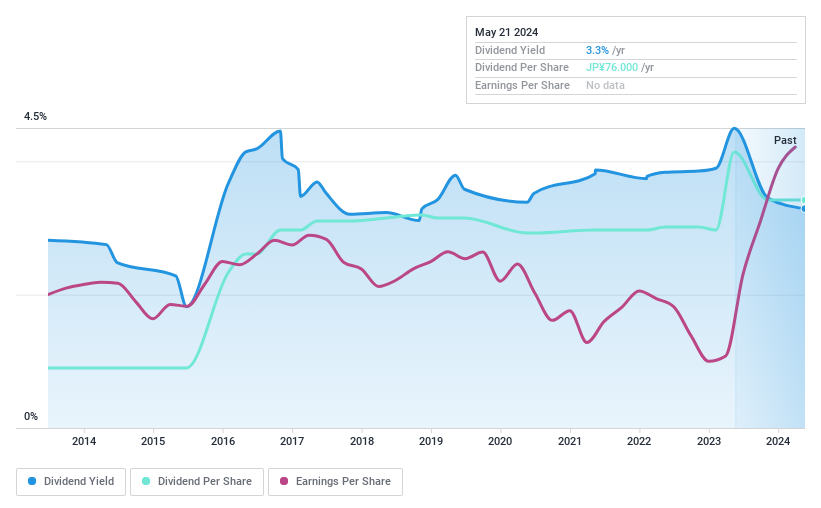

WELLNEO SUGAR

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WELLNEO SUGAR Co., Ltd. is a company based in Japan that focuses on manufacturing and selling sugar along with other food products, with a market capitalization of approximately ¥75.69 billion.

Operations: WELLNEO SUGAR Co., Ltd. generates its revenue primarily through the production and sales of sugar and various food products within Japan.

Dividend Yield: 3.3%

WELLNEO SUGAR's dividend yield of 3.29% is slightly below the top quartile in Japan's market, yet its dividends have shown growth over the past decade. The company recently proposed a significant year-end dividend increase to JPY 56.00 per share from JPY 30.00 last year, reflecting confidence in its financial health. Although WELLNEO SUGAR has experienced volatility in its dividend payments historically, current dividends are comfortably covered by both earnings and cash flows with payout ratios of 48.9% and 50.2%, respectively.

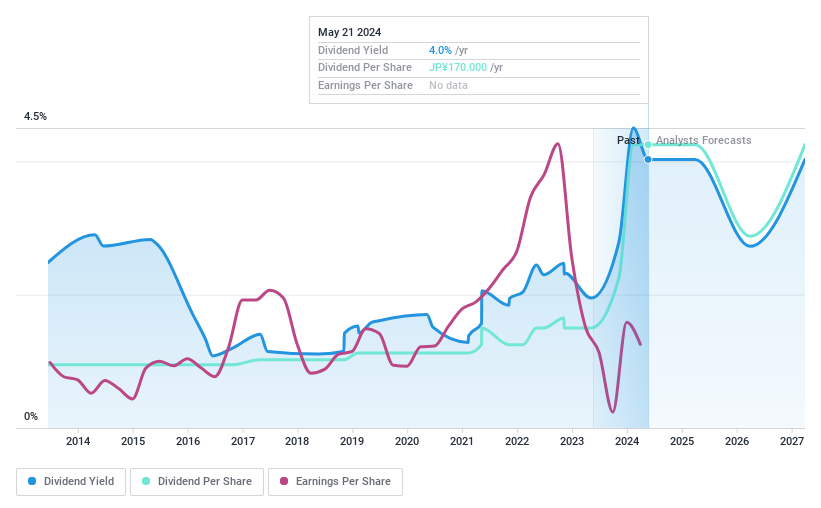

Stella Chemifa

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stella Chemifa Corporation, engaged in the manufacturing and selling of inorganic fluorine compounds both domestically and globally, has a market capitalization of ¥50.76 billion.

Operations: Stella Chemifa Corporation generates its revenue through the production and international sale of inorganic fluorine compounds.

Dividend Yield: 4%

Stella Chemifa offers a dividend yield of 4.03%, ranking in the top 25% in Japan, despite its dividends being poorly covered by cash flows with a high cash payout ratio of 244%. The company trades at a 31% discount to estimated fair value but faces challenges with unreliable and volatile dividend payments over the past decade. Recent guidance for FY ending March 2025 projects significant earnings growth, yet historical payment patterns may concern conservative investors seeking stable returns.

Dive into the specifics of Stella Chemifa here with our thorough dividend report.

Our expertly prepared valuation report Stella Chemifa implies its share price may be too high.

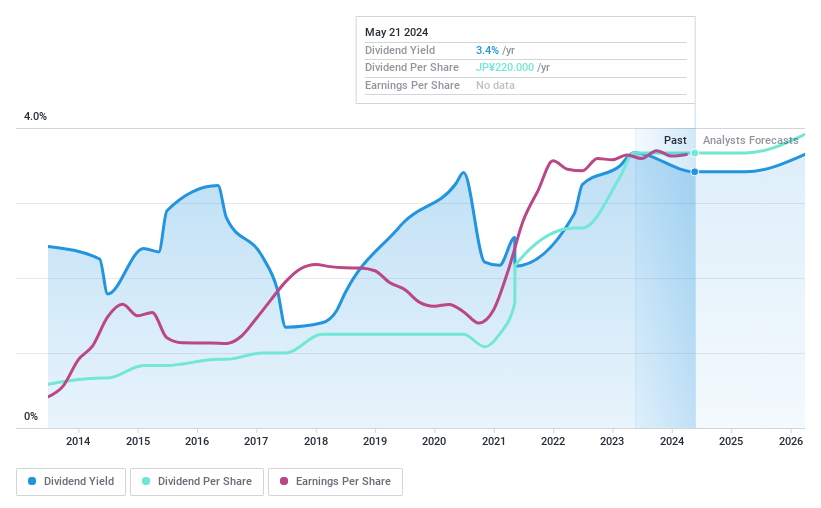

Shibaura ElectronicsLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Electronics Co., Ltd. specializes in manufacturing and selling thermistor elements and related products in Japan, with a market capitalization of approximately ¥49.14 billion.

Operations: Shibaura Electronics Co., Ltd. generates its revenue primarily from the production and sale of thermistor elements and related products within Japan.

Dividend Yield: 3.4%

Shibaura Electronics Co., Ltd. has a dividend yield of 3.42%, placing it among the top 25% of Japanese dividend payers. The dividends are well-supported with a payout ratio and cash payout ratio at 40.1% and 39.2%, respectively, indicating stability from earnings and cash flows despite a decade of fluctuating payments. Recently, the company initiated a share buyback program valued at ¥1 billion, aiming to enhance capital efficiency by repurchasing up to 100,000 shares by November 2024.

Key Takeaways

Get an in-depth perspective on all 363 Top Dividend Stocks by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2117 TSE:4109 and TSE:6957.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance