Exploring Three Growth Companies Where Insiders Hold Significant Stakes

As global markets exhibit mixed signals with record highs in major indices and concerns about economic slowdowns, investors continue to navigate through a landscape of uncertainty and opportunity. In such times, growth companies where insiders hold significant stakes can be particularly intriguing, as high insider ownership often reflects leadership's confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Gaming Innovation Group (OB:GIG) | 13.4% | 36.2% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Let's uncover some gems from our specialized screener.

RWS Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £748.44 million.

Operations: The firm operates primarily in technology-driven language, content management, and intellectual property services.

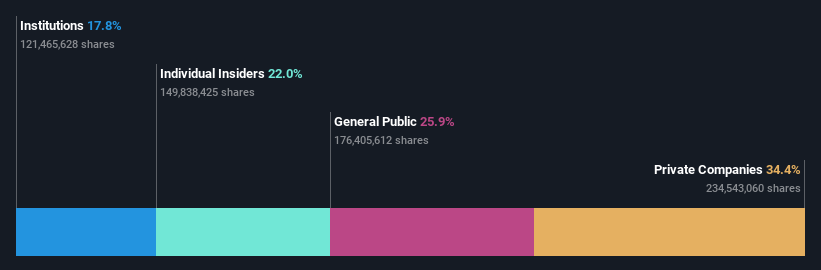

Insider Ownership: 24.6%

RWS Holdings, despite a recent dip in sales to £350.3 million and net income to £11.1 million for the half-year ending March 2024, continues to innovate with the launch of HAI, a secure AI-driven translation platform. This move aligns with its strategy to enhance digital customer experiences globally. However, concerns linger as its dividend coverage by earnings remains weak and insider trading activity has been negligible over the past three months. The company is expected to become profitable within three years, though its revenue growth forecast (4.2% per year) lags behind some market expectations.

Qi An Xin Technology Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and other institutions globally, with a market capitalization of approximately CN¥17.65 billion.

Operations: The company generates revenue primarily from the information security industry, totaling CN¥6.22 billion.

Insider Ownership: 22%

Qi An Xin Technology Group, a growth-focused firm with high insider ownership, reported a decline in Q1 2024 revenue to CNY 704.75 million from CNY 925.07 million year-over-year, alongside a reduced net loss of CNY 480.28 million. Despite recent financial setbacks, the company's earnings are projected to grow by a very large rate annually over the next three years, outpacing the Chinese market average growth rates in both revenue and earnings. However, its return on equity is expected to remain low at 5.5% in three years' time.

Dive into the specifics of Qi An Xin Technology Group here with our thorough growth forecast report.

Shenzhen VMAX New Energy

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen VMAX New Energy Co., Ltd. is a company based in China that specializes in the research, development, production, and sale of power electronics and power transmission products both domestically and internationally, with a market capitalization of approximately CN¥12.36 billion.

Operations: The company generates revenue primarily from its electric equipment segment, totaling CN¥5.85 billion.

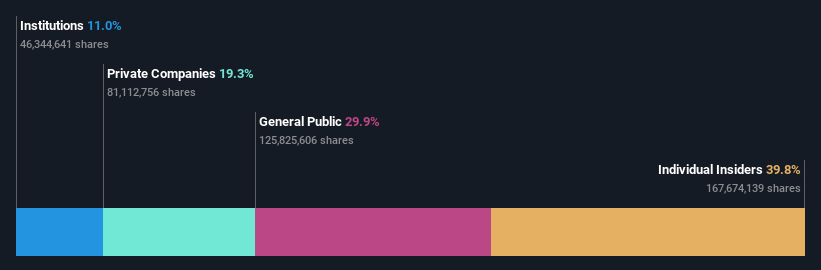

Insider Ownership: 39.8%

Shenzhen VMAX New Energy reported a strong Q1 2024 with revenue up to CNY 1.37 billion and net income rising to CNY 114.2 million, reflecting year-over-year growth. Despite a low projected return on equity of 19.7% in three years, the company's earnings and revenue are expected to grow annually by 23.9% and 22.7%, respectively, outstripping broader market forecasts. However, its dividend coverage is weak, indicating potential cash flow concerns despite these growth metrics.

Summing It All Up

Reveal the 1464 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:RWS SHSE:688561 and SHSE:688612.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance