Exploring Three Growth Companies With Significant Insider Investment

As global markets exhibit mixed signals with record highs in major indexes and a resurgence in services sector strength, investors are navigating through a landscape marked by both opportunity and uncertainty. In this context, growth companies with significant insider ownership stand out as potentially strong contenders, suggesting a level of confidence from those who know the company best during these fluctuating economic times.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Gaming Innovation Group (OB:GIG) | 13.5% | 36.2% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

Calliditas Therapeutics (OM:CALTX) | 10.5% | 52.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Underneath we present a selection of stocks filtered out by our screen.

Vanchip (Tianjin) Technology

Simply Wall St Growth Rating: ★★★★☆☆

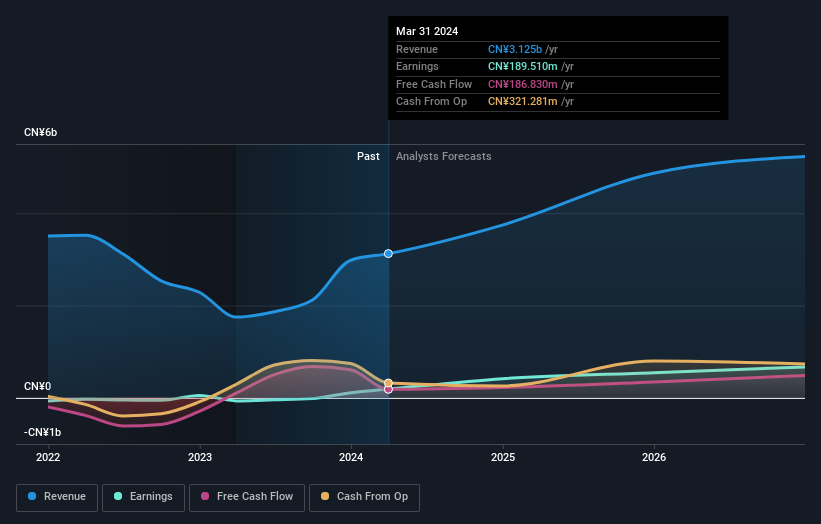

Overview: Vanchip (Tianjin) Technology Co., Ltd. specializes in designing, manufacturing, and selling radio frequency front end and high-end analog chips within China, with a market capitalization of CN¥16.44 billion.

Operations: The company generates CN¥3.12 billion in revenue from its electronic components and parts segment.

Insider Ownership: 16.6%

Earnings Growth Forecast: 37.7% p.a.

Vanchip (Tianjin) Technology has shown a notable rebound, with first-quarter sales rising to CNY 461.32 million from CNY 318.01 million year-over-year, and a significant reduction in net loss to CNY 5.37 million from CNY 82.59 million. Despite recent shareholder dilution, the company's earnings are expected to grow by 37.7% annually over the next three years, outpacing the Chinese market forecast of 22.8%. However, its return on equity is projected to remain low at around 10.5%.

C*Core Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: C*Core Technology Co., Ltd. is a chip design company based in China, specializing in IP authorization, chip customization, and the production of independent chips and module products, with a market capitalization of approximately CN¥6.05 billion.

Operations: The company generates revenue through IP licensing, tailored chip solutions, and sales of standalone chips and modules.

Insider Ownership: 15%

Earnings Growth Forecast: 117.2% p.a.

C*Core Technology is poised for significant growth, with expected revenue increases of 67.8% annually, outpacing the Chinese market's 13.9%. The company plans to become profitable within three years, a goal supported by its recent CNY 40 million share repurchase program aimed at boosting employee stock ownership and equity incentives. However, it reported a widening net loss in Q1 2024 to CNY 46.35 million from CNY 25 million year-over-year, underscoring current financial challenges despite aggressive growth strategies.

Quanta Computer

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, and Europe, and a market capitalization of approximately NT$1.05 trillion.

Operations: The Electronics Sector generates the majority of revenue, totaling approximately NT$2.38 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 18% p.a.

Quanta Computer has demonstrated robust growth with a 57.9% increase in earnings over the past year and forecasts suggest continued expansion, albeit at a moderate pace, with earnings expected to grow by 18% annually. Revenue growth is also strong, projected at 31.4% per year, outperforming the Taiwanese market significantly. Despite these positives, Quanta's share price remains highly volatile. The company maintains a reliable dividend yield of 3.26%, offering some income stability amidst its growth trajectory.

Turning Ideas Into Actions

Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1479 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688153 SHSE:688262 and TWSE:2382.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance