Exploring Three Growth Companies With High Insider Ownership On The Chinese Exchange

Amidst a backdrop of economic challenges and modest growth projections, Chinese equities have shown resilience, with certain sectors demonstrating pockets of strength despite broader market headwinds. This context sets the stage for examining growth companies with high insider ownership in China, which can be indicative of confidence from those most familiar with the companies' potential and strategic direction.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Here's a peek at a few of the choices from the screener.

Bethel Automotive Safety Systems

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd, based in China, specializes in developing, manufacturing, and selling brake system related products for commercial vehicles with a market capitalization of approximately CN¥22.32 billion.

Operations: The company generates revenue primarily from the manufacture and sale of automobile accessories, posting CN¥7.83 billion in this segment.

Insider Ownership: 21.5%

Revenue Growth Forecast: 23% p.a.

Bethel Automotive Safety Systems, a key growth company in China with high insider ownership, has shown robust financial performance. In Q1 2024, the firm reported a significant increase in sales and net income to CNY 1.86 billion and CNY 209.92 million respectively. Despite concerns over shareholder dilution and dividend coverage, Bethel's revenue and earnings are expected to outpace the market with forecasts suggesting annual growth rates of 23% for revenue and 24.6% for earnings. Additionally, the stock is considered undervalued by analysts, trading well below estimated fair values.

Changzhou Fusion New Material

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changzhou Fusion New Material Co., Ltd. is a company based in China that specializes in the development, production, and sale of various products such as conductive silver paste and semiconductor materials, primarily for the photovoltaic industry, with operations extending to South East Asia and other international markets; it has a market capitalization of approximately CN¥8.88 billion.

Operations: The company generates CN¥11.46 billion in revenue primarily from its electronic components and parts segment.

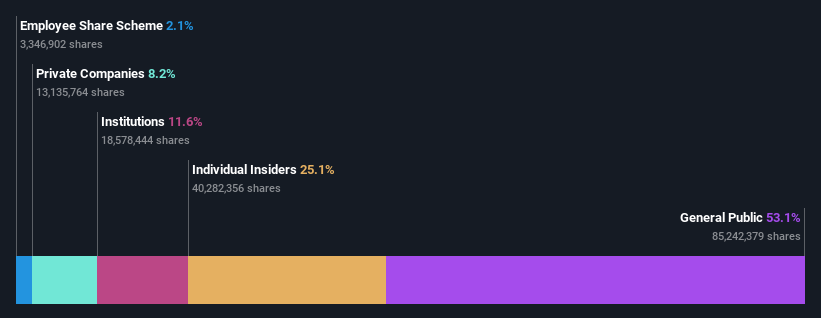

Insider Ownership: 25.1%

Revenue Growth Forecast: 21.3% p.a.

Changzhou Fusion New Material Co., Ltd. is positioned as a growth-oriented company with high insider ownership in China, trading at 44.5% below its estimated fair value. Despite lower profit margins this year, it has demonstrated strong revenue growth of 21.3% per year, outpacing the Chinese market average. Earnings are projected to grow by 32.6% annually, significantly above market trends. However, its dividend coverage is weak due to insufficient cash flows from operations.

Chipsea Technologies (shenzhen)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chipsea Technologies (Shenzhen) Corp. is a chip design firm specializing in ADCs, MCUs, measurement algorithms, and comprehensive solutions for the Internet of Things in China, with a market capitalization of approximately CN¥4.34 billion.

Operations: The primary revenue source for the company is its Integrated Circuit segment, generating CN¥522.61 million.

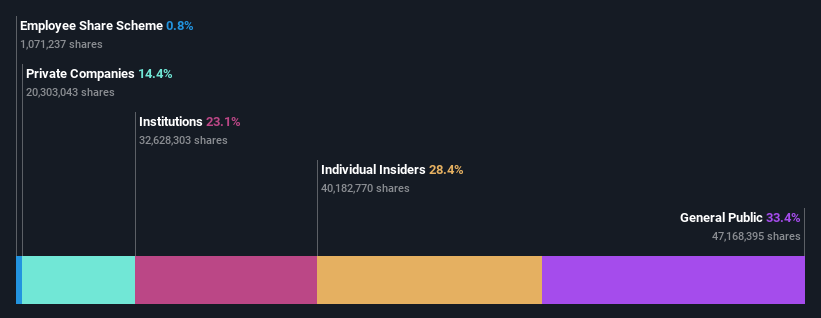

Insider Ownership: 28.4%

Revenue Growth Forecast: 28.0% p.a.

Chipsea Technologies, despite a volatile share price, shows promising growth potential with expected annual revenue growth of 28%, surpassing the Chinese market's 14%. Forecasted to turn profitable within three years, the company recently reported a reduced net loss of CNY 35.43 million for Q1 2024 compared to the previous year and completed a share buyback worth CNY 40.98 million. However, its return on equity is anticipated to remain low at 8.1%.

Turning Ideas Into Actions

Unlock more gems! Our Fast Growing Chinese Companies With High Insider Ownership screener has unearthed 398 more companies for you to explore.Click here to unveil our expertly curated list of 401 Fast Growing Chinese Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603596 SHSE:688503 and SHSE:688595.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance