Exploring Three Growth Companies With High Insider Ownership On The Chinese Exchange

Amid a fluctuating global landscape, Chinese markets have recently faced downward pressure, largely influenced by persistent concerns over U.S. interest rate policies and domestic economic challenges. However, in this environment, companies with high insider ownership can offer unique advantages as these stakeholders often have a vested interest in driving long-term value. In assessing the potential of growth companies within such market conditions, high insider ownership might signal strong confidence from those who know the company best—its leaders and founders—especially during uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Wuxi Acryl Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Acryl Technology Co., Ltd., operating in China, specializes in the production and sale of various resins including polyester, acrylic, polyurethane, high-performance epoxy, and special application types, with a market capitalization of approximately CN¥4.07 billion.

Operations: The company generates revenue primarily from the chemical industry, totaling CN¥496.41 million.

Insider Ownership: 39.6%

Revenue Growth Forecast: 25.9% p.a.

Wuxi Acryl Technology, a growth-oriented company with high insider ownership in China, faces challenges despite strong forecasts. Its earnings are expected to grow significantly at 58.18% annually, outpacing the Chinese market's 23.2%, with revenue also projected to increase by 25.9% per year. However, recent financial results show a substantial decline: full-year net income dropped from CNY 120.17 million to CNY 23.92 million as profit margins fell from 13.6% to 3.8%. This suggests operational or market challenges impacting performance despite optimistic growth projections.

Bozhon Precision Industry TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

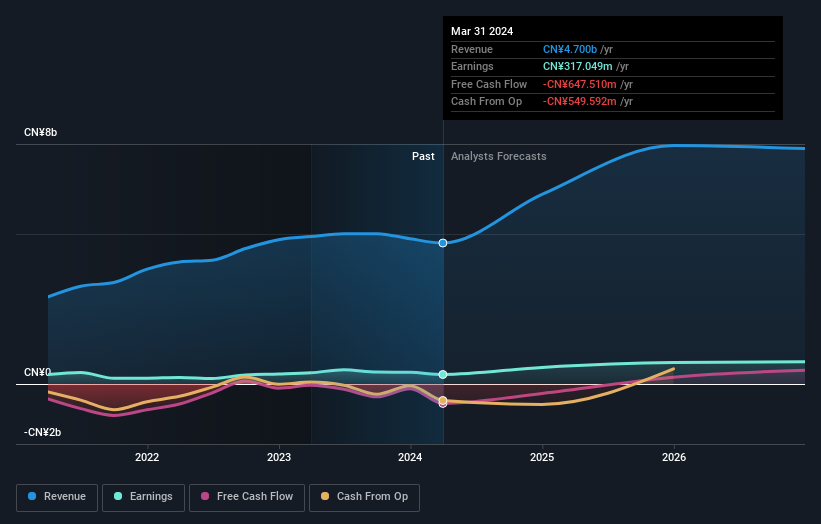

Overview: Bozhon Precision Industry Technology Co., Ltd specializes in the development, design, production, and sale of automation equipment and automated flexible production lines, serving both domestic and international markets with a market capitalization of CN¥9.41 billion.

Operations: Bozhon Precision Industry Technology's revenue from Industrial Automation & Controls totaled CN¥4.70 billion.

Insider Ownership: 29.3%

Revenue Growth Forecast: 21.1% p.a.

Bozhon Precision Industry Technology Co., Ltd., despite a recent downturn in Q1 earnings with a shift from net income to a loss and decreased revenue year-over-year, is positioned for substantial growth. Analysts forecast an annual earnings increase of 30.69% and revenue growth of 21.1%, both outstripping broader Chinese market trends. However, its return on equity is expected to remain low at 12.9%, and the recent share buyback was minimal, reflecting cautious optimism about its growth trajectory amidst current challenges.

Jiangsu Aisen Semiconductor MaterialLtd

Simply Wall St Growth Rating: ★★★★★☆

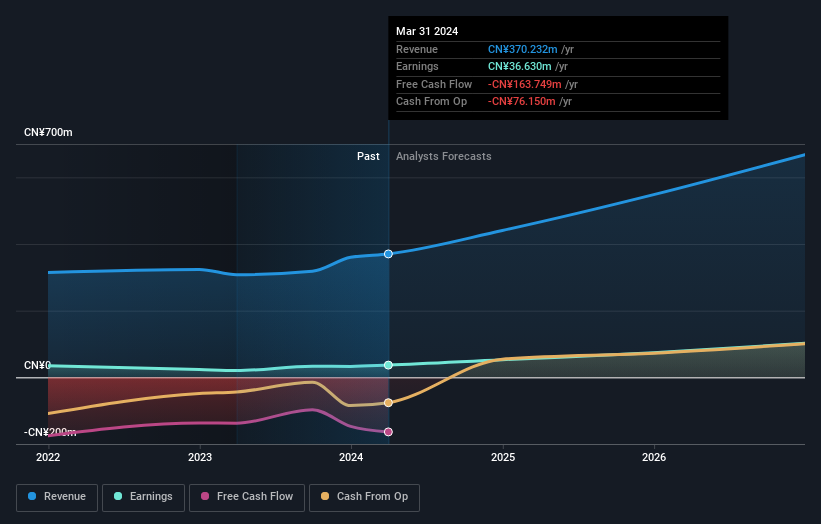

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. is a company engaged in the production of semiconductor materials, with a market capitalization of approximately CN¥3.00 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 33.6%

Revenue Growth Forecast: 21.1% p.a.

Jiangsu Aisen Semiconductor MaterialLtd. has demonstrated robust growth with a 34.62% forecasted annual earnings increase, surpassing the broader Chinese market's expectations. Recent financials show a significant improvement in net income and revenue for Q1 2024, with earnings rising from CNY 3.54 million to CNY 7.51 million year-over-year. However, the company faces challenges with its highly volatile share price and low forecasted return on equity of only 7% in three years' time, indicating potential risks amidst its growth trajectory.

Taking Advantage

Click this link to deep-dive into the 406 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603722 SHSE:688097 and SHSE:688720.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance