Exploring Three Dividend Stocks In May 2024

As global markets display resilience, with indices like the S&P 500 approaching record highs amidst a backdrop of economic recalibration and cautious investor sentiment, it's an opportune moment to consider the stability offered by dividend stocks. In light of recent market dynamics, a good dividend stock typically combines reliable payouts with strong business fundamentals, making them potentially attractive in uncertain economic climates.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.48% | ★★★★★★ |

Guaranty Trust Holding (NGSE:GTCO) | 7.57% | ★★★★★★ |

Globeride (TSE:7990) | 3.56% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.45% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.41% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.99% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.57% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.80% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.11% | ★★★★★★ |

Innotech (TSE:9880) | 4.15% | ★★★★★★ |

Click here to see the full list of 1828 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

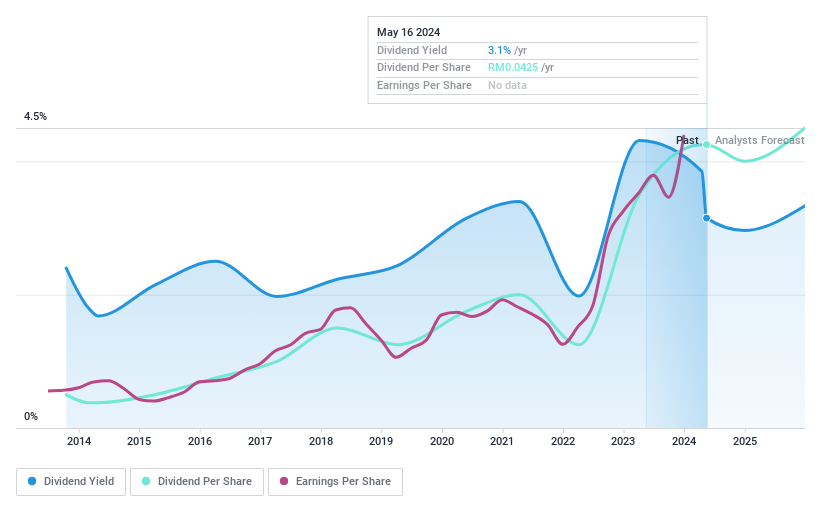

CCK Consolidated Holdings Berhad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CCK Consolidated Holdings Berhad is an investment holding company involved in the rearing and production of poultry, prawns, and seafood products, with a market capitalization of approximately MYR 757.48 million.

Operations: CCK Consolidated Holdings Berhad generates revenue primarily through its retail segment, which brought in MYR 872.83 million, followed by poultry at MYR 336.47 million, and prawns contributing MYR 109.56 million.

Dividend Yield: 3.1%

CCK Consolidated Holdings Berhad announced a dividend of MYR 0.0425 per share for FY 2023, reflecting a commitment to shareholder returns despite its historical volatility in dividend payments. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 31.2% and 33.1% respectively, suggesting sustainability from a financial perspective. However, the dividend yield stands at a modest 3.15%, which is lower compared to the top quartile of Malaysian market payers at 4.41%. Recent board changes and strong yearly earnings growth indicate potential strategic shifts that could impact future dividends.

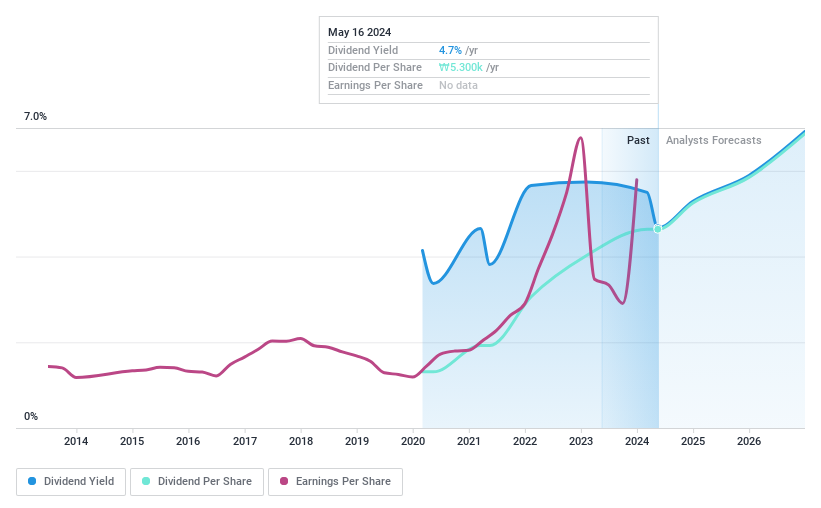

DB Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services within South Korea, with a market capitalization of approximately ₩6.25 billion.

Operations: DB Insurance Co., Ltd. generates revenue primarily from its Non-Life Insurance Sector, which contributes ₩19.04 billion, followed by the Life Insurance Sector at ₩1.50 billion, and a smaller contribution from the Installment Finance Sector at ₩0.04 billion.

Dividend Yield: 4.7%

DB Insurance Co., Ltd. has demonstrated a commitment to dividends, maintaining stable payments with a low cash payout ratio of 7.2% and an earnings payout ratio of 18.3%, ensuring dividends are well-covered by both earnings and cash flows. Despite only initiating dividends four years ago, the company has shown growth in its dividend payments. Currently, its dividend yield of 4.67% ranks in the top quartile within the KR market, outpacing the average of 3.47%. Recent corporate activities include an upcoming Q1 earnings report on May 10, 2024, following their Annual General Meeting on March 22, highlighting ongoing operational transparency and governance.

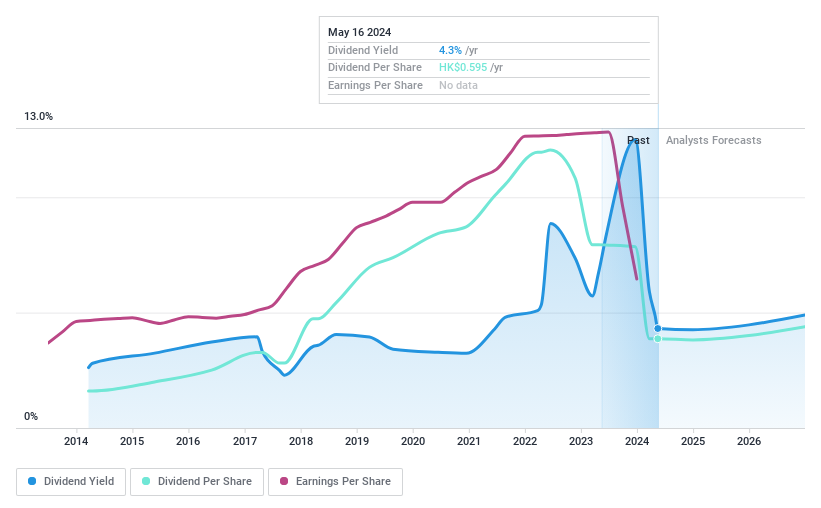

Longfor Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Longfor Group Holdings Limited operates in property development, investment, and management across the People’s Republic of China, with a market capitalization of approximately HK$84.19 billion.

Operations: Longfor Group Holdings Limited generates revenue primarily through three segments: property development at CN¥155.86 billion, services and others at CN¥18.14 billion, and investment property operation at CN¥12.94 billion.

Dividend Yield: 4.3%

Longfor Group Holdings has experienced volatility in its dividend payments over the past decade, with recent decreases noted. Despite this instability, the dividends are well-supported by a low payout ratio of 26.6% from earnings and an even lower cash payout ratio of 11.6%. However, the dividend yield of 4.31% is below the top tier in Hong Kong's market. The company's financial position shows concern with debt not adequately covered by operating cash flow, alongside significant insider selling and a forecasted earnings growth of only 4.48% per year. Recent business expansions include acquiring new land for RMB 624 million but face challenges from declining sales and profitability in a tough real estate market.

Key Takeaways

Unlock our comprehensive list of 1828 Top Dividend Stocks by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KLSE:CCK KOSE:A005830 and SEHK:960.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance