Exploring Three Chinese Exchange Stocks With Estimated Intrinsic Discounts Ranging From 17.1% To 49.5%

Amid concerns of a slowing economy, Chinese equities have shown mixed performance, with the Shanghai Composite Index and the blue chip CSI 300 experiencing modest losses. This environment presents a unique opportunity to explore potentially undervalued stocks that might be poised for recovery or growth despite broader market challenges. In this context, understanding intrinsic value and market discrepancies becomes crucial for investors looking at opportunities in China's fluctuating market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.14 | CN¥33.84 | 46.4% |

Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥24.64 | CN¥46.17 | 46.6% |

Anhui Anli Material Technology (SZSE:300218) | CN¥13.86 | CN¥26.56 | 47.8% |

Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥16.31 | CN¥30.04 | 45.7% |

Eyebright Medical Technology (Beijing) (SHSE:688050) | CN¥66.53 | CN¥121.64 | 45.3% |

China Film (SHSE:600977) | CN¥10.23 | CN¥20.17 | 49.3% |

INKON Life Technology (SZSE:300143) | CN¥7.59 | CN¥14.64 | 48.2% |

Quectel Wireless Solutions (SHSE:603236) | CN¥48.69 | CN¥96.35 | 49.5% |

Yonyou Network TechnologyLtd (SHSE:600588) | CN¥9.08 | CN¥16.97 | 46.5% |

Chengdu Olymvax Biopharmaceuticals (SHSE:688319) | CN¥8.15 | CN¥14.91 | 45.3% |

Underneath we present a selection of stocks filtered out by our screen.

Quectel Wireless Solutions

Overview: Quectel Wireless Solutions Co., Ltd. operates globally, focusing on the research, design, production, and sales of wireless communication modules and solutions, with a market capitalization of approximately CN¥12.74 billion.

Operations: The company generates revenue primarily from the design, production, and sales of wireless communication modules and solutions.

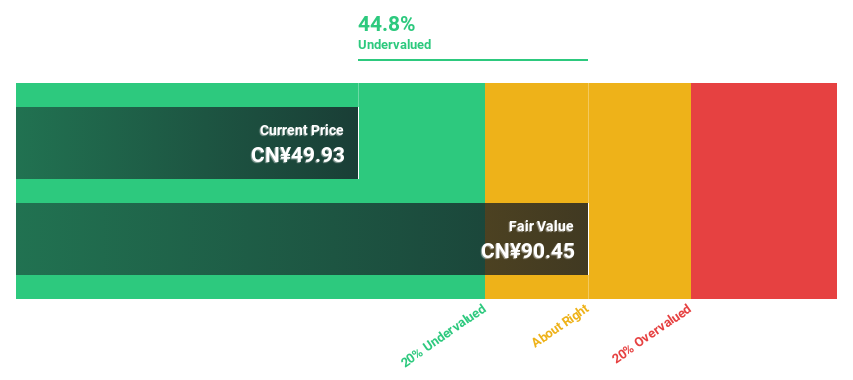

Estimated Discount To Fair Value: 49.5%

Quectel Wireless Solutions, trading at CN¥48.69, is significantly undervalued based on a discounted cash flow (DCF) analysis, with its price being about 49.5% below the estimated fair value of CN¥96.35. Despite a forecasted return on equity considered low at 15.6% in three years, the company's earnings are expected to grow by 38% annually over the next three years—outpacing the Chinese market's growth rate of 22.1%. Recent product launches like the FLM263D Wi-Fi module enhance its portfolio but bear in mind that large one-off items have impacted financial results.

Proya CosmeticsLtd

Overview: Proya Cosmetics Co., Ltd. is a Chinese beauty and personal care company that focuses on researching, developing, producing, and selling cosmetics, with a market capitalization of approximately CN¥41.70 billion.

Operations: Proya Cosmetics generates its revenue primarily through the research, development, production, and sale of beauty and personal care products in China.

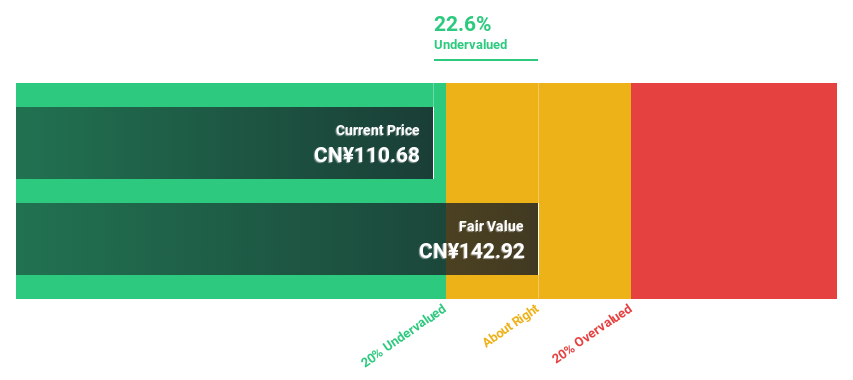

Estimated Discount To Fair Value: 32.6%

Proya Cosmetics Co., Ltd., priced at CN¥105.69, is identified as undervalued based on a DCF valuation, with its market price 32.6% below the calculated fair value of CN¥156.74. Despite a volatile dividend history, recent financials show robust growth with Q1 sales up to CN¥2.18 billion from CN¥1.62 billion year-over-year and net income rising to CN¥302.85 million from CN¥208.03 million. Analyst consensus suggests a potential price increase of 30.1%. However, earnings growth forecasts at 20% annually are slightly below the broader Chinese market expectation of 22%.

Kunshan Huguang Auto HarnessLtd

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of automotive high and low voltage wiring harness assembly products, operating both in China and internationally, with a market capitalization of CN¥12.63 billion.

Operations: The company generates revenue primarily through the production and sales of automotive high and low voltage wiring harness assembly products.

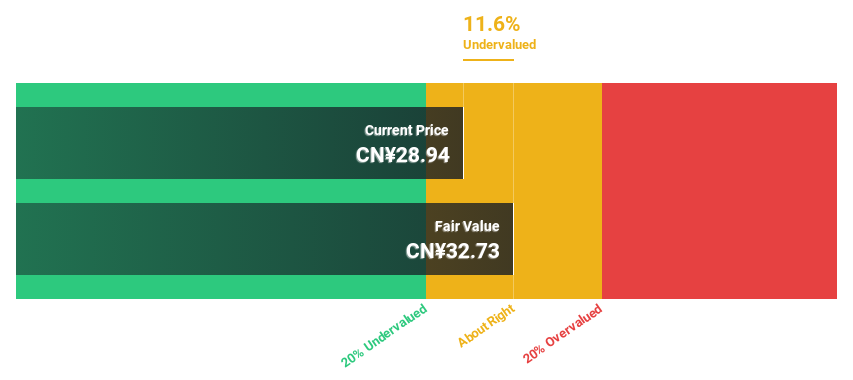

Estimated Discount To Fair Value: 17.1%

Kunshan Huguang Auto Harness Co., Ltd., trading at CN¥28.91, is currently undervalued by 17.1% against a fair value of CN¥34.87 based on DCF analysis. The company has shown strong financial performance with a significant increase in sales from CN¥3.28 billion to CN¥4 billion year-over-year and an impressive earnings growth of 1904.9%. Despite challenges in covering debt with operating cash flow, it is expected to outpace the Chinese market with projected annual revenue and earnings growth rates of 28.8% and 44.27%, respectively.

Seize The Opportunity

Navigate through the entire inventory of 98 Undervalued Chinese Stocks Based On Cash Flows here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603236 SHSE:603605 and SHSE:605333.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance