Exploring Three Chinese Exchange Stocks With Estimated Intrinsic Value Discounts Ranging From 14.3% To 40.9%

Amidst a backdrop of cautious trading and concerns about slowing economic growth in China, investors are keenly watching the market for opportunities. In such an environment, identifying undervalued stocks that have a significant discount to their estimated intrinsic value could offer potential avenues for value-driven investments.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥173.66 | CN¥328.59 | 47.2% |

Uni-Trend Technology (China) (SHSE:688628) | CN¥32.20 | CN¥64.25 | 49.9% |

Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥25.56 | CN¥46.97 | 45.6% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥14.74 | CN¥29.31 | 49.7% |

DongHua Testing Technology (SZSE:300354) | CN¥30.78 | CN¥58.00 | 46.9% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥33.72 | CN¥66.56 | 49.3% |

China Film (SHSE:600977) | CN¥10.86 | CN¥20.21 | 46.3% |

Shenzhen Sunline Tech (SZSE:300348) | CN¥6.86 | CN¥12.70 | 46% |

Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.64 | CN¥18.84 | 48.8% |

Levima Advanced Materials (SZSE:003022) | CN¥13.96 | CN¥27.51 | 49.3% |

Let's uncover some gems from our specialized screener

Aerospace CH UAVLtd

Overview: Aerospace CH UAV Co., Ltd specializes in the research, development, production, maintenance, and sale of capacitor films within China, with a market capitalization of approximately CN¥13.79 billion.

Operations: The company's revenue is derived from activities including the research, development, production, maintenance, and sale of capacitor films in China.

Estimated Discount To Fair Value: 14.3%

Aerospace CH UAV Co., Ltd, trading at CNY 13.92, is positioned below the estimated fair value of CNY 16.24, reflecting a modest undervaluation based on discounted cash flows. Despite recent declines in quarterly revenue and net income—CNY 463.9 million and CNY 2.55 million respectively—the company's long-term prospects appear robust with expected annual earnings growth of 43.89% and revenue growth forecasts outpacing the Chinese market at 28.1% per year. However, current profit margins have dipped to 4.9%, and large one-off items have impacted financial results, suggesting areas for caution amidst overall positive growth expectations.

Click here to discover the nuances of Aerospace CH UAVLtd with our detailed financial health report.

Ganfeng Lithium Group

Overview: Ganfeng Lithium Group Co., Ltd. is a global manufacturer and seller of lithium products, operating in Mainland China, Asia, the European Union, North America, and other international markets with a market capitalization of approximately CN¥51.96 billion.

Operations: The company generates revenue through the manufacture and sale of lithium products across various regions including Mainland China, other parts of Asia, the European Union, and North America.

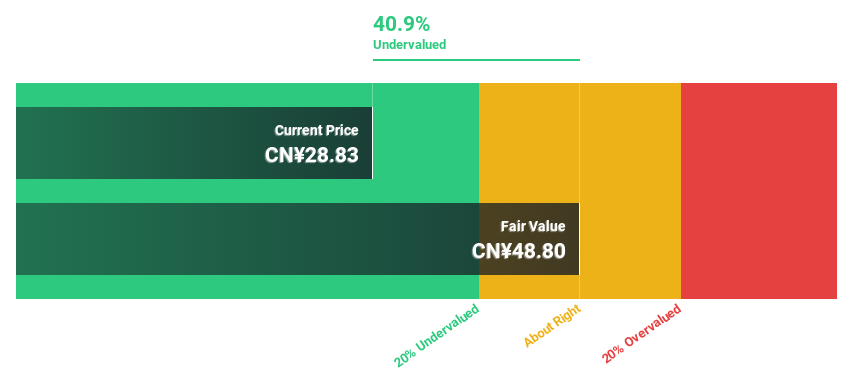

Estimated Discount To Fair Value: 40.9%

Ganfeng Lithium Group Co., Ltd., currently priced at CN¥28.83, is trading significantly below its calculated fair value of CN¥48.8, suggesting a deep undervaluation. Despite this potential, the company's recent performance raises concerns; it reported a substantial net loss of CN¥438.9 million for Q1 2024, contrasting sharply with last year's profit. Additionally, its dividend coverage by cash flow is weak and recent board changes could imply strategic shifts ahead. Nevertheless, with earnings expected to grow by 29.63% annually and revenue growth forecasts surpassing the Chinese market average, Ganfeng presents an intriguing case for investors considering cash flow-based valuations in undervalued stocks.

Inner Mongolia Furui Medical Science

Overview: Inner Mongolia Furui Medical Science Co., Ltd. operates in the healthcare sector, focusing on the production and sale of pharmaceutical products, with a market capitalization of approximately CN¥14.12 billion.

Operations: The company generates its revenue primarily through the production and sale of pharmaceutical products.

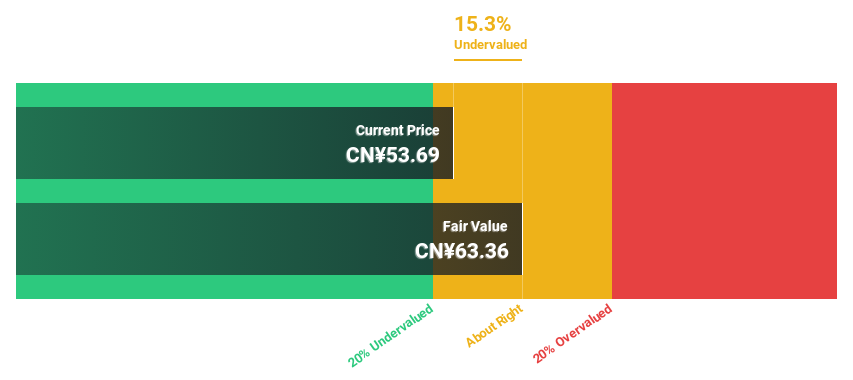

Estimated Discount To Fair Value: 15.3%

Inner Mongolia Furui Medical Science Co., Ltd. reported a robust first quarter with revenue reaching CNY 322.8 million and net income at CNY 42.72 million, marking significant year-over-year growth. Trading at approximately 15% below its fair value, the stock appears undervalued based on discounted cash flow analysis. Despite this, its return on equity is expected to be modest in three years at 17.5%. However, both earnings and revenue are projected to grow substantially above the market average annually by 40.52% and 28.9%, respectively, highlighting potential for future appreciation.

Turning Ideas Into Actions

Click this link to deep-dive into the 97 companies within our Undervalued Chinese Stocks Based On Cash Flows screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SZSE:002389SZSE:002460 and SZSE:300049.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance